The markets had a wild ride down on Friday (8/26/2022). The SPDR S&P 500 ETF (SPY) saw a 14-point drop, about a 3.4% decline in a single trading day. However, the SPY is still higher than its most recent lows. But there are still stocks that have not gone up with the market that are still undervalued, like Kilroy Realty Corporation (KRC).

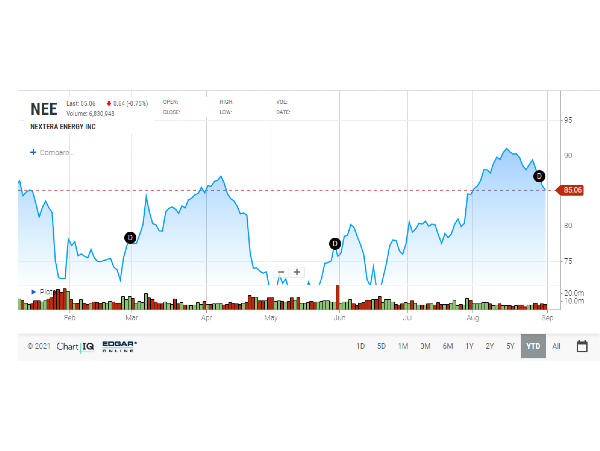

Kilroy Realty is one company that I have been buying as it hit a support level at around $50. The chart below shows that the $48 – $50 level was once a support level for four different instances. That is why I bought shares near $50. The stock is still trading at ~$50.00 per share. Thus, Kilroy Realty is still undervalued at current levels, and the dividend yield is roughly 4.2%. We will discuss details about the company and the amount of undervaluation.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Overview of Kilroy Realty Corporation

Kilroy Realty Corporation (KRC) is a leading U.S. commercial real estate landlord and developer with a more minor residential operation. The firm operates in San Diego, Greater Los Angeles, the San Francisco Bay Area, the Pacific Northwest, and Austin, Texas.

At of the end of Q2 2022, Kilroy’s stabilized real estate portfolio totaled approximately 15.8 million square feet of mainly office and life science space, 91.4% occupied and 93.7% leased. Also, the company owns more than 1,000 residential units in Hollywood and San Diego, with a quarterly average occupancy of 93.7%.

In addition, the company had three in-process life science redevelopment projects with total estimated redevelopment costs of $115.0 million, totaling approximately 344,000 square feet. It also has four in-process development projects with an estimated investment of $1.8 billion, totaling about 1.9 million square feet of office and life science space. The in-process development and redevelopment office and life science space were 38% leased.

Source: Kilroy Realty Investor Relations

KRC was down 37.7% since its high in March 2022, 22 weeks ago. The main reason for the stock price decrease has nothing to do with the company itself, as earnings grew 5% in 2021 and are expected to grow 18% in 2022. Instead, it has to do with the increase in interest rates, as this affected all REIT stocks in the market.

The current stock price of ~$50.00 (as of this writing) is right at the lower end of the 52-week range, between $49.17 and $79.06 per share. Thus, KRC is seemingly a stock in the right place to buy up shares where both the 52-week range and support line meet.

KRC Dividend History, Growth, and Yield

We will now look at KRC’s dividend history, growth, and yield. Finally, we will determine if it’s still a good buy at current prices.

KRC is considered a Dividend Challenger, a company that has increased its dividend for more than five years. In this case, KRC has increased its dividend for six consecutive years. In addition, KRC’s most recent dividend increase was 4%, announced in September 2021. Thus, we expect another dividend increase this September.

Dividend Yield

Additionally, according to Portfolio Insight* , KRC has a five-year dividend growth rate of about 6.9%, which is excellent considering how fast inflation has increased this year. Unfortunately, the 10-year dividend growth rate is lower at ~3.8%.

Something essential to note is that KRC continued to pay its dividend during the most challenging period in the last 100 years. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, KRC continued to pay its dividend and even increased them. That is impressive and leads me to believe in the company’s strength, and that management is focused and committed to the dividend policy.

