Updated on August 26th, 2022 by Josh Arnold

As a business owner, selling products that have high profit margins along with strong brand awareness and an exceptionally loyal customer base is strongly desirable. This allows for predictable revenue and high levels of profits over time.

The tobacco industry fits this model, despite declines over time in the number of customers that use its products. Tobacco stocks are particularly attractive to income investors thanks to their generous dividends and defensive characteristics during economic downturns. Tobacco stocks produce a lot of cash, but have very little capital expenditure needs, creating what could be considered perfect income stocks.

You can download a spreadsheet with all our tobacco stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) using the link below:

Click here to download your spreadsheet of all tobacco stocks now.

Tobacco stocks are widely prized by income investors thanks to their high dividend yields, stable payouts and dividend increase streaks. However, declining customer counts and usage rates are weighing on the group.

This article will analyze the prospects of 6 of the largest tobacco stocks. Rankings are in order of projected total returns from worst to best.

Table of Contents

You can instantly jump to any individual stock analysis by clicking on the links below:

But first, we’ll take a look at the tobacco industry’s primary concern, which is declining tobacco usage.

Industry Overview: Declining Smoking Rates

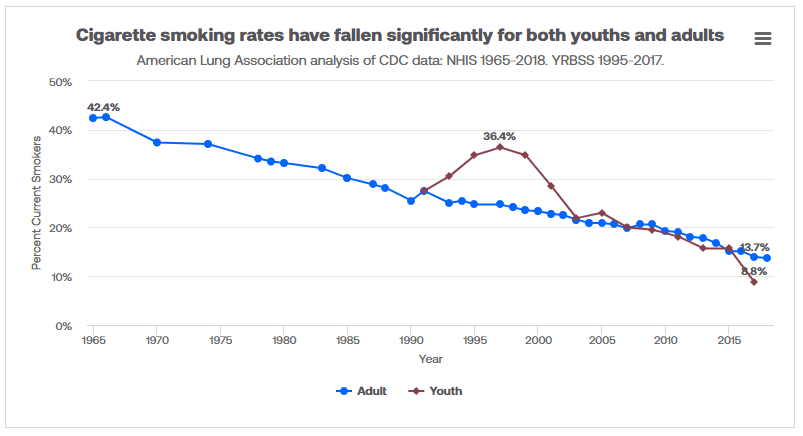

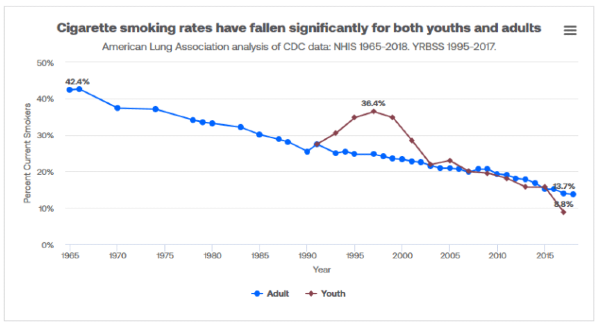

The percent of the U.S. population that smokes is in a continuous decline, and has been for decades.

The percent of the U.S. smoking adult population has steadily declined from 42% in 1965 to just 14% as of 2018. The declines among the youth population have been even bigger. Young people now have a smoking rate of about one in eleven. This sort of decline in an industry’s customer group generally spells trouble for the companies that operate within it.

Other forms of tobacco usage have seen similar rates of decline, including smokeless tobacco. This has been the case with every demographic group, so it is widespread among all of the companies’ potential customers.

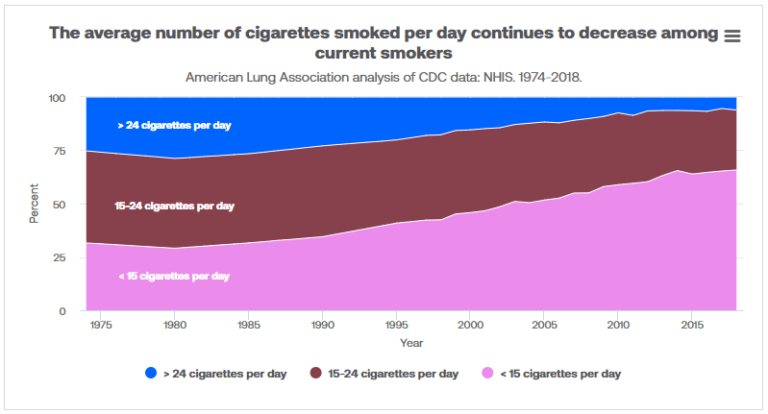

Not only are fewer people smoking, but the ones that do are smoking less than they used to.

The number of people smoking at least 15 cigarettes a day has plummeted in the past few decades. Today, the overwhelming majority of smokers use fewer than 15 cigarettes daily. In other words, there are fewer customers for the industry. And, the ones that remain are using fewer products. This has negatively impacted demand from two directions. This has led to much lower volumes of total cigarettes sold, producing a declining total to be split up among the various companies selling cigarettes.

An increasing number of U.S. states have significantly raised the tax on cigarettes to reduce their budget deficits, and to reduce the potential appeal of smoking for consumers. Given the propensity of localities to use tax increases on cigarettes, the situation will likely only get worse for tobacco stocks.

In addition, pricing increases have the impact of reducing usage further. Demand will almost certainly continue to decline as taxes and prices rise. Indeed, health organizations like the American Lung Association actively encourage localities to raise taxes on cigarettes and other tobacco products to discourage usage.

To make matters worse for tobacco companies, most of the world’s smoking population rate looks much the same as the above chart. It has become abundantly clear that consumers around the world are eschewing tobacco products for health concerns.

These negative trends have kept many investors away from tobacco stocks. However, tobacco stocks can still generate solid total returns given that they tend to offer respectable dividend yields. The key behind an investment in tobacco stocks is the inelastic demand for cigarettes relative to their price due to the addictive nature of these products.

Tobacco companies have been able to raise their prices to help offset declining smoking rates. As a result, they have exceptional growth records. In addition, population growth partly offsets the effect of the declining percent of smokers. However, investors must keep in mind that the total volumes for the industry are in fairly steep decline, and all indications are that this is irreversible.

