Why LMT is a Buy for its Dividends and Growth

LMT Intrinsic Value

Lockheed Martin results showcased operational excellence and future sales potential. The executive leadership was confident in their 2022 projections. These projections were strong sales, earnings, and cash flow.

Cash flow is especially significant as they are using excess cash to buy back shares and give the rest as dividends. The stock buy back program itself is looking to be a healthy buoyant for Lockheed Martin's stock. The leadership was confident enough in their buy back strategy to say that LMT's intrinsic value may be higher than the stock's current price.

Our analysis agrees. The key indicator is LMT eps growth. If Lockheed Martin can continue growing earnings per share, its intrinsic value may be as high as $500 in Q2 2022. To achieve earnings growth, Lockheed needs to grow its revenue. Lockheed Martin's quarterly presentation and press releases show that booked sales are growing. Revenue is growing, so earnings per share (EPS) looks poised to grow as well.

LMT Dividend Growth

LMT Dividend History

LMT Dividend data by YCharts

LMT Dividend data by YCharts

Lockheed Martin has consistently raised its dividend since 2004. There are no signs this pattern is looking to change all through the 2020's. Lockheed Martin has prioritized returning free cash flow to its investors either by share buy backs or dividends.

Is LMT too Expensive?

Lockheed Martin is not too expensive and nearly anyone can buy shares in Lockheed Martin thanks to fractional shares. Do not let its price per share of over $400 scare you into thinking its "too expensive". Many analysts are setting target prices that reach $500.

LMT Q1 Results

Increased Cash Flow

Cash flow per share increased and the share repurchase program has now purchased $2 Billion in shares. Free cash flow was also used to payout ~$800 Million in dividends.

Space Sector Falls for LMT

Lockheed Martin's space sector declined $400 Million in sales. This was due to the nationalization of the Atomic Weapons Establishment program. The facility handles the design and execution of the United Kingdom's nuclear weapons.

In February, LMT was awarded a prototype agreement to design and build 42 small satellites. These satellites will provide low-latency military data to a "full range of war fighter platforms". Some of these platforms include the F-16 and F-35 fighter jets.

Robust Demand for F-35 Platform

The Ukraine War has caused urgency internationally to buff up Aerospace capabilities.

- Germany booked 35 F-35 fighter jets

- Canada is looking to procure 88 fighter jets

- Switzerland and Finland also booked F-35 fighter jets in 2021

- In all, 223 fighter jets potentially to be added to F-35 back log

- The latest DoD budget funded an additional 85 F-35 fighter jets.

Favorable DoD Budget

The latest Department of Defense budget was favorable to Lockheed Martin. Multiple programs including the Black Hawk helicopter and F-16 fighter jet saw increases to spending.