Dividend Yield

The company has an excellent dividend yield of around 4.2%, which is more than twice the S&P 500 Index’s average dividend yield, and the highest in the past decade. This dividend yield is a respectable one for dividend growth-driven investors. This dividend yield is also appropriate for investors leaving the bond market looking for higher yields. However, it may not be an excellent stock for income investors who may want a 4.5% yield or greater. However, with the company’s growing dividend, I can see over a 5% yield on cost (YOC) in the next 5 to 7 years.

KRC’s current dividend yield is higher than its own 5-year average dividend yield of ~2.84%. I like to examine this metric because it provides a good idea if a company is undervalued or overvalued based on the current and 5-year average yield. The stock price and dividend yield are inversely related. If the stock price increases, the dividend yield decreases, and vice versa.

Dividend Safety

Let’s analyze dividend safety. This metric is essential to look at as a dividend growth investor. Undervalued dividend stocks sometimes present a “value trap,” and the stock price can keep falling.

We must look at two fundamental metrics to determine if the dividend payments are safe yearly. The first one is Funds From Operation per share (FFO), and then we must look into Free Cash Flow (FCF) per share or Operating Cash Flow (OCF).

Analysts anticipate that KRC will earn an FFO of about $4.59 per share for the fiscal year (FY) 2022. Analysts are 85% accurate when forecasting KRC’s future FFO. Also, the company beats these estimates 15% of the time. In addition, the company is expected to pay an annualized $2.11 per share in dividends. These numbers give a payout ratio of approximately 46% based on FFO, an excellent value. It also leaves the company with room to continue to grow its dividend. Most REITs usually have a payout ratio of over 80%.

I am excited by having an 80% or lower dividend coverage with a dividend yield of 4.2% for future growth. At this point, it will allow the company to continue to grow its dividend at a mid-single-digit rate without sacrificing dividend safety. In addition, KRC has a dividend payout ratio of 60% on an FCF basis. Hence, the dividend is well covered by both FFO and FCF.

KRC Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well KRC performed and grew its FFO and revenue in the past several years. When valuing a company, these two metrics are at the top of my list to examine. Without revenue growth, a company can’t have sustainable FFO growth and continue paying a growing dividend.

KRC revenues have been growing modestly at a compound annual growth rate (CAGR) of about 11.9% for the past ten years. Net income, however, did significantly better with a CAGR of ~59% over the same ten-year period.

However, according to Portfolio Insight* , FFO has grown 6.3% annually over the past ten years and has a CAGR of 3.4% over the past five years.

Since revenue, net income, and FFO had good growth in the past, this stock is attractive based on its valuation and dividend yield. We will discuss the company’s valuation later in this article. Meanwhile, analysts expect the company to grow FFO at a 9% rate over the next five years.

Last year’s FFO increased from $3.71 per share in FY2020 to $3.89 per share for FY2021, an increase of 5%, a solid increase after considering the problematic two years caused by the COVID-19 pandemic. This performance was an excellent growth year over year. Additionally, analysts estimate KRC to make an FFO of $4.59 per share for the fiscal year 2022, which would be a ~18% increase compared to FY2021. I like to see that future earnings continue to grow.

The company has an excellent balance sheet. KRC has an S&P Global credit rating of BBB, a lower-medium investment-grade rating. Also, the company has a debt-to-equity ratio of 0.8, which is a good one. Thus, the company has a stable balance sheet to overcome significant economic downturns like the COVID-19 pandemic last two years, adding to the dividend safety.

That said, there are still risks with an investment in KRC. For example, a recession can continue to punish the stock price as it did in the Great Recession and during the COVID-19 pandemic, which saw prices decrease by 47.1% and 99.7%, respectively. Also, companies leaving the west coast because of higher state taxes could affect this REIT’s occupancy rate.