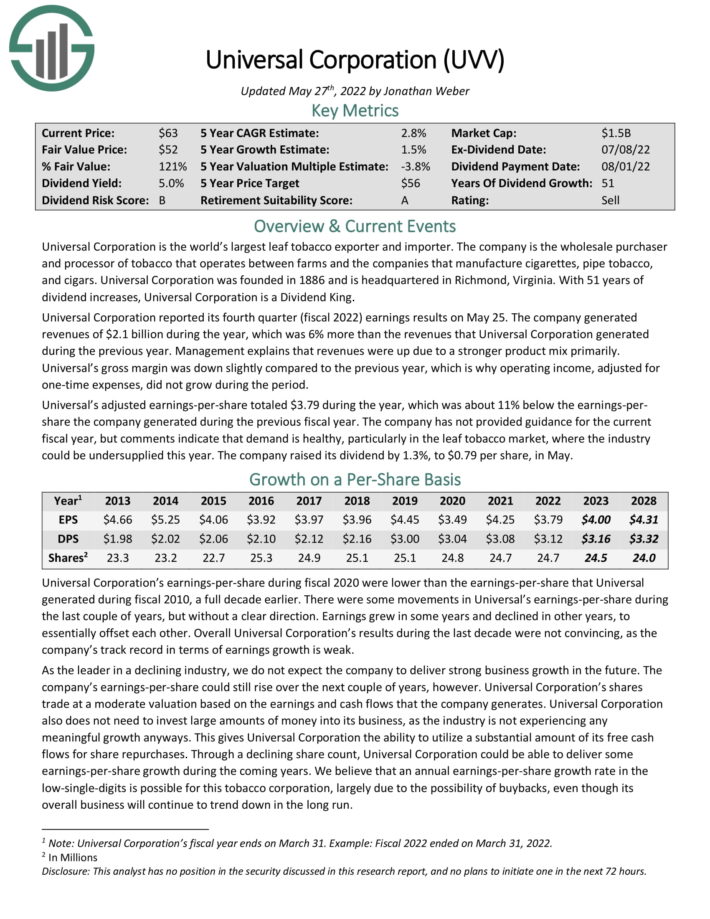

Tobacco Stock #6: Universal Corporation (UVV)

- 5-year expected returns: 6.6%

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates as an intermediary between tobacco farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal also has an ingredients business that is separate from the core leaf segment.

Universal reported first quarter earnings on August 3rd, 2022, and results were quite strong. Revenue was up 23% year-over-year, while cost of goods rose 22%. That meant gross margins rose 70 basis points to 18.5% of revenue, and adjusted operating income was up 5% to $13.3 million. Ingredients revenue soared 46% higher year-over-year due mostly to the company’s 2021 acquisition of Shank’s Extracts.

As the leader in a declining industry, we do not expect the company to deliver strong growth in the future. The company’s earnings-per-share could still rise over the next couple of years, however. Universal’s shares trade at a moderate valuation based on the earnings and cash flows that the company generates.

Universal also does not need to invest large amounts of money into its business, which gives it the ability to utilize a substantial amount of its free cash flows for share repurchases and dividends.

And, for its part Universal is attempting a transition to a producer of fruits, vegetables, and ingredients which the company hopes will diversify its business and provide renewed growth. Universal acquired FruitSmart, an independent specialty fruit and vegetable ingredient processor. FruitSmart supplies juices, concentrates, blends, purees, fibers, seed and seed powders, and other products to food, beverage and flavor companies around the world.

It also acquired Silva International, a privately-held dehydrated vegetable, fruit, and herb processing company. Silva procures over 60 types of dehydrated vegetables, fruits, and herbs from over 20 countries around the world. And as mentioned, the company most recently acquired Shank’s in order to further diversify away from tobacco.

The ingredients business was 19% of revenue in the most recent quarter, up from 16% a year ago. Therefore, Universal has the most diverse business model of the major tobacco stocks.

With a dividend payout of ~79% for the current fiscal year, we view Universal’s dividend as moderately safe, with the caveat that the company faces headwinds due to the steady decline of the tobacco industry.

The stock is now trading at 13.2 times this year’s earnings estimates, which is nearly identical to our estimate of fair value at 13 times earnings. Given this, the stock could generate total returns of 6.6% per year, as the 6.0% dividend yield and 1.5% EPS growth will be somewhat offset by a declining valuation. We therefore rate shares a hold.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

Tobacco Stock #5: Philip Morris International (PM)

- 5-year expected returns: 7.0%

Philip Morris International was spun off from Altria in 2008, and is charged with the production and distribution of Altria’s products outside of the United States. This distribution includes the exceedingly valuable Marlboro brand.

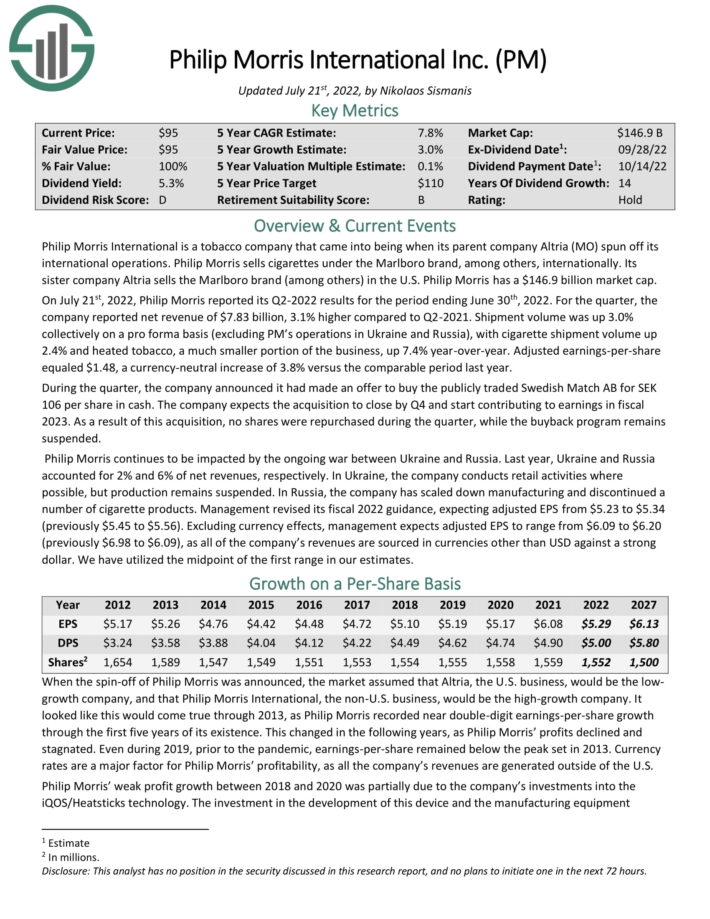

Philip Morris is a large-cap stock with a sizable market capitalization of $152 billion.

Philip Morris reported second quarter earnings on July 21st, 2022, and results were largely in line with expectations. The company reported revenue of $7.83 billion, 3.1% higher year-over-year. Shipment volume rose 3% excluding Ukrainian and Russian operations, which have been severely impacted by the ongoing war. Cigarette volume was up 2.4% while heated tobacco was up 7.4%. Adjusted earnings-per-share rose 4% on a currency-neutral basis to $1.48.

The company is in the process of acquiring Swedish Match AB, which Philip Morris expects to close in the fourth quarter of 2022.

The company now expects $5.23 to $5.34 in adjusted earnings-per-share for this year.

