The rising inflation wave and tighter monetary policy to control this unrestrained price hike could affect the spending patterns of consumers. As Visa stock is pro-cyclical, expected to lose revenues in periods of recessions many of you might ask is Visa stock a buy?

Due to inflation, many consumers are likely to pull back their discretionary spending – non-essential, entertainment and recreation. The Visa earns revenue when people buy more, spending their incomes on travel and purchasing goods and services online.

Check Bank of America Second-quarter earnings Reports and Future Growth Forecasts, Microsoft (MSFT) and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

In this scenario, many experts rated the Visa stock, surprisingly, as a strong buy due to the low intrinsic value. Moreover, the expected higher revenues in the upcoming years due to a jump in the outstanding shares in the VISA stock and the double-digit returns makes it popular among investors.

In this article, we will try to provide a 360-degree analysis of this stock for those seeking dividend earnings and investors looking for the long-term growth of their investment portfolios. So, let's start our exciting discussion!

Read Also: Should You Buy Tesla Stock? and Why is Apple dividend So Low

VISA Inc.

Visa Inc. provides financial services regarding payments digitally on a global scale. Being a leading and dominant digital payments service provider, Visa Inc. facilitates many ecommerce merchants, businesses, consumers, government entities and financial institutions.

The digital payment system of Visa Inc has shown tremendous growth since its establishment by the Bank of America in 1958. However, this expanding corporation, then named BankAmeriCard credit card program, was made independent and started licensing other companies in 1976 when it was converted into a consortium with the name of Visa Inc.

Since then, this California-based digital payment system has expanded globally by providing financial services to more than 2.8 billion users in more than 200 countries.

Besides, Visa Inc is getting its hands on the cryptocurrency ecosystem to bring innovation and facilitate investors across the globe to make payments conveniently for everyone everywhere.

Visa enables its users to make online payments without extending credit to anyone. It provides an ecosystem for the digital transfer of funds from one place to another to make transactions seamless, convenient and efficient.

The revenue of Fintech Corporation comes from the processing of the data, client services, worldwide transactions and value-added services.

Read Also: What Happened to Netflix Stock? Stranger Things About the Netflix Stock Drop in 2022 and Goog Earnings in Second Quarter 2022

Is Visa Stock A Buy? Fundamental Analysis

Visa is listed as V at the NYSE and is also a component of Dow Jones Industrial Average (DJIA), S&P 500 and S&P 100.

| Visa Stock Metrics |

Value |

| Current Price |

$204.15 |

| Market Cap |

425.28 B |

| P/E Ratio |

33.51 |

| Dividend Yield |

0.73% |

| 52-week Range |

$185.91 - $252.67 |

| Beta |

0.90 |

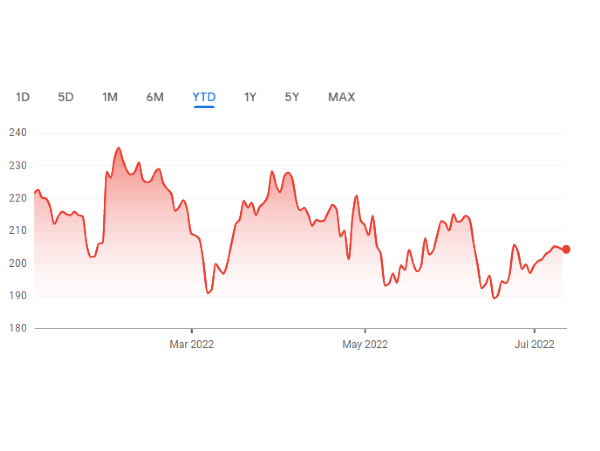

The table shows that Visa stock is pretty stable and has shown impressive results. However, the current share price is much lower than the intrinsic value of this stock.

Many of you might have heard that Visa stock is undervalued, and its intrinsic value is lower than its actual worth. The intrinsic value has been estimated close to the $271.26 by the experts.

The current value is $204.15, much lower than the actual value of this stock. So, you are convinced that you must buy this stock to enjoy higher revenues. Before that, you should not overlook the following facts.

Why is Visa Not a Strong Buy?

Visa stock is a tech stock and pro cyclical that moves with the market sentiments. During recessions, consumers become pessimists cutting back their expenses and cancelling their travel plans.

Read Also: Here's How You Can Pay Your Utility Bills With Sempra Energy Stock Dividend, SRE Stock Forecast, NRG Energy Stock and NextEra Energy Stock (NEE)

Visa has also suspended its services in Russia due to the ongoing war in Ukraine and provided $2 million in humanitarian aid. Besides, you might argue that Visa will perform less under the current inflationary pressure, and consumers are expected to slash their spending levels.