KRC Competitive Advantage

Management execution of new properties through acquisition or construction is its most significant competitive advantage in the future. Thus, the efficiency to scale is its most crucial growth driver.

Kilroy realty Undervalued

One of the valuation metrics that I like to analyze is the dividend yield compared to the history in the past several years. I also want to look for a lower P/FFO ratio based on the past 5-year or 10-year averages. Lastly, I like to use the Dividend Discount Model (DDM). I use a DDM analysis because a business ultimately equals the sum of the future cash flow that that business can provide. Our analysis shows that Kilroy Realty is undervalued.

Let’s first examine the P/FFO ratio. KRC has a P/FFO ratio of ~11.5X based on FY 2022 FFO of $4.59 per share. The P/FFO multiple is excellent compared to the past 5-year P/FFO average of 19.4X. If KRC were to vert back to a P/FFO of 19.4X, we would obtain a price of $89.05 per share.

Now let’s analyze the dividend yield. As I mentioned, the dividend yield currently is ~4.2%. There is good upside potential as KRC’s 5-year dividend yield average is ~2.8%. For example, if KRC were to return to its dividend yield 5-year average, the price target would be $75.36.

The last item I like to look at to determine a fair price is the DDM analysis. I factored in an 8% discount rate and a long-term dividend growth rate of 5%. I use an 8% discount rate because of the higher-than-normal current dividend yield. In addition, the projected dividend growth rate is conservative and lower than its past 5-year compound rate. These assumptions give a fair price target of approximately $73.85 per share.

If we average the three fair price targets of $89.05, $75.36, and $73.85, we obtain a reasonable, fair price of $79.42 per share, giving KRC a possible upside of 58.8% from the current price of $50.00 share price.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter* . You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter* , the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

Conclusion on Kilroy Realty (KRC): Undervalued and 4.2% Yield

Kilroy realty is a high-quality and undervalued company that should meet most investors’ requirements. The company has a market-beating 4.2% yield and a decent dividend growth history. Past earnings growth has been excellent. However, past performance does not mean it will be the same in the future. However, I expect that KRC will do well. That is why I own shares and acquiring more at this level.

Disclosure: Long KRC

Thanks for reading Kilroy Realty (KRC): Undervalued and 4.2% Yield.

You can also read Comcast (CMCSA): Undervalued and a 2.5% Yield by the same author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has invested in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks with capital return and dividend income potential. Make sure to follow me on my YouTube Channel. See you there.

* This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

The markets had a wild ride down on Friday (8/26/2022). The SPDR S&P 500 ETF (SPY) saw a 14-point drop, about a 3.4% decline in a single trading day. However, the SPY is still higher than its most recent lows. But there are still stocks that have not gone up with the market that are still undervalued, like Kilroy Realty Corporation (KRC).

Kilroy Realty is one company that I have been buying as it hit a support level at around $50. The chart below shows that the $48 – $50 level was once a support level for four different instances. That is why I bought shares near $50. The stock is still trading at ~$50.00 per share. Thus, Kilroy Realty is still undervalued at current levels, and the dividend yield is roughly 4.2%. We will discuss details about the company and the amount of undervaluation.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Overview of Kilroy Realty Corporation

Kilroy Realty Corporation (KRC) is a leading U.S. commercial real estate landlord and developer with a more minor residential operation. The firm operates in San Diego, Greater Los Angeles, the San Francisco Bay Area, the Pacific Northwest, and Austin, Texas.

At of the end of Q2 2022, Kilroy’s stabilized real estate portfolio totaled approximately 15.8 million square feet of mainly office and life science space, 91.4% occupied and 93.7% leased. Also, the company owns more than 1,000 residential units in Hollywood and San Diego, with a quarterly average occupancy of 93.7%.

In addition, the company had three in-process life science redevelopment projects with total estimated redevelopment costs of $115.0 million, totaling approximately 344,000 square feet. It also has four in-process development projects with an estimated investment of $1.8 billion, totaling about 1.9 million square feet of office and life science space. The in-process development and redevelopment office and life science space were 38% leased.