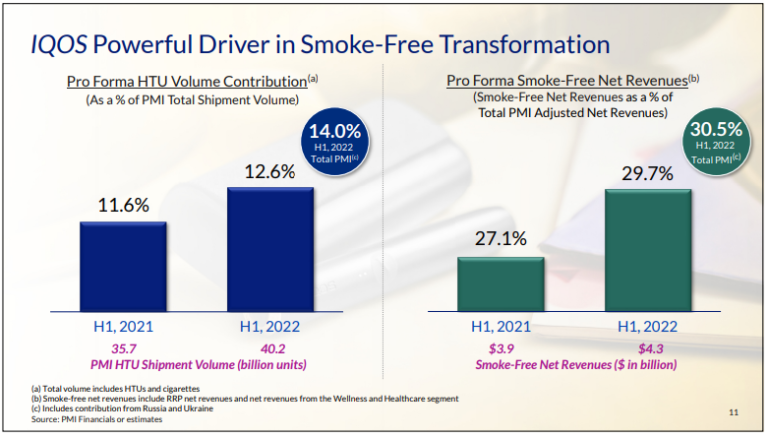

A potential game-changer for the company is the expansion of IQOS in new markets. Philip Morris has increased its capital expenses in the last few years in order to develop and manufacture this product, and it’s being rewarded with strong results globally.

This has helped the company grow its sales meaningfully in recent quarters, even though the volumes of traditional cigarettes have remained steady. Philip Morris counts tens of millions of users of IQOS products, and as we can see above, it is helping to drive gains in shipment volumes.

Interestingly, Philip Morris has a stated corporate goal of switching all of is users from tobacco products to some sort of smoke-free alternative over time. We are cautious at 3% projected annual earnings growth given the declining tobacco user base, and relative infancy of the company’s smoke-free alternatives.

Philip Morris currently offers an attractive 5.1% dividend yield. The stock is trading at a price-to-earnings ratio of 18.6, which is only slightly above our fair value estimate of 18.

On the other hand, thanks to the promising prospects of IQOS, the company has a reasonably positive growth outlook. In addition, shareholders receive a generous dividend while waiting for the growth expectations to materialize.

These factors mean Philip Morris could produce 7.0% total annual returns in the next five years, and the stock earns a hold rating as a result.

Click here to download our most recent Sure Analysis report on PM (preview of page 1 of 3 shown below):

Tobacco Stock #4: Imperial Brands plc (IMBBY)

- 5-year expected returns: 8.8%

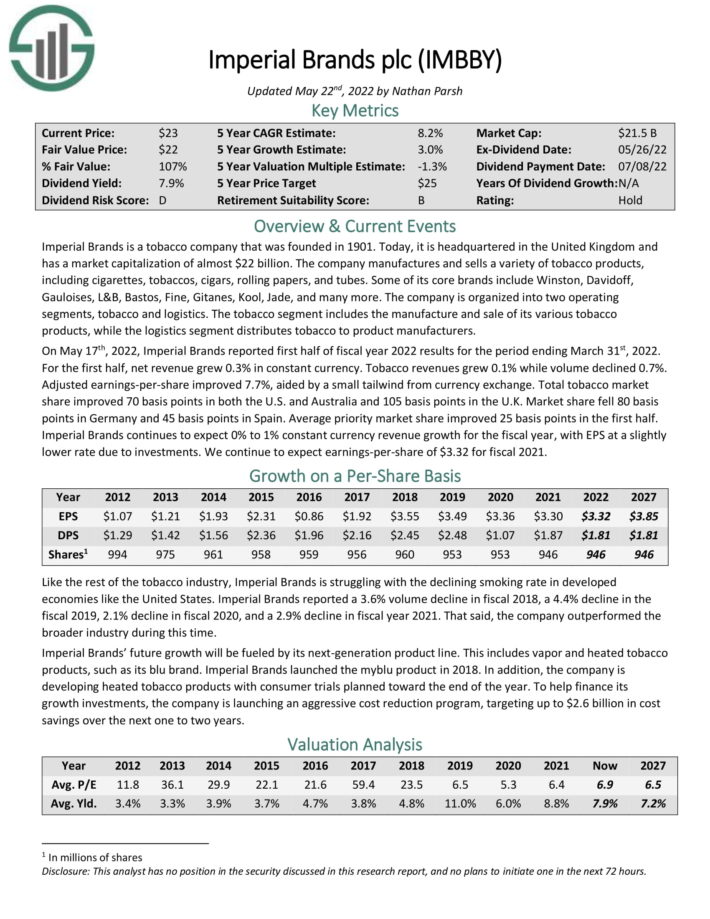

The next stock on our list is Imperial Brands, a British tobacco product conglomerate that was founded in 1901. Today, the company is a market leader in a variety of locations around the globe and produces just over $10 billion in annual revenue, and has a $21 billion market cap.

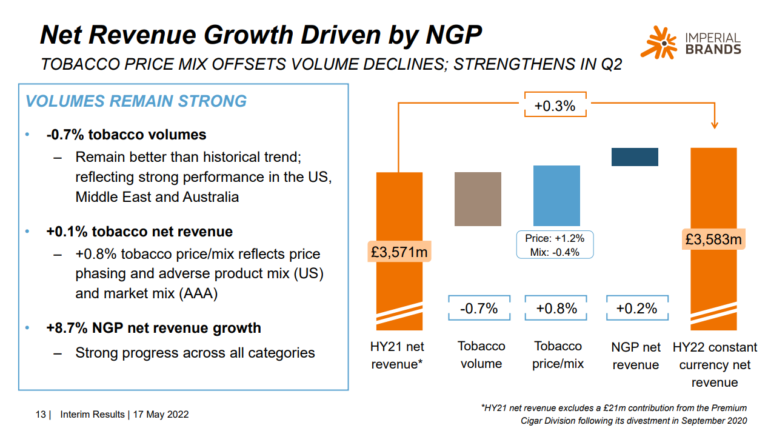

The company reported first half results on May 17th, 2022. Revenue was up 0.3% in constant currency, as tobacco revenue was up 0.1%, but volume fell 0.7%. Adjusted earnings-per-share grew 7.7%, however, as a small tailwind from currency translation and margin improvement drove a good bottom line result. We expect $3.32 in earnings-per-share for this year following first half results.

We note that – like other tobacco companies – Imperial is attempting to diversify away from tobacco with heated tobacco and other products. In Imperial’s case, it refers to these as NGP, or next generation products. We can see that NGP produced almost 9% revenue growth for Imperial in the first half of this year, whereas tobacco was essentially flat. We see 3% earnings-per-share growth going forward, driven in part by the company’s focus on NGP.

The stock is trading for a low multiple of earnings at just 6.8, and Imperial, like many of the other companies on this list, converts an enormous amount of revenue into free cash flow. That is just ahead of our assessed value of 6.5 times earnings. Coupled with 3% expected growth per year and the 8.0% dividend yield, Imperial could return 8.8% annually to shareholders in the coming years.

