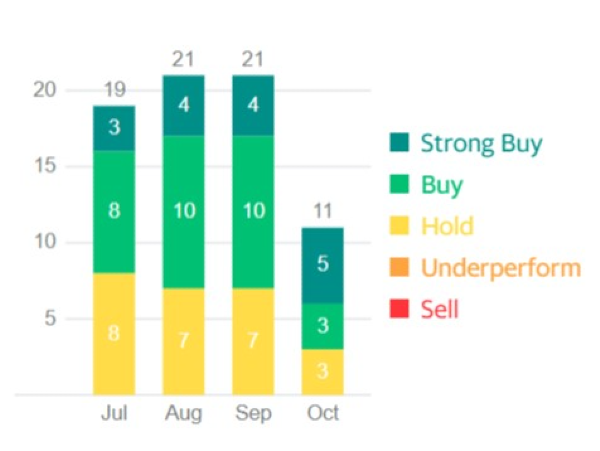

A new trading month is about the begin and boy do we have a seemingly endless crop of stocks that are becoming fair valued to undervalued. The reality of the day is that we’ll continue to see stock prices continue to come down as interest rates rise. No reason to believe interest rates will stop climbing anytime soon. Of course, the silver lining amid the market collapse is that every new dollar put to work today in dividend stocks comes with an automatic higher yield when compared to just a few weeks ago. With that being said, let’s take a look at my October 2022 stock considerations.

First up, I’m thinking about adding to recent spin off Viatris Inc. (VTRS). The relatively new separate consumer division of Pfizer (Upjohn and Mylan merge) is sporting a forward yield north of 5% with a manageable payout ratio of around 73%. This new company controls many popular consumer drug brands still in great demand for the foreseeable future. Under $10 a share the stock looks to be fairly valued with a current PE around 13.

Next, I am looking at adding to my V.F. Corporation (VFC) position. This stock is having a year it would like to forget but at current prices this dividend stalwart is looking a little under valued. With a current forward PE of just 10 and a forward yield well north of 6% this stock is too hard to ignore. Ideally, I’d like to see a slightly lower payout ratio for the dividend but at 77% it appears to be safe based on current cash flow.

Another company I’m considering is UGI Corporation (UGI). This gas utility stock has been in my portfolio less than a year and I have never added to my small position since my initial buy. It’s current PE sits at a modest 5 while sporting a forward yield around 4.5%. The payout ratio for this dividend is around 22% making this beaten down utility dividend appear to be quite safe.

Next, is the stock everyone loves to hate, Altria Group, Inc. (MO). I’m aware of all the legal issues surrounding the company and recent headwinds related to Juul. Yet, despite those issues coupled with lower smoking rates the company is still able to raise dividends and because of current price declines is sporting a yield just north of 9%. I admit, I am the yield moth drawn to this flame of a stock but it’s hard to argue with decades upon decades of dividend growth. With a forward PE that sits around 8, I’m willing to nibble at current levels.

Finally, I am looking at Verizon Communications Inc. (VZ) once again. This stock is trading with a low PE of about 7 and sports a very juicy yield getting close to 7% and a moderate payout ratio of around 51% making this dividend appear to be very safe going forward. I realize that this company may not be a growth machine going forward but what it lacks in growth the current yield makes up for.

What do you think about my stock considerations for October? What are you looking to buy this month? Please let me know below.

Disclosure: Long VTRS, VZ, VFC, UGI, MO

Related Posts:

- September 2022 Stock Considerations

- May 2022 Stock Considerations

- April 2022 Stock Considerations

- June 2022 Stock Considerations

A new trading month is about the begin and boy do we have a seemingly endless crop of stocks that are becoming fair valued to undervalued. The reality of the day is that we’ll continue to see stock prices continue to come down as interest rates rise. No reason to believe interest rates will stop climbing anytime soon. Of course, the silver lining amid the market collapse is that every new dollar put to work today in dividend stocks comes with an automatic higher yield when compared to just a few weeks ago. With that being said, let’s take a look at my October 2022 stock considerations.

First up, I’m thinking about adding to recent spin off Viatris Inc. (VTRS). The relatively new separate consumer division of Pfizer (Upjohn and Mylan merge) is sporting a forward yield north of 5% with a manageable payout ratio of around 73%. This new company controls many popular consumer drug brands still in great demand for the foreseeable future. Under $10 a share the stock looks to be fairly valued with a current PE around 13.

Next, I am looking at adding to my V.F. Corporation (VFC) position. This stock is having a year it would like to forget but at current prices this dividend stalwart is looking a little under valued. With a current forward PE of just 10 and a forward yield well north of 6% this stock is too hard to ignore. Ideally, I’d like to see a slightly lower payout ratio for the dividend but at 77% it appears to be safe based on current cash flow.

Another company I’m considering is UGI Corporation (UGI). This gas utility stock has been in my portfolio less than a year and I have never added to my small position since my initial buy. It’s current PE sits at a modest 5 while sporting a forward yield around 4.5%. The payout ratio for this dividend is around 22% making this beaten down utility dividend appear to be quite safe.

Next, is the stock everyone loves to hate, Altria Group, Inc. (MO). I’m aware of all the legal issues surrounding the company and recent headwinds related to Juul. Yet, despite those issues coupled with lower smoking rates the company is still able to raise dividends and because of current price declines is sporting a yield just north of 9%. I admit, I am the yield moth drawn to this flame of a stock but it’s hard to argue with decades upon decades of dividend growth. With a forward PE that sits around 8, I’m willing to nibble at current levels.

Finally, I am looking at Verizon Communications Inc. (VZ) once again. This stock is trading with a low PE of about 7 and sports a very juicy yield getting close to 7% and a moderate payout ratio of around 51% making this dividend appear to be very safe going forward. I realize that this company may not be a growth machine going forward but what it lacks in growth the current yield makes up for.

What do you think about my stock considerations for October? What are you looking to buy this month? Please let me know below.

Disclosure: Long VTRS, VZ, VFC, UGI, MO

Related Posts:

Originally Posted in [DivHut] (https://divhut.com/october-2022-stock-considerations/)