As this technology-driven company earns its revenues from the processing fee of the transactions, its revenues will definitely fall during the most anticipated recession.

Read Also: Edison International Stock Price - A Stock to Hold in Recession and Amazon Stock Price Prediction

But the actual situation might surprise you. Let’s discuss why and how!

Why is Visa a Strong Buy?

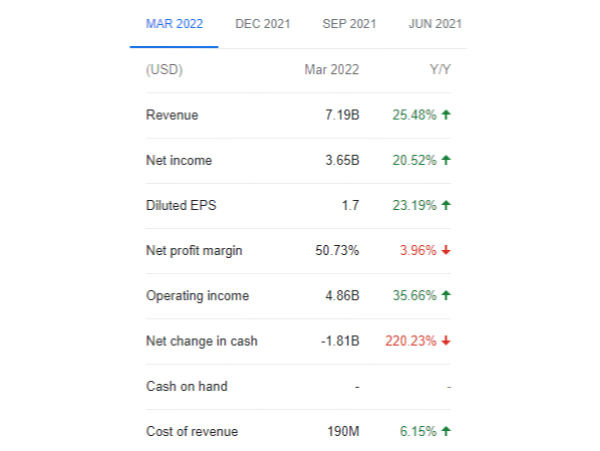

In its second-quarter report in March 2022, the company attributed a surge of 25% YoY, almost $7.2, to the rebound in travel worldwide.

The Earnings-per-share (EPS) were recorded at $1.79, a 30% increase from the EPS of 2021. Moreover, Visa will announce the earnings for the third fiscal quarter on the 26th of July. Despite the loss in Russia, the company has witnessed impressive growth in the second quarter earnings.

Read Also: Why is Dominion Energy Stock Dropping? Is It Still Safe to Invest? and Will Meta stock Go Up?

On the other hand, the Visa Fintech stock is making headway in new cryptocurrency ventures. It has made whopping payments in USD Coin (USDC). Leading the cryptocurrency transaction ecosystem, this Fintech has also started an initiative of Bitcoin Rewards Credit Cards at 2% for the customers of the USA.

It also made advances by purchasing a CyperPunk NFT at $150 000 in Ethereum (ETH-USD) in August 2021. However, these ventures might stop you from buying this stock due to the recent high volatility in crypto markets.

But, there's no denying that Visa is also struggling to become a leader in the future by making innovations and investing in innovative financial projects, adopting them to meet the trends in the financial markets.

Similarly, the competitors of Visa, MasterCard and PayPal expanded their business and made an entry into the China financial market. Still, Visa is performing much better than its competitors during the current economic slowdown.

Final Thoughts

In the end, we can conclude that Visa Inc. earns, however, most of its revenues are from cross-border payments and commerce-led businesses, the contactless and cashless payments are most likely to increase in the future, as the current trends have shown.

The peers in the Fintech stocks might take many years to develop a brand value equal to Visa Corporation. However, the year-end holidays and cashless payments are expected to boost the earnings of Visa stock. The travel industry is resilient despite inflation and recession concerns.

So, you must brush away your worries regarding this Fintech stock and buy this stock at the lowest price to enjoy good returns for a lifetime. Is Visa stock a buy? Of course, it is if you are looking for the long-term growth of your portfolio.

Suppose you are an investor seeking stable dividends. In that case, you can also buy this stock to diversify your portfolio despite the low yet steady dividend yield.

The rising inflation wave and tighter monetary policy to control this unrestrained price hike could affect the spending patterns of consumers. As Visa stock is pro-cyclical, expected to lose revenues in periods of recessions many of you might ask is Visa stock a buy?

Due to inflation, many consumers are likely to pull back their discretionary spending – non-essential, entertainment and recreation. The Visa earns revenue when people buy more, spending their incomes on travel and purchasing goods and services online.

Check Bank of America Second-quarter earnings Reports and Future Growth Forecasts, Microsoft (MSFT) and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

In this scenario, many experts rated the Visa stock, surprisingly, as a strong buy due to the low intrinsic value. Moreover, the expected higher revenues in the upcoming years due to a jump in the outstanding shares in the VISA stock and the double-digit returns makes it popular among investors.

In this article, we will try to provide a 360-degree analysis of this stock for those seeking dividend earnings and investors looking for the long-term growth of their investment portfolios. So, let's start our exciting discussion!

Read Also: Should You Buy Tesla Stock? and Why is Apple dividend So Low

VISA Inc.

Visa Inc. provides financial services regarding payments digitally on a global scale. Being a leading and dominant digital payments service provider, Visa Inc. facilitates many ecommerce merchants, businesses, consumers, government entities and financial institutions.