Click here to download our most recent Sure Analysis report on IMBBY (preview of page 1 of 3 shown below):

Tobacco Stock #3: Altria Group (MO)

- 5-year expected returns: 10.5%

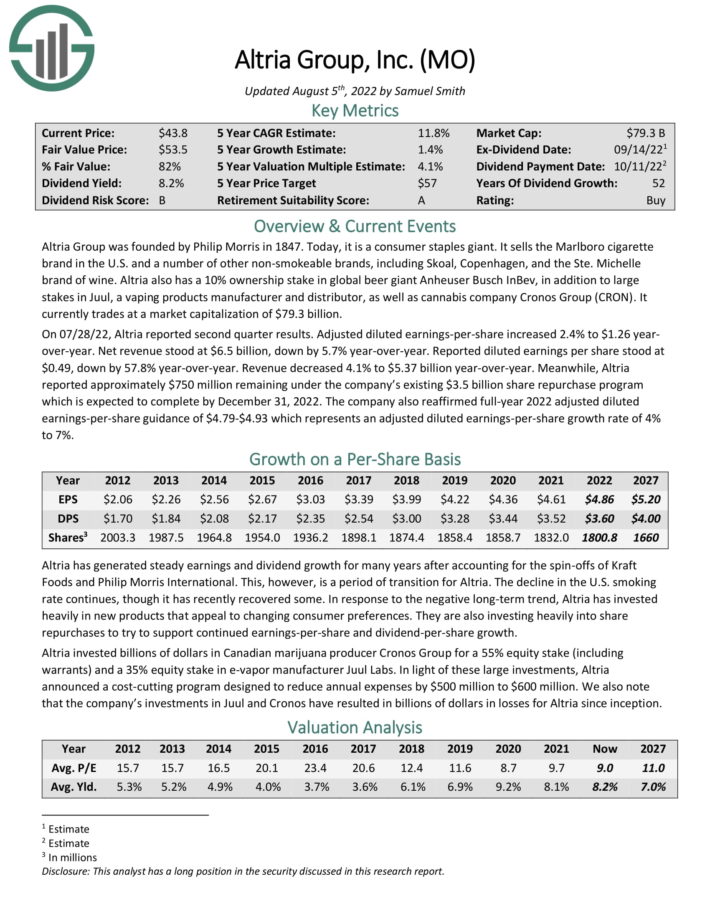

Altria is the market leader in American tobacco stocks. Before 2003, the company was known as Philip Morris, but was renamed as Altria after restructuring (including the aforementioned spin-off of Philip Morris International in 2008).

The company owns many well-known brands, including Marlboro, Skoal and Copenhagen. Altria still derives the overwhelming majority of its revenue and profits from smokeable tobacco, but the company also recognized years ago that smoking rate declines would likely continue. To that end, it has been very busy remaking itself for the industry challenges it knew it would face.

Altria reported second quarter earnings on July 28th, 2022. Adjusted earnings-per-share came to $1.26, which was up 2.4% year-over-year. Revenue was down almost 6% to $6.5 billion. guidance was reaffirmed at $4.79 to $4.93 per share for the year after first half results.

The long-term future is cloudy for cigarette manufacturers such as Altria, which is why the company has invested heavily in adjacent categories to fuel its future growth.

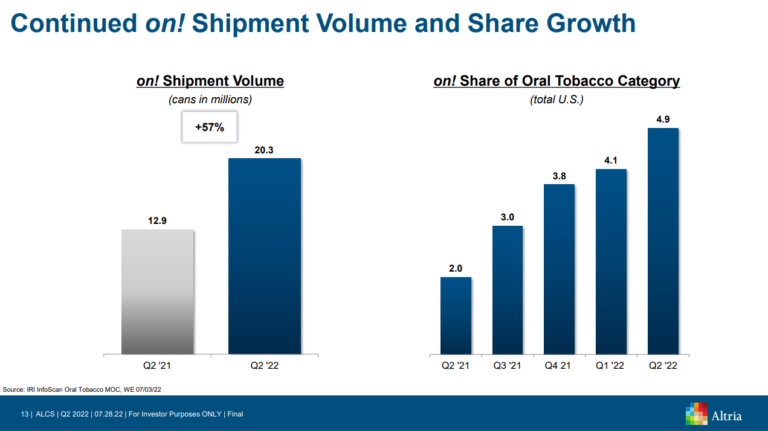

The company purchased a 55% equity stake in Canadian marijuana producer Cronos Group, invested nearly $13 billion for a 35% equity stake in e-vapor manufacturer Juul Labs, and recently acquired the remaining 20% ownership stake in Switzerland-based Burger Söhne Group it didn’t already own, for its on! oral nicotine pouch brand. As seen above, on! has been a continuous grower since the company took it over.

Related: The Best Marijuana Stocks: List of 140+ Marijuana Industry Companies

Altria is the market leader in the US cigarette industry. Market shares for large cigarette brands are relatively stable due to advertising restrictions; Marlboro remains the #1 brand in cigarettes today with over 40% domestic retail share.

This is an impressive record, particularly given the aforementioned decline in the percent of the U.S. smoking population. Its extraordinary performance is a testament to the strength of the business model of Altria and the reliability of its cash flows.

Altria is one of just 45 Dividend Kings, an exclusive group of stocks with 50+ consecutive years of dividend increases.

Altria has largely been able to offset smoking declines with price hikes. And, as its volume sales have decreased, its production cost has decreased as well. While Altria has an uphill climb in front of it, it appears conditions are stabilized with its core tobacco business.

The company enjoys extremely strong free cash flow. As a result, almost all of the company’s operating cash flows end up as free cash flow. Thus, almost all earnings are available for shareholder distributions, reinvestment in future growth, or share repurchases.

This is the exact type of business model that Warren Buffett looks for; companies that need minimum capital expenses and thus, enjoy strong free cash flows. Thanks to this strength, Altria pursues a dividend payout ratio around 80% and its management has confirmed that it will continue to distribute about 80% of adjusted earnings in dividends.

With 1.4% expected EPS growth, and a 7.8% dividend yield with a small boost from an expanding P/E multiple, we expect 10.5% annual returns for Altria stock over the next five years, and rate it a buy.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