Source: Kilroy Realty Investor Relations

KRC was down 37.7% since its high in March 2022, 22 weeks ago. The main reason for the stock price decrease has nothing to do with the company itself, as earnings grew 5% in 2021 and are expected to grow 18% in 2022. Instead, it has to do with the increase in interest rates, as this affected all REIT stocks in the market.

The current stock price of ~$50.00 (as of this writing) is right at the lower end of the 52-week range, between $49.17 and $79.06 per share. Thus, KRC is seemingly a stock in the right place to buy up shares where both the 52-week range and support line meet.

KRC Dividend History, Growth, and Yield

We will now look at KRC’s dividend history, growth, and yield. Finally, we will determine if it’s still a good buy at current prices.

KRC is considered a Dividend Challenger, a company that has increased its dividend for more than five years. In this case, KRC has increased its dividend for six consecutive years. In addition, KRC’s most recent dividend increase was 4%, announced in September 2021. Thus, we expect another dividend increase this September.

Dividend Yield

Additionally, according to Portfolio Insight* , KRC has a five-year dividend growth rate of about 6.9%, which is excellent considering how fast inflation has increased this year. Unfortunately, the 10-year dividend growth rate is lower at ~3.8%.

Something essential to note is that KRC continued to pay its dividend during the most challenging period in the last 100 years. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, KRC continued to pay its dividend and even increased them. That is impressive and leads me to believe in the company’s strength, and that management is focused and committed to the dividend policy.

Dividend Yield

The company has an excellent dividend yield of around 4.2%, which is more than twice the S&P 500 Index’s average dividend yield, and the highest in the past decade. This dividend yield is a respectable one for dividend growth-driven investors. This dividend yield is also appropriate for investors leaving the bond market looking for higher yields. However, it may not be an excellent stock for income investors who may want a 4.5% yield or greater. However, with the company’s growing dividend, I can see over a 5% yield on cost (YOC) in the next 5 to 7 years.

Source: Portfolio Insight*

KRC’s current dividend yield is higher than its own 5-year average dividend yield of ~2.84%. I like to examine this metric because it provides a good idea if a company is undervalued or overvalued based on the current and 5-year average yield. The stock price and dividend yield are inversely related. If the stock price increases, the dividend yield decreases, and vice versa.

Dividend Safety

Let’s analyze dividend safety. This metric is essential to look at as a dividend growth investor. Undervalued dividend stocks sometimes present a “value trap,” and the stock price can keep falling.

We must look at two fundamental metrics to determine if the dividend payments are safe yearly. The first one is Funds From Operation per share (FFO), and then we must look into Free Cash Flow (FCF) per share or Operating Cash Flow (OCF).

Analysts anticipate that KRC will earn an FFO of about $4.59 per share for the fiscal year (FY) 2022. Analysts are 85% accurate when forecasting KRC’s future FFO. Also, the company beats these estimates 15% of the time. In addition, the company is expected to pay an annualized $2.11 per share in dividends. These numbers give a payout ratio of approximately 46% based on FFO, an excellent value. It also leaves the company with room to continue to grow its dividend. Most REITs usually have a payout ratio of over 80%.

I am excited by having an 80% or lower dividend coverage with a dividend yield of 4.2% for future growth. At this point, it will allow the company to continue to grow its dividend at a mid-single-digit rate without sacrificing dividend safety. In addition, KRC has a dividend payout ratio of 60% on an FCF basis. Hence, the dividend is well covered by both FFO and FCF.

KRC Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well KRC performed and grew its FFO and revenue in the past several years. When valuing a company, these two metrics are at the top of my list to examine. Without revenue growth, a company can’t have sustainable FFO growth and continue paying a growing dividend.

KRC revenues have been growing modestly at a compound annual growth rate (CAGR) of about 11.9% for the past ten years. Net income, however, did significantly better with a CAGR of ~59% over the same ten-year period.