F-35 Platform Innovations

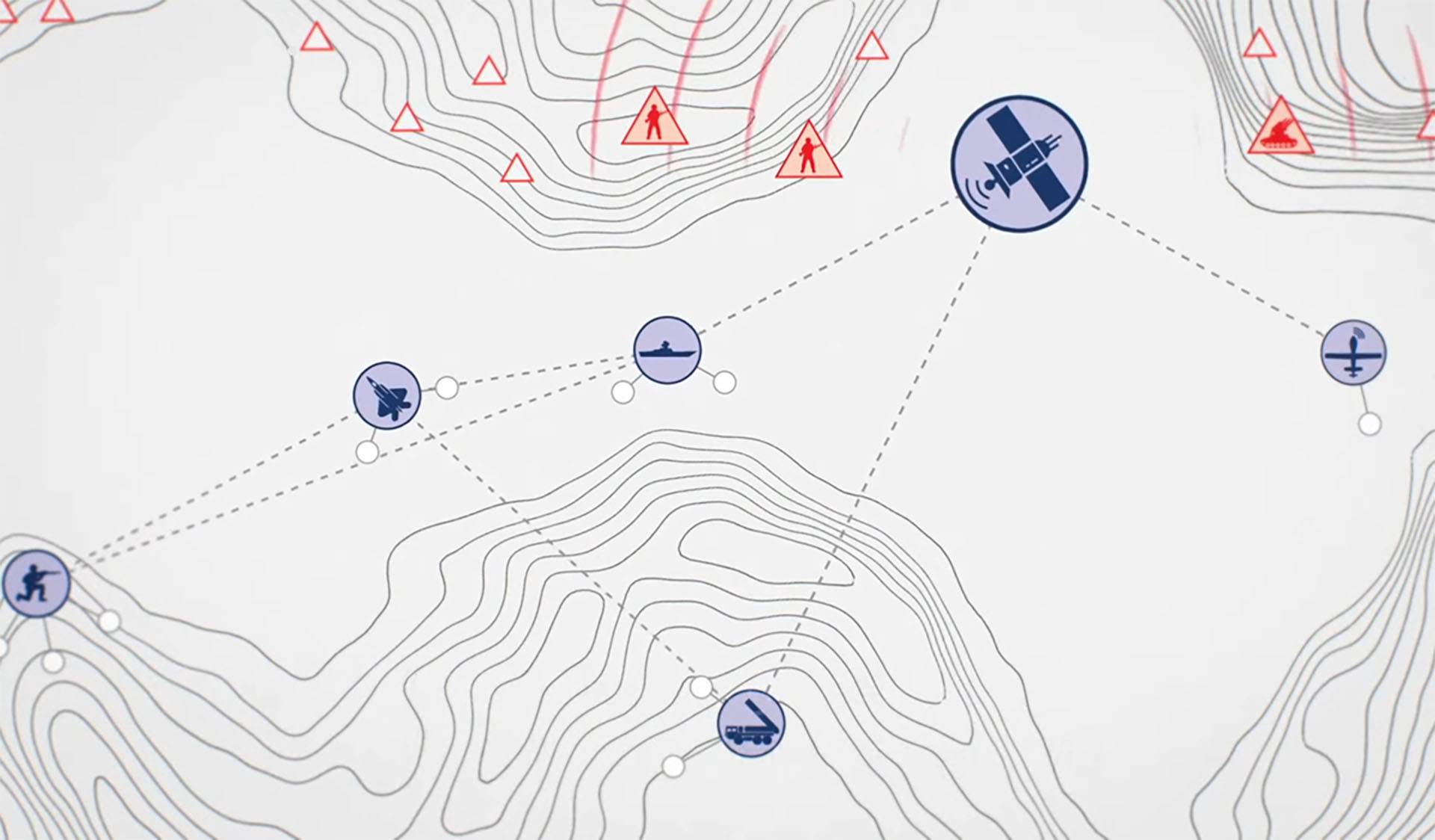

Executive leadership took time on the investor call to discuss the F-35. They noted that the fighter jet platform is "unmatched", and with demand soaring, this claim may hold merit. The F-35 is a highly connected jet. It has a wide array of sensing capabilities, data processing power, and connectivity back to command and control. Note command and control was a major problem for Russia in the Kyiv theater.

The fighter jet is a platform, with Chief Brown calling it the "Quarterback of the U.S. Air Force". The fighter jet is a key component of the integrated deterrence and of Lockheed Martin's 5G.mil program.

My Impressions

If you want a stock with strong dividends and growth potential, Lockheed Martin is for you. It is weathering the current downturn well and is poised to do meet its financial goals for 2022. Lockheed Martin is in a strong position to help defend our allies as the current geo-political situation unfolds.

Lockheed has also reported last quarter about same day hiring events at its Marietta plants. This is another sign that they are looking to rapidly expand their operations.

Demand for their missile supply system is on the rise. Even though space faltered this quarter, I do not believe it will be on the back burner for long. Though defense is the top priority right now, space is becoming intertwined with the defense sector. LMT's prototype satellite award is a space contract, but it supports Lockheed's defense platforms.

Lockheed Martin is a 5 year buy for me. For 2022, look to see leadership meet the goals they set out in Q1. Keep an eye on further bookings to solidify LMT's backlog. Also watch for more growth in space related industries. Hopefully, if we can return to peace, Lockheed can pivot from deterrence programs to space industries by the 2030s.