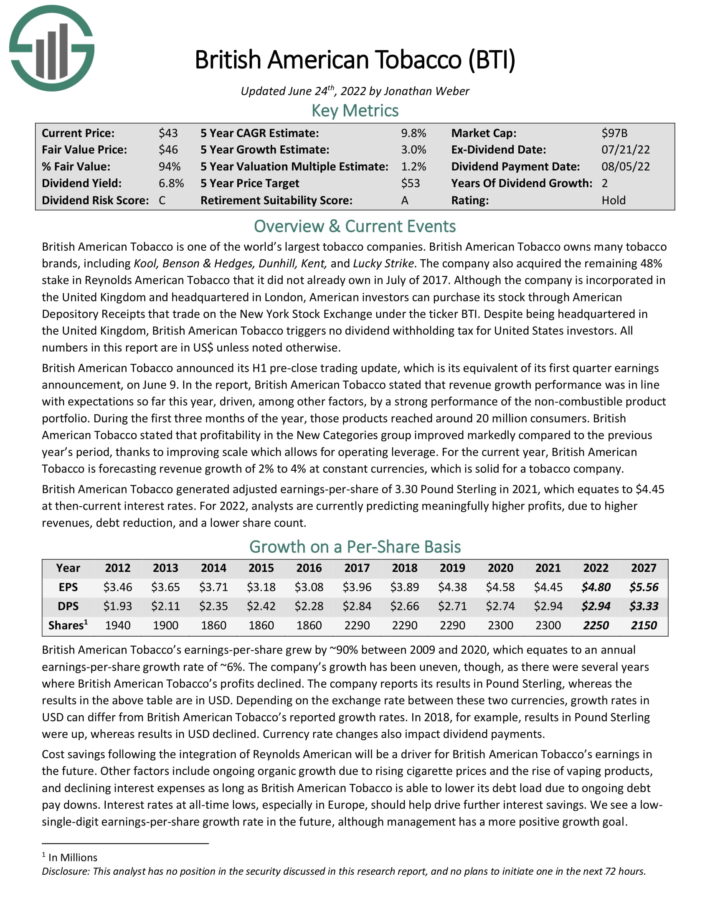

Tobacco Stock #2: British American Tobacco (BTI)

- 5-year expected returns: 11.0%

British American Tobacco is one of the largest tobacco companies in the world, with a market capitalization of $91 billion. British American Tobacco owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

In July 2017, the company acquired the remaining 48% stake in Reynolds American Tobacco that it did not already own. This cemented its competitive position as one of the world’s largest tobacco companies.

Although the company is incorporated in the United Kingdom, American investors can purchase its stock through American Depository Receipts. The ADRs trade on the New York Stock Exchange under the ticker BTI. The United Kingdom does not impose a dividend withholding tax on United States investors.

British American Tobacco has grown its earnings-per-share at a ~5% average annual rate over the last decade. However, most of this growth came in the early part of the decade. Indeed, from 2013 to 2018, earnings-per-share growth averaged just 1% annually. Going forward, we see 3% growth annually.

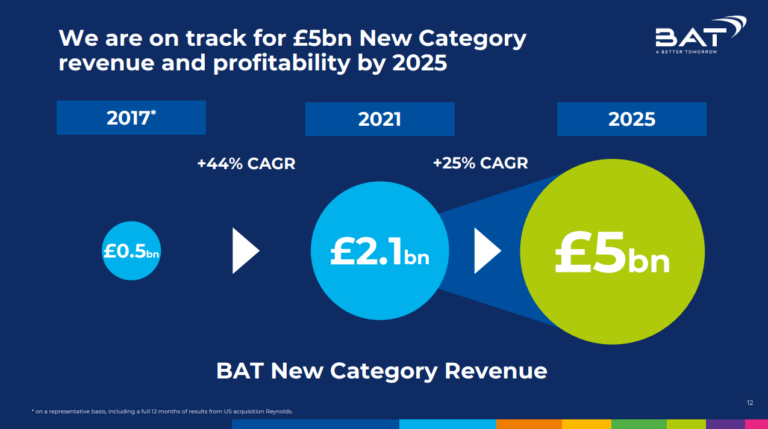

The company’s portfolio of new, non-combustible products is leading the way.

Management believes it can double the amount of New Category revenue by 2025 over last year’s levels, which would help offset the largely stagnant core tobacco category.

British American Tobacco announced first half earnings on July 27th, 2022. Revenue was up 3.7%, led by New Category growth. Combustible revenue was up 0.6%, as price/mix was up 4.8%, offset mostly by a volume decline.

The company’s cost saving program is expected to deliver about $2 billion in cost savings by the end of the year, and adjusted profit from operations rose 4.9% as part of this. Forex was a 1.5% headwind to operating profits. Adjusted diluted earnings-per-share rose almost 6%. We see $4.80 in earnings-per-share for this year following first half results.

This level of adjusted EPS should cover the company’s dividend payment, which currently yields 7.2%. Given the payout ratio of 61% expected for 2022, the dividend seems to be safe.

Shares trade for just 8.6 times this year’s earnings. This is meaningfully lower than our fair value estimate of 9.5 times earnings. This implies a modest tailwind to total returns in the years to come.

We expect 11% annual returns over the next five years, making BTI our second pick among tobacco stocks, as it earns a buy rating.

Click here to download our most recent Sure Analysis report on BTI (preview of page 1 of 3 shown below):

Tobacco Stock #1: Vector Group (VGR)

- 5-year expected returns: 11.5%

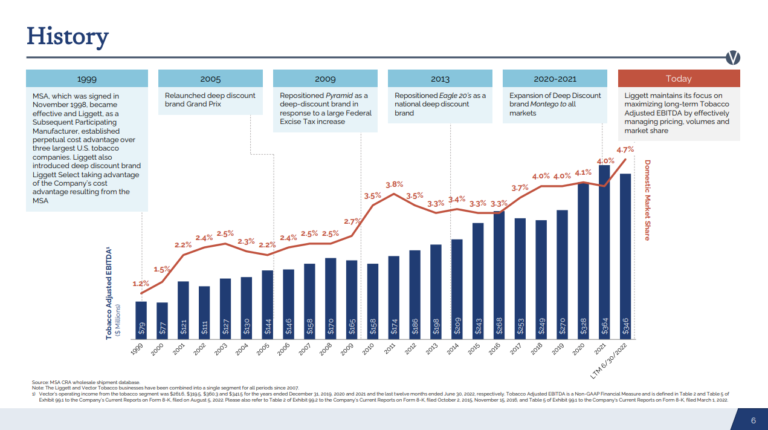

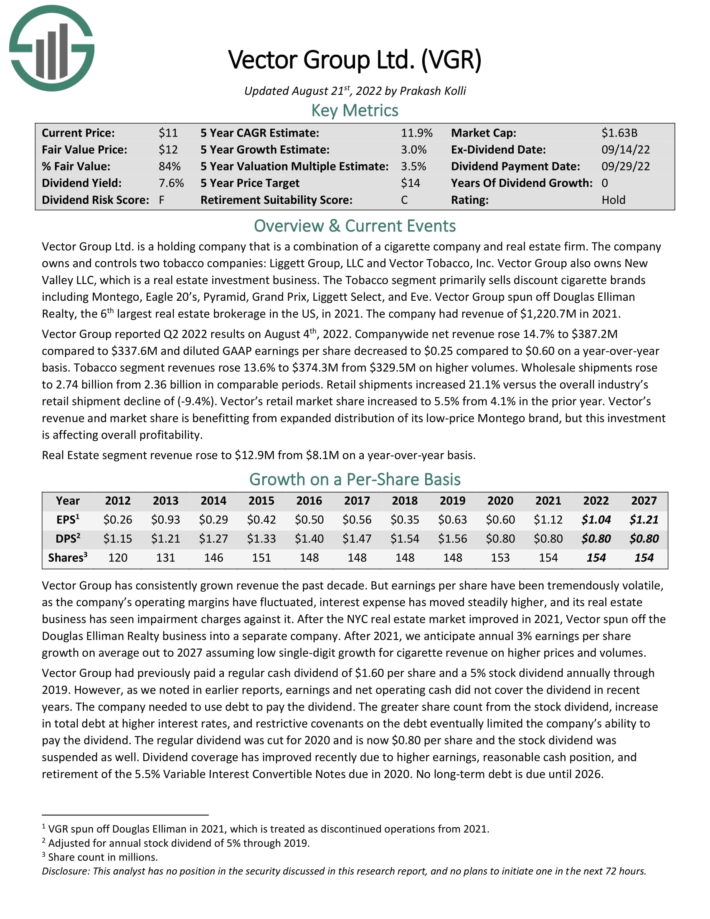

Vector Group is an unusual combination of a real estate investment firm and a tobacco company. The latter was founded in 1873 and continues to operate today as the Liggett Group, while the real estate business came later. Vector generates over $1.2 billion in annual revenue.

