Why Investors Don’t Only Invest in the S&P 500

Key points

- ETFs that follow the S&P 500 index provide a fund with great diversification with over 500 different companies in its basket of stocks

- The S&P 500 has historically continued to grow for the last century. If historical trends continue, the S&P 500 will likely continue to grow throughout the 21st century

- The S&P 500 is a continually updating index of stocks. Most investors do not have the time or money to duplicate the S&P 500 exactly

- Duplicating the S&P 500 will typically mean buying an index ETF fund or mutual fund. This comes with additional fees, risks, and options

- The S&P 500 value is concentrated in just a few highly valued stocks

- “Only invest in the S&P 500” approach is flawed. The process the index uses to choose stocks has no guarantee that those stocks will perform well

- There is a risk of index stocks forming a bubble if investors blindly follow the indices in mass

What is the S&P 500?

The Standard and Poor’s 500 is a U.S. stock index created and updated by company S&P Global. Per the companies methodology documents [1]:

"[The S&P 500] measures the performance of the large-cap segment of the market. Considered to be a proxy of the U.S. equity market, the index is composed of 500 constituent companies"

The S&P 500 is rebalanced quarterly, and its rebalancing is weighted by each stock's market capitalization. This means that larger companies have a bigger impact on the S&P 500, making it a large cap weighted index.

A company qualifies to be on the index if:

- A U.S. company, with the majority of its fixed assets and revenues from the U.S. The S&P makes a determination of geographic location based on the companies own reporting.

- Listed on a U.S. exchange like the NYSE or the NASDAQ.

- An incorporated organizational structure, including common stock and REIT structures

- Market liquidity

What is the Best S&P 500 ETF?

If you want to invest in the S&P 500, the practical method is to use an ETF. Duplicating the S&P 500 would require you to buy 500 different stocks, and making sure those purchases reflect how S&P Global weighted each stock. With fractional shares, buying all 500 stocks in the S&P 500 could be less than $1000, but the time you need to do this would make the endeavor impractical. Instead, buying an S&P 500 ETF saves you time as the ETF fund managers will conduct the portfolio rebalancing and purchases for you.

The SPY ETF is one of the largest and most heavility-traded ETFs in the world [2]. SPY is a market cap weighted ETF that broadly matches the S&P 500 index.

Pros for SPY

- Well known, popular ETF

- Good liquidity, easy to get in and out of ETF

Cons against SPY

- High expense ratio at 0.09%[2]

- Weighted more towards large cap stocks, which historically has less growth potential versus other weighted strategies[2]

- SPY is a Unit Investment Trust (UIT). It cannot lend out shares or reinvest dividends[2]

VOO is Vanguards premier S&P 500 ETF. The fund replicates the index's stock composition and weighting. It is blended with 503 stocks (exactly as the benchmark) with an average P/E ratio of 19.8[3].

Pros for VOO

- A lower expense ratio that SPY at 0.03%[3]

- An actual exchange traded fund that can lend out shares and reinvest dividends[2]

• Likely the best choice to match the structure, returns, and volatility of the S&P 500 index

Cons for VOO

- Like the SPY, its large cap weighted, meaning it has less exposure to smaller companies with historically higher growth potential

RSP is an equal-weighted ETF that invests in stocks represented in the S&P 500. Each company in RSP gets approximately an equal weighting[4]. This means that smaller companies represent a larger portion of the ETF.

Pros for RSP

- RSP has more exposure to small cap stocks, giving the investor more upside potential[4]

Cons for RSP

- RSP will likely have more volatility than other ETFs like SPY and VOO

- The expense ratio is 0.20%[4], significantly higher than other S&P 500 ETFs

Why Investors May Want to Invest in the S&P 500

The S&P 500 index gives you a broad and diverse portfolio of the top U.S. stocks. Their methodology is robust and has been proven to work for decades. There are a diverse range of ETF options that will allow you to invest in the index with minimal effort. And thanks to high competition, the expense ratios of these ETFs are relatively inexpensive.

Is the S&P 500 a good investment for beginners?

Investing in ETFs are great for new beginners. An S&P 500 ETF has the following benefits:

- Immediately provides a diversified basket of stocks for the new investor

- Gives the new investor a starting point to learn more about ETFs

- Provides a beta that follows the market, meaning volatility and performance will match market performance

- Has multiple variations for different investment strategies. Investors can modify the weighting process, investment methodology, and expense ratio by choosing different S&P 500 ETF types.

