I’ve been publishing the Zen Ten list each December since 2008. I pick my favorites and stick with them all year – no trading.

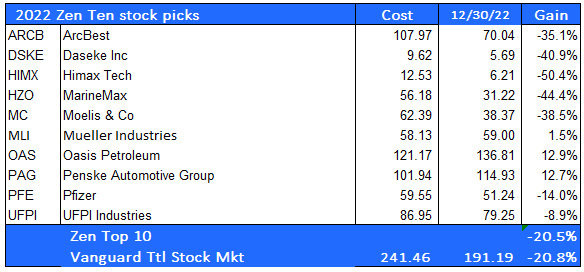

Before I reveal my new stock picks for 2023, a quick review of last year’s picks is in order. Table 1 has the details.

Table 1. 2022 Zen Ten Performance

As you can see, my 2022 picks outperformed (by a whisker) the benchmark VTI. I don’t cherry-pick the start and end dates, I use the actual start and end dates for all securities, including VTI, based on the date I published the list.

Why you should pay attention to this list

I have been trading and managing money for 30 years. I'm still a stock picker at heart, but now I only do it for my own account, my family, and for consulting clients who ask me to pick stocks for them.

I do not claim to have a special gift for spotting the next Google or Amazon. I don't have a crystal ball. I’m skilled, but it takes more than skill to get the results I get - it also takes a little bit of luck.

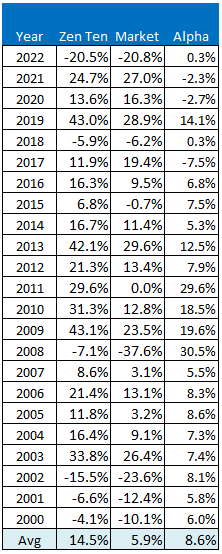

I've managed to beat the market by an average of 3.4% per year over the past 10 years. Since I began using this list with clients in 2000, I’ve beaten the market by an average of 8.6% per year.

Table 2. My full track record back to 2000

My winning record isn't all down to luck. I do have a system, and it's been working since 2000. The problem, of course, is that any system can stop working at any time and without warning. I'll explain how my system works in a minute, but first take a look at the results of my picks from 2000 (the first year I used them with client money) through 2022.

In addition to skill and some hard work, my success with picking stocks is also due to a strict methodology that I follow - no matter what. I don't just throw darts at the Wall Street Journal stock tables. There's a method behind what I do. But anyone who beats the market repeatedly, as I have done throughout my career, must have some kind of an edge. My edge is my methodology.

My Methodology

Now let's move on to the issue of how I arrive at my stock picks. For the past ten years, I have published a list of stocks that I thought would be solid performers over the following 12 months. Finding these stocks is a matter of filtering the universe of available stocks using three different criteria. Here's a quick review:

Starting with a universe of 8,000 stocks, I first screen for the ones that are rated 1 or 2 by Zacks Investment Research. This screen is all about earnings - growth, positive surprises, and upward revisions. This narrows the list of candidates to about 900 names.

Next, I cross-reference the Zacks list with Refinitiv top-rated stocks. The Refinitiv screen looks for top scores in Value, Quality, Earnings Growth, and Financial Stability. This complements the earnings focus of the Zacks screen. The list of candidates that pass both of these screens is now down to about 400.

Lastly, I run the surviving names through the StockRover screen and keep only the names that scored at least an 80 on their 100-point scale for profitability, sustainability, and margin of safety. The screen consolidates the opinions of all the analysts who cover the stocks, and it gives more weight to those analysts who have proven to be the most accurate in each of the stocks over time.

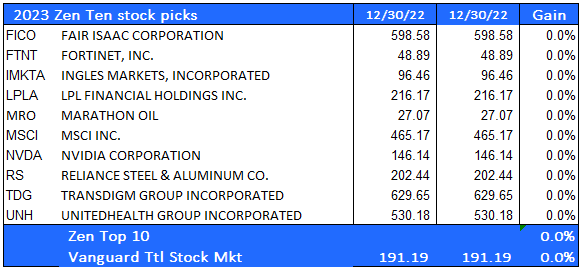

The 10 stocks that made it through all three of these screens for 2022 appear below:

Table 3. My top picks for 2023

The advantage of using this three-step screening process is that each screen focuses on a different aspect of what makes a stock attractive. It's a Bayesian approach to stock selection. You begin with a prior probability (the Zacks rank has a history of identifying winning stocks), and you further refine the list by adding layers of non-correlated screening criteria.