I/we have a position in an asset mentioned

Why LMT is a Buy for its Dividends and Growth

LMT Intrinsic Value

Lockheed Martin results showcased operational excellence and future sales potential. The executive leadership was confident in their 2022 projections. These projections were strong sales, earnings, and cash flow.

Cash flow is especially significant as they are using excess cash to buy back shares and give the rest as dividends. The stock buy back program itself is looking to be a healthy buoyant for Lockheed Martin's stock. The leadership was confident enough in their buy back strategy to say that LMT's intrinsic value may be higher than the stock's current price.

Our analysis agrees. The key indicator is LMT eps growth. If Lockheed Martin can continue growing earnings per share, its intrinsic value may be as high as $500 in Q2 2022. To achieve earnings growth, Lockheed needs to grow its revenue. Lockheed Martin's quarterly presentation and press releases show that booked sales are growing. Revenue is growing, so earnings per share (EPS) looks poised to grow as well.

LMT Dividend Growth

LMT Dividend History

Lockheed Martin has consistently raised its dividend since 2004. There are no signs this pattern is looking to change all through the 2020's. Lockheed Martin has prioritized returning free cash flow to its investors either by share buy backs or dividends.

Is LMT too Expensive?

Lockheed Martin is not too expensive and nearly anyone can buy shares in Lockheed Martin thanks to fractional shares. Do not let its price per share of over $400 scare you into thinking its "too expensive". Many analysts are setting target prices that reach $500.

LMT Q1 Results

Increased Cash Flow

Cash flow per share increased and the share repurchase program has now purchased $2 Billion in shares. Free cash flow was also used to payout ~$800 Million in dividends.

Space Sector Falls for LMT

Lockheed Martin's space sector declined $400 Million in sales. This was due to the nationalization of the Atomic Weapons Establishment program. The facility handles the design and execution of the United Kingdom's nuclear weapons.

In February, LMT was awarded a prototype agreement to design and build 42 small satellites. These satellites will provide low-latency military data to a "full range of war fighter platforms". Some of these platforms include the F-16 and F-35 fighter jets.

Robust Demand for F-35 Platform

The Ukraine War has caused urgency internationally to buff up Aerospace capabilities.

Favorable DoD Budget

The latest Department of Defense budget was favorable to Lockheed Martin. Multiple programs including the Black Hawk helicopter and F-16 fighter jet saw increases to spending.

F-35 Platform Innovations

Executive leadership took time on the investor call to discuss the F-35. They noted that the fighter jet platform is "unmatched", and with demand soaring, this claim may hold merit. The F-35 is a highly connected jet. It has a wide array of sensing capabilities, data processing power, and connectivity back to command and control. Note command and control was a major problem for Russia in the Kyiv theater.

The fighter jet is a platform, with Chief Brown calling it the "Quarterback of the U.S. Air Force". The fighter jet is a key component of the integrated deterrence and of Lockheed Martin's 5G.mil program.

My Impressions

If you want a stock with strong dividends and growth potential, Lockheed Martin is for you. It is weathering the current downturn well and is poised to do meet its financial goals for 2022. Lockheed Martin is in a strong position to help defend our allies as the current geo-political situation unfolds.

Lockheed has also reported last quarter about same day hiring events at its Marietta plants. This is another sign that they are looking to rapidly expand their operations.

Demand for their missile supply system is on the rise. Even though space faltered this quarter, I do not believe it will be on the back burner for long. Though defense is the top priority right now, space is becoming intertwined with the defense sector. LMT's prototype satellite award is a space contract, but it supports Lockheed's defense platforms.

Lockheed Martin is a 5 year buy for me. For 2022, look to see leadership meet the goals they set out in Q1. Keep an eye on further bookings to solidify LMT's backlog. Also watch for more growth in space related industries. Hopefully, if we can return to peace, Lockheed can pivot from deterrence programs to space industries by the 2030s.

I/we have a position in an asset mentioned