What is the #1 medical device company?

According to MDDIonline, the largest medical device company in terms of revenue is Medtronic plc. Medtronic is a medical device manufacturer based out of Minneapolis, Minnesota. They were founded in Ireland in 1949, and have become a major player in the medical device field. Their revenue for 2023 was $31.56 billion. This narrowly edged out Abbott Laboratories, Danaher Corporation, and Johnson & Johnson. While some of these are more well known household names, Medtronic has actually been the top medical device manufacturer since 2017.

Their hold on the highest revenue in the segment is due to their innovative approach to patient care. In 2023, Medtronic and NVidia introduced a plan to use AI to assist in connected care. They have also been at the forefront of treatment for more than 70 health conditions from diabetes to cardiovascular disease.

In recent times, another midwest-based medical device company has been making waves, and that is Stryker Corporation. The Kalamazoo, Michigan based company has entered the top 10 largest medical device companies. Their growth in recent years has led many to question; what is the better buy?

The Case for Stryker

As mentioned previously, Stryker is an American manufacturer of medical devices. They are based out of Kalamazoo, Michigan. Last year, they had revenue of $20.49 billion, the highest in the company’s history, and an 11% increase over 2022. This continues their very strong performance over the past 5 years, as they have seen quarterly growth every single quarter since June 2020, and that was the only time since 2010 that they have not experienced quarterly growth. They have continued to see steady revenue growth, only ever halted by the Covid-19 pandemic.

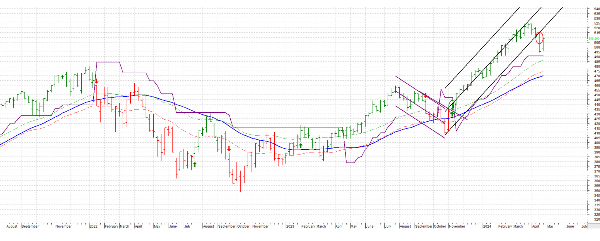

The continued and consistent increase in the revenue for Stryker is reflected in the stock price. No matter how you look at it, or which time frame, the performance for Stryker has been impressive. Year-to-date the stock price is up over 13%, and over the last full year is up 23%. Also of note is the dividend. They have increased their dividend each year since 1994, further cementing them as a strong stock to consider.

Medtronic’s “Shaky Standing”?

While yes, Medtronic is still the largest medical device manufacturer, there are some who believe there is less potential reward there. While their revenue has been high, there has been very little growth. In fact, their trailing 12 month revenue has ranged between $27.8 billion and $32.3 billion each report since 2016. While Stryker had only one quarter of failing to increase revenue since 2010, in the same time frame, Medtronic has failed to do so 13 times.

When diving into the stock for Medtronic, things remain unclear. While over the past year there has been an increase to Medtronic’s stock price, it has only increased 1.02%. Year-to-date performance is not impressive, falling 0.66%. The largest concern, however, is on the long-term outlook for Medtronic. Over the past 5 years, they have experienced and 11.11% decrease in the price of their stock. During this same window. Stryker has increased over 80%%. Medtronic does, however, have an impressive record of increasing their dividend share. For 47 consecutive years, they have increased the dividend per share, now reaching a yield of 3.35% and annual dividend of $2.76 per share.

There is reason to believe revenue and stock price growth may be on the horizon. Recent progress with their cardiovascular division offers promise of larger revenues in the coming years, while the impact of Covid-19 lessens with each passing year.

Which Stock Should You Buy?

While the numbers certainly look impressive for Stryker, and less so for Medtronic, the answer to this question is not so simple. It is unlikely that Stryker will continue to increase their revenue by 8+% per year. This will lead to a slowing of the increase in their stock price at some time in the future. At the current traded price of $335.54, how much higher can this stock price climb?

Medtronic has been a major player in the segment for decades, and has been the highest revenue company in the field for a decade. Their current traded price of $82.29 comes despite hitting an all-time high in 2021 and failing to match that revenue in the time following. Also noteworthy is the greater FCF margin that Medtronic still operates with, at 20%.

While some analysts like the potential for long-term growth for Stryker, others prefer the stability and proven track record of dividend increases and excellence at the top of the industry from Medtronic. Trefis predicts that currently, Medtronic is a better buy while The Motley Fool, Forbes, and The Globe and Mail all see more opportunity with Stryker.

Conclusions

It may seem clear to some, but there is a lack of agreement when it comes down to which stock is the better buy. I believe that both are certainly warranting consideration as buys, but based on my research, as well as the numbers, I believe there may actually be more opportunity in the long-term buying Medtronic.

Medtronic operates with a significantly more appropriate price-to-projected-FCF range, and we can see this thanks to GuruFocus. Their intrinsic value based on this model is significantly closer to the actual traded price than that of Stryker. The consistency with their dividend growth is enticing. The recent advancements in their neurosurgery and cardiovascular device businesses offer potential to right the ship. The could to increased revenue growth in the coming years.