The future challenges facing the S&P 500

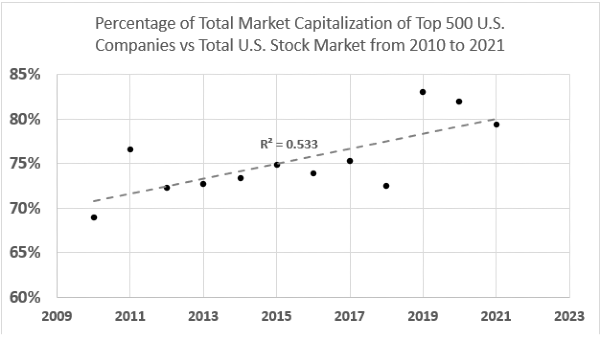

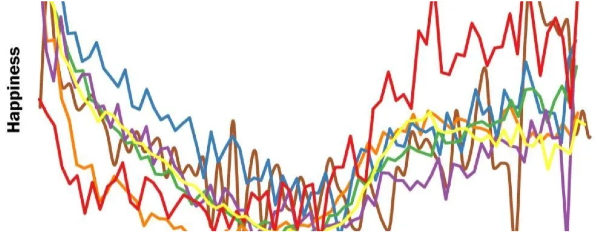

The S&P 500 is relied upon by new investors to be a reliable investment opportunity. Legendary investor Warren Buffett recommends retail investors invest in index funds. However, multiple bubbles have occurred because of unconditional optimism for an investment. This kind of overconfidence caused the tech bubble of 2000 and the real estate bubble in 2009. In the last decade, more money is being invested into the top 500 companies as a percentage of total market value.

Data from siblisresearch.com[5]

Investors need to be wary of irrational exuberance creating an over reliance on index funds. Large cap companies dominate the S&P 500, but being a large cap company means you will face challenges growing company value. Large Cap companies dominate their market but may have problems adapting to new markets. If a large company needs to pivot their business, its very hard to move a large organization to compete against smaller, more agile companies in new market spaces. Many well known companies have been removed from the S&P 500 index due to a lack of performance.

ETFs that represent the S&P 500 index is a great starting point for new investors. But be sure you do further research to protect yourself from investor’s over reliance on index funds.

References

Why Investors Don’t Only Invest in the S&P 500

Key points

What is the S&P 500?

The Standard and Poor’s 500 is a U.S. stock index created and updated by company S&P Global. Per the companies methodology documents [1]:

"[The S&P 500] measures the performance of the large-cap segment of the market. Considered to be a proxy of the U.S. equity market, the index is composed of 500 constituent companies"

The S&P 500 is rebalanced quarterly, and its rebalancing is weighted by each stock's market capitalization. This means that larger companies have a bigger impact on the S&P 500, making it a large cap weighted index. A company qualifies to be on the index if:

What is the Best S&P 500 ETF?

If you want to invest in the S&P 500, the practical method is to use an ETF. Duplicating the S&P 500 would require you to buy 500 different stocks, and making sure those purchases reflect how S&P Global weighted each stock. With fractional shares, buying all 500 stocks in the S&P 500 could be less than $1000, but the time you need to do this would make the endeavor impractical. Instead, buying an S&P 500 ETF saves you time as the ETF fund managers will conduct the portfolio rebalancing and purchases for you.

SPDR S&P 500 ETF Trust (SPY)

The SPY ETF is one of the largest and most heavility-traded ETFs in the world [2]. SPY is a market cap weighted ETF that broadly matches the S&P 500 index.

Pros for SPY

Cons against SPY

Vanguards S&P 500 ETF (VOO)

VOO is Vanguards premier S&P 500 ETF. The fund replicates the index's stock composition and weighting. It is blended with 503 stocks (exactly as the benchmark) with an average P/E ratio of 19.8[3].

Pros for VOO

Cons for VOO

Invesco S&P 500 Equal Weight ETF (RSP)

RSP is an equal-weighted ETF that invests in stocks represented in the S&P 500. Each company in RSP gets approximately an equal weighting[4]. This means that smaller companies represent a larger portion of the ETF.

Pros for RSP

Cons for RSP

Why Investors May Want to Invest in the S&P 500

The S&P 500 index gives you a broad and diverse portfolio of the top U.S. stocks. Their methodology is robust and has been proven to work for decades. There are a diverse range of ETF options that will allow you to invest in the index with minimal effort. And thanks to high competition, the expense ratios of these ETFs are relatively inexpensive.

Is the S&P 500 a good investment for beginners?

Investing in ETFs are great for new beginners. An S&P 500 ETF has the following benefits:

The future challenges facing the S&P 500

The S&P 500 is relied upon by new investors to be a reliable investment opportunity. Legendary investor Warren Buffett recommends retail investors invest in index funds. However, multiple bubbles have occurred because of unconditional optimism for an investment. This kind of overconfidence caused the tech bubble of 2000 and the real estate bubble in 2009. In the last decade, more money is being invested into the top 500 companies as a percentage of total market value.

Data from siblisresearch.com[5]

Investors need to be wary of irrational exuberance creating an over reliance on index funds. Large cap companies dominate the S&P 500, but being a large cap company means you will face challenges growing company value. Large Cap companies dominate their market but may have problems adapting to new markets. If a large company needs to pivot their business, its very hard to move a large organization to compete against smaller, more agile companies in new market spaces. Many well known companies have been removed from the S&P 500 index due to a lack of performance.

ETFs that represent the S&P 500 index is a great starting point for new investors. But be sure you do further research to protect yourself from investor’s over reliance on index funds.

References

1). S&P U.S. Indices Methodology

2). The SPY on etfdb.com

3). VOO, Vanguard S&P 500 ETF

4). The RSP on etfdb.com

5). The Total Market Value of U.S. Stock Market