Source: Portfolio Insight*

However, according to Portfolio Insight* , FFO has grown 6.3% annually over the past ten years and has a CAGR of 3.4% over the past five years.

Since revenue, net income, and FFO had good growth in the past, this stock is attractive based on its valuation and dividend yield. We will discuss the company’s valuation later in this article. Meanwhile, analysts expect the company to grow FFO at a 9% rate over the next five years.

Last year’s FFO increased from $3.71 per share in FY2020 to $3.89 per share for FY2021, an increase of 5%, a solid increase after considering the problematic two years caused by the COVID-19 pandemic. This performance was an excellent growth year over year. Additionally, analysts estimate KRC to make an FFO of $4.59 per share for the fiscal year 2022, which would be a ~18% increase compared to FY2021. I like to see that future earnings continue to grow.

The company has an excellent balance sheet. KRC has an S&P Global credit rating of BBB, a lower-medium investment-grade rating. Also, the company has a debt-to-equity ratio of 0.8, which is a good one. Thus, the company has a stable balance sheet to overcome significant economic downturns like the COVID-19 pandemic last two years, adding to the dividend safety.

That said, there are still risks with an investment in KRC. For example, a recession can continue to punish the stock price as it did in the Great Recession and during the COVID-19 pandemic, which saw prices decrease by 47.1% and 99.7%, respectively. Also, companies leaving the west coast because of higher state taxes could affect this REIT’s occupancy rate.

KRC Competitive Advantage

Management execution of new properties through acquisition or construction is its most significant competitive advantage in the future. Thus, the efficiency to scale is its most crucial growth driver.

Kilroy realty Undervalued

One of the valuation metrics that I like to analyze is the dividend yield compared to the history in the past several years. I also want to look for a lower P/FFO ratio based on the past 5-year or 10-year averages. Lastly, I like to use the Dividend Discount Model (DDM). I use a DDM analysis because a business ultimately equals the sum of the future cash flow that that business can provide. Our analysis shows that Kilroy Realty is undervalued.

Let’s first examine the P/FFO ratio. KRC has a P/FFO ratio of ~11.5X based on FY 2022 FFO of $4.59 per share. The P/FFO multiple is excellent compared to the past 5-year P/FFO average of 19.4X. If KRC were to vert back to a P/FFO of 19.4X, we would obtain a price of $89.05 per share.

Now let’s analyze the dividend yield. As I mentioned, the dividend yield currently is ~4.2%. There is good upside potential as KRC’s 5-year dividend yield average is ~2.8%. For example, if KRC were to return to its dividend yield 5-year average, the price target would be $75.36.

The last item I like to look at to determine a fair price is the DDM analysis. I factored in an 8% discount rate and a long-term dividend growth rate of 5%. I use an 8% discount rate because of the higher-than-normal current dividend yield. In addition, the projected dividend growth rate is conservative and lower than its past 5-year compound rate. These assumptions give a fair price target of approximately $73.85 per share.

If we average the three fair price targets of $89.05, $75.36, and $73.85, we obtain a reasonable, fair price of $79.42 per share, giving KRC a possible upside of 58.8% from the current price of $50.00 share price.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter* . You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter* , the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

Conclusion on Kilroy Realty (KRC): Undervalued and 4.2% Yield

Kilroy realty is a high-quality and undervalued company that should meet most investors’ requirements. The company has a market-beating 4.2% yield and a decent dividend growth history. Past earnings growth has been excellent. However, past performance does not mean it will be the same in the future. However, I expect that KRC will do well. That is why I own shares and acquiring more at this level.

Disclosure: Long KRC

Thanks for reading Kilroy Realty (KRC): Undervalued and 4.2% Yield.

You can also read Comcast (CMCSA): Undervalued and a 2.5% Yield by the same author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has invested in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks with capital return and dividend income potential. Make sure to follow me on my YouTube Channel. See you there.

* This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Originally Posted on dividendpower.org