The digital payment system of Visa Inc has shown tremendous growth since its establishment by the Bank of America in 1958. However, this expanding corporation, then named BankAmeriCard credit card program, was made independent and started licensing other companies in 1976 when it was converted into a consortium with the name of Visa Inc.

Since then, this California-based digital payment system has expanded globally by providing financial services to more than 2.8 billion users in more than 200 countries.

Besides, Visa Inc is getting its hands on the cryptocurrency ecosystem to bring innovation and facilitate investors across the globe to make payments conveniently for everyone everywhere.

Visa enables its users to make online payments without extending credit to anyone. It provides an ecosystem for the digital transfer of funds from one place to another to make transactions seamless, convenient and efficient.

The revenue of Fintech Corporation comes from the processing of the data, client services, worldwide transactions and value-added services.

Read Also: What Happened to Netflix Stock? Stranger Things About the Netflix Stock Drop in 2022 and Goog Earnings in Second Quarter 2022

Is Visa Stock A Buy? Fundamental Analysis

Visa is listed as V at the NYSE and is also a component of Dow Jones Industrial Average (DJIA), S&P 500 and S&P 100.

The table shows that Visa stock is pretty stable and has shown impressive results. However, the current share price is much lower than the intrinsic value of this stock.

Many of you might have heard that Visa stock is undervalued, and its intrinsic value is lower than its actual worth. The intrinsic value has been estimated close to the $271.26 by the experts.

The current value is $204.15, much lower than the actual value of this stock. So, you are convinced that you must buy this stock to enjoy higher revenues. Before that, you should not overlook the following facts.

Why is Visa Not a Strong Buy?

Visa stock is a tech stock and pro cyclical that moves with the market sentiments. During recessions, consumers become pessimists cutting back their expenses and cancelling their travel plans.

Read Also: Here's How You Can Pay Your Utility Bills With Sempra Energy Stock Dividend, SRE Stock Forecast, NRG Energy Stock and NextEra Energy Stock (NEE)

Visa has also suspended its services in Russia due to the ongoing war in Ukraine and provided $2 million in humanitarian aid. Besides, you might argue that Visa will perform less under the current inflationary pressure, and consumers are expected to slash their spending levels.

As this technology-driven company earns its revenues from the processing fee of the transactions, its revenues will definitely fall during the most anticipated recession.

Read Also: Edison International Stock Price - A Stock to Hold in Recession and Amazon Stock Price Prediction

But the actual situation might surprise you. Let’s discuss why and how!

Why is Visa a Strong Buy?

In its second-quarter report in March 2022, the company attributed a surge of 25% YoY, almost $7.2, to the rebound in travel worldwide.

The Earnings-per-share (EPS) were recorded at $1.79, a 30% increase from the EPS of 2021. Moreover, Visa will announce the earnings for the third fiscal quarter on the 26th of July. Despite the loss in Russia, the company has witnessed impressive growth in the second quarter earnings.

Read Also: Why is Dominion Energy Stock Dropping? Is It Still Safe to Invest? and Will Meta stock Go Up?

On the other hand, the Visa Fintech stock is making headway in new cryptocurrency ventures. It has made whopping payments in USD Coin (USDC). Leading the cryptocurrency transaction ecosystem, this Fintech has also started an initiative of Bitcoin Rewards Credit Cards at 2% for the customers of the USA.

It also made advances by purchasing a CyperPunk NFT at $150 000 in Ethereum (ETH-USD) in August 2021. However, these ventures might stop you from buying this stock due to the recent high volatility in crypto markets.

But, there's no denying that Visa is also struggling to become a leader in the future by making innovations and investing in innovative financial projects, adopting them to meet the trends in the financial markets.

Similarly, the competitors of Visa, MasterCard and PayPal expanded their business and made an entry into the China financial market. Still, Visa is performing much better than its competitors during the current economic slowdown.

Final Thoughts

In the end, we can conclude that Visa Inc. earns, however, most of its revenues are from cross-border payments and commerce-led businesses, the contactless and cashless payments are most likely to increase in the future, as the current trends have shown.

The peers in the Fintech stocks might take many years to develop a brand value equal to Visa Corporation. However, the year-end holidays and cashless payments are expected to boost the earnings of Visa stock. The travel industry is resilient despite inflation and recession concerns.

So, you must brush away your worries regarding this Fintech stock and buy this stock at the lowest price to enjoy good returns for a lifetime. Is Visa stock a buy? Of course, it is if you are looking for the long-term growth of your portfolio.

Suppose you are an investor seeking stable dividends. In that case, you can also buy this stock to diversify your portfolio despite the low yet steady dividend yield.