Why Vale S.A. (NYSE:VALE) is a Buy

Vale S.A. (NYSE:VALE) stands out as a compelling buy for several reasons. As the world’s largest producer of iron ore and iron ore pellets, Vale plays a crucial role in the global steel industry. This makes it a significant player in the commodities market, providing a stable foundation for its stock. Additionally, Vale is a dividend stock, offering a robust dividend yield of around 11.04%. This high yield makes it attractive for income-focused investors looking for reliable returns.

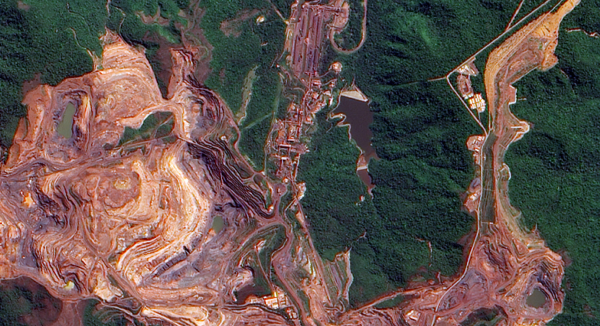

What Vale S.A. Does

Vale S.A. is a diversified mining company headquartered in Rio de Janeiro, Brazil. It operates through two main segments: Iron Solutions and Energy Transition Materials. The Iron Solutions segment focuses on the production and extraction of iron ore and pellets, along with related logistic services. The Energy Transition Materials segment produces nickel, copper, and by-products such as gold, silver, and cobalt. Vale’s extensive portfolio also includes manganese, ferroalloys, bauxite, potash, and kaolin. This diversification helps mitigate risks associated with price fluctuations in individual commodities.

Competitors

In the competitive landscape, Vale faces significant competition from other mining giants like Rio Tinto and BHP Billiton. While Rio Tinto and BHP are also major players in the iron ore market, Vale’s extensive mineral portfolio and significant global presence give it a competitive edge. Vale operates in over 30 countries across five continents, which not only diversifies its revenue streams but also positions it as a major player in the global mining industry.

Acquisitions

Vale has made strategic acquisitions to bolster its market position and diversify its operations. One notable acquisition was the purchase of Canadian nickel producer Inco in 2006, which significantly expanded Vale’s presence in the nickel market. This acquisition has allowed Vale to become one of the world’s leading nickel producers, further diversifying its mineral portfolio.

In recent years, Vale has continued to pursue acquisitions that align with its strategic goals. For instance, the company has invested in projects aimed at enhancing its production capabilities and sustainability efforts. These acquisitions not only strengthen Vale’s market position but also support its long-term growth objectives.

Future Earnings and Sales

Vale’s future earnings and sales prospects look promising. Analysts project steady growth in iron ore demand, driven by global infrastructure development and industrial activities. Vale’s focus on increasing iron ore production, despite fluctuating prices, positions it well to capitalize on this demand1. Additionally, the company’s diversified mineral portfolio ensures multiple revenue streams, reducing dependency on any single commodity.

Debt Analysis

Vale’s debt levels are manageable, with a focus on maintaining a healthy balance sheet. The company has been proactive in reducing its debt, which has improved its financial stability. Vale’s debt-to-equity ratio is within a comfortable range, indicating that the company is not overly leveraged. This prudent financial management enhances its ability to invest in growth opportunities and weather economic downturns.

Two-Year Outlook

Looking ahead, Vale’s two-year outlook is optimistic. The company aims to boost its iron ore production, which is expected to drive revenue growth. Vale’s commitment to sustainability, including its pledge to restore 500,000 hectares of degraded land in the Amazon rainforest by 2030, positions it favorably in an increasingly environmentally conscious market. Furthermore, ongoing investments in technology and innovation are likely to enhance operational efficiency and profitability.