Unlike some of the others we’ve looked at, Vector is making no attempt to diversify away from cigarettes. In fact, it’s stated goal is to continue to increase market share of its Liggett brand and maximize long-term profitability in that market.

Vector Group has exhibited a volatile performance record and has failed to grow its earnings-per-share meaningfully over the last decade. While its earnings have remained essentially flat in the last eight years, the company has increased its share count by more than 30% over this period. Therefore, it is prudent to keep growth expectations at a minimum for this company on a per-share basis, as near-constant dilution has taken its toll.

Vector Group had previously paid a rising cash dividend and a 5% stock dividend annually through 2019. But its earnings and net operating cash have not covered the dividend in recent years, so the company needed to borrow and use debt to pay the dividend.

The regular dividend was cut for 2020 and is now $0.80 per share, and the stock dividend was suspended as well. Notably, the current cash dividend of $0.80 is still not covered by earnings or cash flow. But the company has a reasonable cash position and so no long-term debt is due until 2025.

Related: 3 Reasons Why Companies Cut Their Dividends (With Examples)

The only appealing feature of Vector Group is its 7.7% dividend yield. Such a yield may be sufficient to entice income investors. However, investors should note that the dividend payout ratio currently stands at 77% for 2022, which is elevated. While we don’t see another cut as needed, we also don’t believe the company can raise the dividend.

Shares trade at 10 times our earnings-per-share estimate for this year, which is below our fair value of 12. Taking the 7.7% yield and earnings growth of 3% into account, we estimate total annual returns of 11.5% for the next five years for Vector stock. This makes it a buy-rated stock, and the most attractive from a total return basis.

Click here to download our most recent Sure Analysis report on VGR (preview of page 1 of 3 shown below):

Final Thoughts

Tobacco stocks as a group have had a difficult time in the past couple of years. Regulatory and consumer preference changes continue to plague the group. But valuations are relatively low, dividend yields are high, and most companies are diversifying away from tobacco. Vector Group now offers the best total projected annual returns, but all of these companies offer high dividend yields.

We see Altria, British American Tobacco, and Vector as offering the best total returns. And, all offer sizable dividend yields. Dividend sustainability varies by stock in this group, but overall, there is a lot for income investors to like when it comes to these 6 tobacco stocks.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Updated on August 26th, 2022 by Josh Arnold

As a business owner, selling products that have high profit margins along with strong brand awareness and an exceptionally loyal customer base is strongly desirable. This allows for predictable revenue and high levels of profits over time.

The tobacco industry fits this model, despite declines over time in the number of customers that use its products. Tobacco stocks are particularly attractive to income investors thanks to their generous dividends and defensive characteristics during economic downturns. Tobacco stocks produce a lot of cash, but have very little capital expenditure needs, creating what could be considered perfect income stocks.

You can download a spreadsheet with all our tobacco stocks (along with important financial metrics such as dividend yields and price-to-earnings ratios) using the link below:

Click here to download your spreadsheet of all tobacco stocks now.

Tobacco stocks are widely prized by income investors thanks to their high dividend yields, stable payouts and dividend increase streaks. However, declining customer counts and usage rates are weighing on the group.

This article will analyze the prospects of 6 of the largest tobacco stocks. Rankings are in order of projected total returns from worst to best.

Table of Contents

You can instantly jump to any individual stock analysis by clicking on the links below:

But first, we’ll take a look at the tobacco industry’s primary concern, which is declining tobacco usage.

Industry Overview: Declining Smoking Rates

The percent of the U.S. population that smokes is in a continuous decline, and has been for decades.

Source: American Lung Association

The percent of the U.S. smoking adult population has steadily declined from 42% in 1965 to just 14% as of 2018. The declines among the youth population have been even bigger. Young people now have a smoking rate of about one in eleven. This sort of decline in an industry’s customer group generally spells trouble for the companies that operate within it.

Other forms of tobacco usage have seen similar rates of decline, including smokeless tobacco. This has been the case with every demographic group, so it is widespread among all of the companies’ potential customers.

Not only are fewer people smoking, but the ones that do are smoking less than they used to.

Source: American Lung Association

The number of people smoking at least 15 cigarettes a day has plummeted in the past few decades. Today, the overwhelming majority of smokers use fewer than 15 cigarettes daily. In other words, there are fewer customers for the industry. And, the ones that remain are using fewer products. This has negatively impacted demand from two directions. This has led to much lower volumes of total cigarettes sold, producing a declining total to be split up among the various companies selling cigarettes.

An increasing number of U.S. states have significantly raised the tax on cigarettes to reduce their budget deficits, and to reduce the potential appeal of smoking for consumers. Given the propensity of localities to use tax increases on cigarettes, the situation will likely only get worse for tobacco stocks.

In addition, pricing increases have the impact of reducing usage further. Demand will almost certainly continue to decline as taxes and prices rise. Indeed, health organizations like the American Lung Association actively encourage localities to raise taxes on cigarettes and other tobacco products to discourage usage.

To make matters worse for tobacco companies, most of the world’s smoking population rate looks much the same as the above chart. It has become abundantly clear that consumers around the world are eschewing tobacco products for health concerns.

These negative trends have kept many investors away from tobacco stocks. However, tobacco stocks can still generate solid total returns given that they tend to offer respectable dividend yields. The key behind an investment in tobacco stocks is the inelastic demand for cigarettes relative to their price due to the addictive nature of these products.

Tobacco companies have been able to raise their prices to help offset declining smoking rates. As a result, they have exceptional growth records. In addition, population growth partly offsets the effect of the declining percent of smokers. However, investors must keep in mind that the total volumes for the industry are in fairly steep decline, and all indications are that this is irreversible.