I didn't spend months analyzing financial statements and visiting these companies in person. I'm relying on the analyst community to do that for me. My methodology takes into account a consensus of top analysts and how their earnings estimates have changed over time.

Final Thoughts

I can be reasonably confident that these are solid companies producing solid and growing earnings, and they can be a powerful addition to your own watch list as long as you do your own due diligence. I do not recommend that anyone blindly follows my picks - always do your own research.

I’ve been publishing the Zen Ten list each December since 2008. I pick my favorites and stick with them all year – no trading.

Before I reveal my new stock picks for 2023, a quick review of last year’s picks is in order. Table 1 has the details.

Table 1. 2022 Zen Ten Performance

As you can see, my 2022 picks outperformed (by a whisker) the benchmark VTI. I don’t cherry-pick the start and end dates, I use the actual start and end dates for all securities, including VTI, based on the date I published the list.

Why you should pay attention to this list

I have been trading and managing money for 30 years. I'm still a stock picker at heart, but now I only do it for my own account, my family, and for consulting clients who ask me to pick stocks for them.

I do not claim to have a special gift for spotting the next Google or Amazon. I don't have a crystal ball. I’m skilled, but it takes more than skill to get the results I get - it also takes a little bit of luck.

I've managed to beat the market by an average of 3.4% per year over the past 10 years. Since I began using this list with clients in 2000, I’ve beaten the market by an average of 8.6% per year.

Table 2. My full track record back to 2000

My winning record isn't all down to luck. I do have a system, and it's been working since 2000. The problem, of course, is that any system can stop working at any time and without warning. I'll explain how my system works in a minute, but first take a look at the results of my picks from 2000 (the first year I used them with client money) through 2022.

In addition to skill and some hard work, my success with picking stocks is also due to a strict methodology that I follow - no matter what. I don't just throw darts at the Wall Street Journal stock tables. There's a method behind what I do. But anyone who beats the market repeatedly, as I have done throughout my career, must have some kind of an edge. My edge is my methodology.

My Methodology

Now let's move on to the issue of how I arrive at my stock picks. For the past ten years, I have published a list of stocks that I thought would be solid performers over the following 12 months. Finding these stocks is a matter of filtering the universe of available stocks using three different criteria. Here's a quick review:

Starting with a universe of 8,000 stocks, I first screen for the ones that are rated 1 or 2 by Zacks Investment Research. This screen is all about earnings - growth, positive surprises, and upward revisions. This narrows the list of candidates to about 900 names.

Next, I cross-reference the Zacks list with Refinitiv top-rated stocks. The Refinitiv screen looks for top scores in Value, Quality, Earnings Growth, and Financial Stability. This complements the earnings focus of the Zacks screen. The list of candidates that pass both of these screens is now down to about 400.

Lastly, I run the surviving names through the StockRover screen and keep only the names that scored at least an 80 on their 100-point scale for profitability, sustainability, and margin of safety. The screen consolidates the opinions of all the analysts who cover the stocks, and it gives more weight to those analysts who have proven to be the most accurate in each of the stocks over time.

The 10 stocks that made it through all three of these screens for 2022 appear below:

Table 3. My top picks for 2023

The advantage of using this three-step screening process is that each screen focuses on a different aspect of what makes a stock attractive. It's a Bayesian approach to stock selection. You begin with a prior probability (the Zacks rank has a history of identifying winning stocks), and you further refine the list by adding layers of non-correlated screening criteria.

I didn't spend months analyzing financial statements and visiting these companies in person. I'm relying on the analyst community to do that for me. My methodology takes into account a consensus of top analysts and how their earnings estimates have changed over time.

Final Thoughts

I can be reasonably confident that these are solid companies producing solid and growing earnings, and they can be a powerful addition to your own watch list as long as you do your own due diligence. I do not recommend that anyone blindly follows my picks - always do your own research.

Originally Posted in The Zen Ten