Conclusion

In conclusion, Vale S.A. (NYSE:VALE) presents a compelling investment opportunity. Its status as the world’s largest iron ore producer, diversified mineral portfolio, and significant global presence make it a strong contender in the mining industry. The company’s robust dividend yield and prudent financial management further enhance its appeal. With a positive outlook for future earnings and a commitment to sustainability, Vale is well-positioned for long-term growth. Investors seeking a reliable dividend stock with growth potential should consider adding Vale to their portfolios.

Why Vale S.A. (NYSE:VALE) is a Buy

Vale S.A. (NYSE:VALE) stands out as a compelling buy for several reasons. As the world’s largest producer of iron ore and iron ore pellets, Vale plays a crucial role in the global steel industry. This makes it a significant player in the commodities market, providing a stable foundation for its stock. Additionally, Vale is a dividend stock, offering a robust dividend yield of around 11.04%. This high yield makes it attractive for income-focused investors looking for reliable returns.

What Vale S.A. Does

Vale S.A. is a diversified mining company headquartered in Rio de Janeiro, Brazil. It operates through two main segments: Iron Solutions and Energy Transition Materials. The Iron Solutions segment focuses on the production and extraction of iron ore and pellets, along with related logistic services. The Energy Transition Materials segment produces nickel, copper, and by-products such as gold, silver, and cobalt. Vale’s extensive portfolio also includes manganese, ferroalloys, bauxite, potash, and kaolin. This diversification helps mitigate risks associated with price fluctuations in individual commodities.

Competitors

In the competitive landscape, Vale faces significant competition from other mining giants like Rio Tinto and BHP Billiton. While Rio Tinto and BHP are also major players in the iron ore market, Vale’s extensive mineral portfolio and significant global presence give it a competitive edge. Vale operates in over 30 countries across five continents, which not only diversifies its revenue streams but also positions it as a major player in the global mining industry.

Acquisitions

Vale has made strategic acquisitions to bolster its market position and diversify its operations. One notable acquisition was the purchase of Canadian nickel producer Inco in 2006, which significantly expanded Vale’s presence in the nickel market. This acquisition has allowed Vale to become one of the world’s leading nickel producers, further diversifying its mineral portfolio.

In recent years, Vale has continued to pursue acquisitions that align with its strategic goals. For instance, the company has invested in projects aimed at enhancing its production capabilities and sustainability efforts. These acquisitions not only strengthen Vale’s market position but also support its long-term growth objectives.

Future Earnings and Sales

Vale’s future earnings and sales prospects look promising. Analysts project steady growth in iron ore demand, driven by global infrastructure development and industrial activities. Vale’s focus on increasing iron ore production, despite fluctuating prices, positions it well to capitalize on this demand1. Additionally, the company’s diversified mineral portfolio ensures multiple revenue streams, reducing dependency on any single commodity.

Debt Analysis

Vale’s debt levels are manageable, with a focus on maintaining a healthy balance sheet. The company has been proactive in reducing its debt, which has improved its financial stability. Vale’s debt-to-equity ratio is within a comfortable range, indicating that the company is not overly leveraged. This prudent financial management enhances its ability to invest in growth opportunities and weather economic downturns.

Two-Year Outlook

Looking ahead, Vale’s two-year outlook is optimistic. The company aims to boost its iron ore production, which is expected to drive revenue growth. Vale’s commitment to sustainability, including its pledge to restore 500,000 hectares of degraded land in the Amazon rainforest by 2030, positions it favorably in an increasingly environmentally conscious market. Furthermore, ongoing investments in technology and innovation are likely to enhance operational efficiency and profitability.

Conclusion

In conclusion, Vale S.A. (NYSE:VALE) presents a compelling investment opportunity. Its status as the world’s largest iron ore producer, diversified mineral portfolio, and significant global presence make it a strong contender in the mining industry. The company’s robust dividend yield and prudent financial management further enhance its appeal. With a positive outlook for future earnings and a commitment to sustainability, Vale is well-positioned for long-term growth. Investors seeking a reliable dividend stock with growth potential should consider adding Vale to their portfolios.