Tobacco Stock #6: Universal Corporation (UVV)

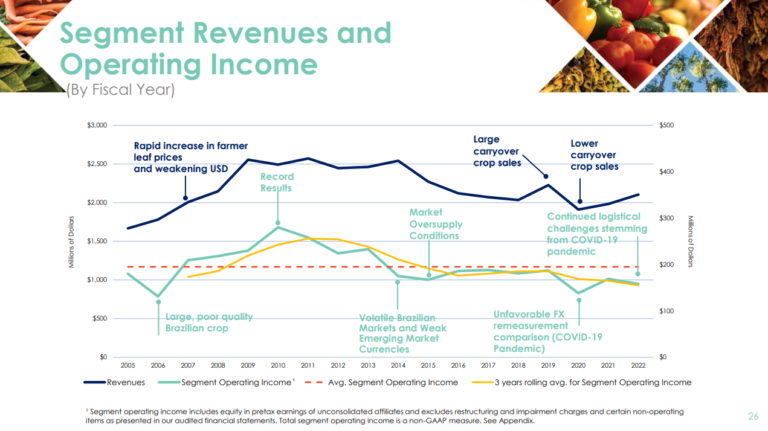

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates as an intermediary between tobacco farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal also has an ingredients business that is separate from the core leaf segment.

Universal reported first quarter earnings on August 3rd, 2022, and results were quite strong. Revenue was up 23% year-over-year, while cost of goods rose 22%. That meant gross margins rose 70 basis points to 18.5% of revenue, and adjusted operating income was up 5% to $13.3 million. Ingredients revenue soared 46% higher year-over-year due mostly to the company’s 2021 acquisition of Shank’s Extracts.

Source: Investor Presentation, page 26

As the leader in a declining industry, we do not expect the company to deliver strong growth in the future. The company’s earnings-per-share could still rise over the next couple of years, however. Universal’s shares trade at a moderate valuation based on the earnings and cash flows that the company generates.

Universal also does not need to invest large amounts of money into its business, which gives it the ability to utilize a substantial amount of its free cash flows for share repurchases and dividends.

And, for its part Universal is attempting a transition to a producer of fruits, vegetables, and ingredients which the company hopes will diversify its business and provide renewed growth. Universal acquired FruitSmart, an independent specialty fruit and vegetable ingredient processor. FruitSmart supplies juices, concentrates, blends, purees, fibers, seed and seed powders, and other products to food, beverage and flavor companies around the world.

It also acquired Silva International, a privately-held dehydrated vegetable, fruit, and herb processing company. Silva procures over 60 types of dehydrated vegetables, fruits, and herbs from over 20 countries around the world. And as mentioned, the company most recently acquired Shank’s in order to further diversify away from tobacco.

The ingredients business was 19% of revenue in the most recent quarter, up from 16% a year ago. Therefore, Universal has the most diverse business model of the major tobacco stocks.

With a dividend payout of ~79% for the current fiscal year, we view Universal’s dividend as moderately safe, with the caveat that the company faces headwinds due to the steady decline of the tobacco industry.

The stock is now trading at 13.2 times this year’s earnings estimates, which is nearly identical to our estimate of fair value at 13 times earnings. Given this, the stock could generate total returns of 6.6% per year, as the 6.0% dividend yield and 1.5% EPS growth will be somewhat offset by a declining valuation. We therefore rate shares a hold.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

Tobacco Stock #5: Philip Morris International (PM)

Philip Morris International was spun off from Altria in 2008, and is charged with the production and distribution of Altria’s products outside of the United States. This distribution includes the exceedingly valuable Marlboro brand.

Philip Morris is a large-cap stock with a sizable market capitalization of $152 billion.

Philip Morris reported second quarter earnings on July 21st, 2022, and results were largely in line with expectations. The company reported revenue of $7.83 billion, 3.1% higher year-over-year. Shipment volume rose 3% excluding Ukrainian and Russian operations, which have been severely impacted by the ongoing war. Cigarette volume was up 2.4% while heated tobacco was up 7.4%. Adjusted earnings-per-share rose 4% on a currency-neutral basis to $1.48.

The company is in the process of acquiring Swedish Match AB, which Philip Morris expects to close in the fourth quarter of 2022.

The company now expects $5.23 to $5.34 in adjusted earnings-per-share for this year.

Source: Investor presentation, page 11

A potential game-changer for the company is the expansion of IQOS in new markets. Philip Morris has increased its capital expenses in the last few years in order to develop and manufacture this product, and it’s being rewarded with strong results globally.

This has helped the company grow its sales meaningfully in recent quarters, even though the volumes of traditional cigarettes have remained steady. Philip Morris counts tens of millions of users of IQOS products, and as we can see above, it is helping to drive gains in shipment volumes.

Interestingly, Philip Morris has a stated corporate goal of switching all of is users from tobacco products to some sort of smoke-free alternative over time. We are cautious at 3% projected annual earnings growth given the declining tobacco user base, and relative infancy of the company’s smoke-free alternatives.

Philip Morris currently offers an attractive 5.1% dividend yield. The stock is trading at a price-to-earnings ratio of 18.6, which is only slightly above our fair value estimate of 18.

On the other hand, thanks to the promising prospects of IQOS, the company has a reasonably positive growth outlook. In addition, shareholders receive a generous dividend while waiting for the growth expectations to materialize.

These factors mean Philip Morris could produce 7.0% total annual returns in the next five years, and the stock earns a hold rating as a result.

Click here to download our most recent Sure Analysis report on PM (preview of page 1 of 3 shown below):

Tobacco Stock #4: Imperial Brands plc (IMBBY)

The next stock on our list is Imperial Brands, a British tobacco product conglomerate that was founded in 1901. Today, the company is a market leader in a variety of locations around the globe and produces just over $10 billion in annual revenue, and has a $21 billion market cap.

The company reported first half results on May 17th, 2022. Revenue was up 0.3% in constant currency, as tobacco revenue was up 0.1%, but volume fell 0.7%. Adjusted earnings-per-share grew 7.7%, however, as a small tailwind from currency translation and margin improvement drove a good bottom line result. We expect $3.32 in earnings-per-share for this year following first half results.

Source: Investor presentation, page 13

We note that – like other tobacco companies – Imperial is attempting to diversify away from tobacco with heated tobacco and other products. In Imperial’s case, it refers to these as NGP, or next generation products. We can see that NGP produced almost 9% revenue growth for Imperial in the first half of this year, whereas tobacco was essentially flat. We see 3% earnings-per-share growth going forward, driven in part by the company’s focus on NGP.

The stock is trading for a low multiple of earnings at just 6.8, and Imperial, like many of the other companies on this list, converts an enormous amount of revenue into free cash flow. That is just ahead of our assessed value of 6.5 times earnings. Coupled with 3% expected growth per year and the 8.0% dividend yield, Imperial could return 8.8% annually to shareholders in the coming years.

Click here to download our most recent Sure Analysis report on IMBBY (preview of page 1 of 3 shown below):

Tobacco Stock #3: Altria Group (MO)

Altria is the market leader in American tobacco stocks. Before 2003, the company was known as Philip Morris, but was renamed as Altria after restructuring (including the aforementioned spin-off of Philip Morris International in 2008).

The company owns many well-known brands, including Marlboro, Skoal and Copenhagen. Altria still derives the overwhelming majority of its revenue and profits from smokeable tobacco, but the company also recognized years ago that smoking rate declines would likely continue. To that end, it has been very busy remaking itself for the industry challenges it knew it would face.