This is not to say Stryker is not a buy. I believe they strongly warrant consideration. I worry about the extreme recent increase to the stock price. I also question how sustainable the revenue growth is year over year. The same GuruFocus model also suggests that the current stock price is significantly higher than their intrinsic value. The 30 years of dividend growth is a sign of stability, but as of now, I would stick with Medtronic if I could only choose one.

What is the #1 medical device company?

According to MDDIonline, the largest medical device company in terms of revenue is Medtronic plc. Medtronic is a medical device manufacturer based out of Minneapolis, Minnesota. They were founded in Ireland in 1949, and have become a major player in the medical device field. Their revenue for 2023 was $31.56 billion. This narrowly edged out Abbott Laboratories, Danaher Corporation, and Johnson & Johnson. While some of these are more well known household names, Medtronic has actually been the top medical device manufacturer since 2017.

Their hold on the highest revenue in the segment is due to their innovative approach to patient care. In 2023, Medtronic and NVidia introduced a plan to use AI to assist in connected care. They have also been at the forefront of treatment for more than 70 health conditions from diabetes to cardiovascular disease. In recent times, another midwest-based medical device company has been making waves, and that is Stryker Corporation. The Kalamazoo, Michigan based company has entered the top 10 largest medical device companies. Their growth in recent years has led many to question; what is the better buy?

The Case for Stryker

As mentioned previously, Stryker is an American manufacturer of medical devices. They are based out of Kalamazoo, Michigan. Last year, they had revenue of $20.49 billion, the highest in the company’s history, and an 11% increase over 2022. This continues their very strong performance over the past 5 years, as they have seen quarterly growth every single quarter since June 2020, and that was the only time since 2010 that they have not experienced quarterly growth. They have continued to see steady revenue growth, only ever halted by the Covid-19 pandemic.

The continued and consistent increase in the revenue for Stryker is reflected in the stock price. No matter how you look at it, or which time frame, the performance for Stryker has been impressive. Year-to-date the stock price is up over 13%, and over the last full year is up 23%. Also of note is the dividend. They have increased their dividend each year since 1994, further cementing them as a strong stock to consider.

Medtronic’s “Shaky Standing”?

While yes, Medtronic is still the largest medical device manufacturer, there are some who believe there is less potential reward there. While their revenue has been high, there has been very little growth. In fact, their trailing 12 month revenue has ranged between $27.8 billion and $32.3 billion each report since 2016. While Stryker had only one quarter of failing to increase revenue since 2010, in the same time frame, Medtronic has failed to do so 13 times.

When diving into the stock for Medtronic, things remain unclear. While over the past year there has been an increase to Medtronic’s stock price, it has only increased 1.02%. Year-to-date performance is not impressive, falling 0.66%. The largest concern, however, is on the long-term outlook for Medtronic. Over the past 5 years, they have experienced and 11.11% decrease in the price of their stock. During this same window. Stryker has increased over 80%%. Medtronic does, however, have an impressive record of increasing their dividend share. For 47 consecutive years, they have increased the dividend per share, now reaching a yield of 3.35% and annual dividend of $2.76 per share.

There is reason to believe revenue and stock price growth may be on the horizon. Recent progress with their cardiovascular division offers promise of larger revenues in the coming years, while the impact of Covid-19 lessens with each passing year.

Which Stock Should You Buy?

While the numbers certainly look impressive for Stryker, and less so for Medtronic, the answer to this question is not so simple. It is unlikely that Stryker will continue to increase their revenue by 8+% per year. This will lead to a slowing of the increase in their stock price at some time in the future. At the current traded price of $335.54, how much higher can this stock price climb? Medtronic has been a major player in the segment for decades, and has been the highest revenue company in the field for a decade. Their current traded price of $82.29 comes despite hitting an all-time high in 2021 and failing to match that revenue in the time following. Also noteworthy is the greater FCF margin that Medtronic still operates with, at 20%.

While some analysts like the potential for long-term growth for Stryker, others prefer the stability and proven track record of dividend increases and excellence at the top of the industry from Medtronic. Trefis predicts that currently, Medtronic is a better buy while The Motley Fool, Forbes, and The Globe and Mail all see more opportunity with Stryker.

Conclusions

It may seem clear to some, but there is a lack of agreement when it comes down to which stock is the better buy. I believe that both are certainly warranting consideration as buys, but based on my research, as well as the numbers, I believe there may actually be more opportunity in the long-term buying Medtronic.

Medtronic operates with a significantly more appropriate price-to-projected-FCF range, and we can see this thanks to GuruFocus. Their intrinsic value based on this model is significantly closer to the actual traded price than that of Stryker. The consistency with their dividend growth is enticing. The recent advancements in their neurosurgery and cardiovascular device businesses offer potential to right the ship. The could to increased revenue growth in the coming years.

This is not to say Stryker is not a buy. I believe they strongly warrant consideration. I worry about the extreme recent increase to the stock price. I also question how sustainable the revenue growth is year over year. The same GuruFocus model also suggests that the current stock price is significantly higher than their intrinsic value. The 30 years of dividend growth is a sign of stability, but as of now, I would stick with Medtronic if I could only choose one.