Altria reported second quarter earnings on July 28th, 2022. Adjusted earnings-per-share came to $1.26, which was up 2.4% year-over-year. Revenue was down almost 6% to $6.5 billion. guidance was reaffirmed at $4.79 to $4.93 per share for the year after first half results.

The long-term future is cloudy for cigarette manufacturers such as Altria, which is why the company has invested heavily in adjacent categories to fuel its future growth.

Source: Investor presentation, page 13

The company purchased a 55% equity stake in Canadian marijuana producer Cronos Group, invested nearly $13 billion for a 35% equity stake in e-vapor manufacturer Juul Labs, and recently acquired the remaining 20% ownership stake in Switzerland-based Burger Söhne Group it didn’t already own, for its on! oral nicotine pouch brand. As seen above, on! has been a continuous grower since the company took it over.

Related: The Best Marijuana Stocks: List of 140+ Marijuana Industry Companies

Altria is the market leader in the US cigarette industry. Market shares for large cigarette brands are relatively stable due to advertising restrictions; Marlboro remains the #1 brand in cigarettes today with over 40% domestic retail share.

This is an impressive record, particularly given the aforementioned decline in the percent of the U.S. smoking population. Its extraordinary performance is a testament to the strength of the business model of Altria and the reliability of its cash flows.

Altria is one of just 45 Dividend Kings, an exclusive group of stocks with 50+ consecutive years of dividend increases.

Altria has largely been able to offset smoking declines with price hikes. And, as its volume sales have decreased, its production cost has decreased as well. While Altria has an uphill climb in front of it, it appears conditions are stabilized with its core tobacco business.

The company enjoys extremely strong free cash flow. As a result, almost all of the company’s operating cash flows end up as free cash flow. Thus, almost all earnings are available for shareholder distributions, reinvestment in future growth, or share repurchases.

This is the exact type of business model that Warren Buffett looks for; companies that need minimum capital expenses and thus, enjoy strong free cash flows. Thanks to this strength, Altria pursues a dividend payout ratio around 80% and its management has confirmed that it will continue to distribute about 80% of adjusted earnings in dividends.

With 1.4% expected EPS growth, and a 7.8% dividend yield with a small boost from an expanding P/E multiple, we expect 10.5% annual returns for Altria stock over the next five years, and rate it a buy.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

Tobacco Stock #2: British American Tobacco (BTI)

British American Tobacco is one of the largest tobacco companies in the world, with a market capitalization of $91 billion. British American Tobacco owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

In July 2017, the company acquired the remaining 48% stake in Reynolds American Tobacco that it did not already own. This cemented its competitive position as one of the world’s largest tobacco companies.

Although the company is incorporated in the United Kingdom, American investors can purchase its stock through American Depository Receipts. The ADRs trade on the New York Stock Exchange under the ticker BTI. The United Kingdom does not impose a dividend withholding tax on United States investors.

British American Tobacco has grown its earnings-per-share at a ~5% average annual rate over the last decade. However, most of this growth came in the early part of the decade. Indeed, from 2013 to 2018, earnings-per-share growth averaged just 1% annually. Going forward, we see 3% growth annually.

The company’s portfolio of new, non-combustible products is leading the way.

Source: Investor Presentation, page 12

Management believes it can double the amount of New Category revenue by 2025 over last year’s levels, which would help offset the largely stagnant core tobacco category.

British American Tobacco announced first half earnings on July 27th, 2022. Revenue was up 3.7%, led by New Category growth. Combustible revenue was up 0.6%, as price/mix was up 4.8%, offset mostly by a volume decline.

The company’s cost saving program is expected to deliver about $2 billion in cost savings by the end of the year, and adjusted profit from operations rose 4.9% as part of this. Forex was a 1.5% headwind to operating profits. Adjusted diluted earnings-per-share rose almost 6%. We see $4.80 in earnings-per-share for this year following first half results.

This level of adjusted EPS should cover the company’s dividend payment, which currently yields 7.2%. Given the payout ratio of 61% expected for 2022, the dividend seems to be safe.

Shares trade for just 8.6 times this year’s earnings. This is meaningfully lower than our fair value estimate of 9.5 times earnings. This implies a modest tailwind to total returns in the years to come.

We expect 11% annual returns over the next five years, making BTI our second pick among tobacco stocks, as it earns a buy rating.

Click here to download our most recent Sure Analysis report on BTI (preview of page 1 of 3 shown below):

Tobacco Stock #1: Vector Group (VGR)

Vector Group is an unusual combination of a real estate investment firm and a tobacco company. The latter was founded in 1873 and continues to operate today as the Liggett Group, while the real estate business came later. Vector generates over $1.2 billion in annual revenue.

Unlike some of the others we’ve looked at, Vector is making no attempt to diversify away from cigarettes. In fact, it’s stated goal is to continue to increase market share of its Liggett brand and maximize long-term profitability in that market.

Source: Investor presentation, page 6

Vector Group has exhibited a volatile performance record and has failed to grow its earnings-per-share meaningfully over the last decade. While its earnings have remained essentially flat in the last eight years, the company has increased its share count by more than 30% over this period. Therefore, it is prudent to keep growth expectations at a minimum for this company on a per-share basis, as near-constant dilution has taken its toll.

Vector Group had previously paid a rising cash dividend and a 5% stock dividend annually through 2019. But its earnings and net operating cash have not covered the dividend in recent years, so the company needed to borrow and use debt to pay the dividend.

The regular dividend was cut for 2020 and is now $0.80 per share, and the stock dividend was suspended as well. Notably, the current cash dividend of $0.80 is still not covered by earnings or cash flow. But the company has a reasonable cash position and so no long-term debt is due until 2025.

Related: 3 Reasons Why Companies Cut Their Dividends (With Examples)

The only appealing feature of Vector Group is its 7.7% dividend yield. Such a yield may be sufficient to entice income investors. However, investors should note that the dividend payout ratio currently stands at 77% for 2022, which is elevated. While we don’t see another cut as needed, we also don’t believe the company can raise the dividend.

Shares trade at 10 times our earnings-per-share estimate for this year, which is below our fair value of 12. Taking the 7.7% yield and earnings growth of 3% into account, we estimate total annual returns of 11.5% for the next five years for Vector stock. This makes it a buy-rated stock, and the most attractive from a total return basis.

Click here to download our most recent Sure Analysis report on VGR (preview of page 1 of 3 shown below):

Final Thoughts

Tobacco stocks as a group have had a difficult time in the past couple of years. Regulatory and consumer preference changes continue to plague the group. But valuations are relatively low, dividend yields are high, and most companies are diversifying away from tobacco. Vector Group now offers the best total projected annual returns, but all of these companies offer high dividend yields.

We see Altria, British American Tobacco, and Vector as offering the best total returns. And, all offer sizable dividend yields. Dividend sustainability varies by stock in this group, but overall, there is a lot for income investors to like when it comes to these 6 tobacco stocks.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Originally Posted on suredividend.com