AMC Theatres, originally an acronym for American Multi-Cinema; frequently referred to as simply AMC; and recognized in some regions as Cinemas or Multi-Cinemas; is an American movie theatre chain that was founded in Kansas City, Missouri, and is currently based in Leawood, Kansas. It is owned by AMC Entertainment Holdings, Inc. The biggest chain of movie theatres in the world is this one. The firm, which was founded in 1920, commands a larger market share than Regal and Cinemark Movie theaters in the United States.

The largest movie theater network in the world after owning Odeon Cinemas, Carmike Cinemas and UCI Cinemas in 2016. In Europe, it has 2,807 screens spread over 353 theaters, while in the US, it has 7,755 screens throughout 593 venues.

The Wanda Group, a Chinese corporation, owned the majority of the business's shares from 2012 to 2018; the company is listed on the New York Stock Exchange. The company received a $600 million investment from private equity company Silver Lake Partners in September 2018, yet Wanda Group continued to control the majority of firm's board of directors due to the voting power of the business shares being set up in this fashion.

Due to additional financing from firm and short squeezes that led to Silver Lake changing its $600 million debt holding to stock in January 2021 during economic downturns brought on by the COVID-19 epidemic, Wanda's shareholding was becoming progressively diluted. Early in February 2021, Wanda changed its Class B shares into Class A shares, lowering its voting right to less than 50%.

Firm's starting price was $27.20 in 2022. The firm share fare has dropped by -78% from the start of the year, trading at $6 today. The estimated for the end of 2022 is $9.66, representing a -64% continuous decline. Increase from now to year's end: +61% The firm share fare will increase to $13.19 in the first half of 2023; in the second half, it will increase by $1.53 to complete the 12 months at $14.72, which is a +145% increase over the current price.

| October 17, 2022 | $6.10 |

| Tuesday, Oct 18 | $6.14 |

| Wednesday, Oct 19 | $6.19 |

| Thursday, Oct 20 | $6.24 |

| Friday, Oct 21 | $6.29 |

| November 15 | $7.47 |

| December 15 | $8.90 |

| January 15, 2023 | $9.95 |

| February 15, 2023 | $10.56 |

| March 15, 2023 | $11.10 |

AMC Share Forecast 2024-2028

According to coin price forecast the firm value would rise significantly over these five years, from $14.72 to $37.68, a 156% increase. Stock value in 2024 will begin at $14.72, rise to $17.15 during the first six months of the year, and end of 2024 at $20.24. This translates to +237% from today.

we expect the price to reach a lower range of $20.50, a higher range of $23.50, and a medium range of $21.75 by the year 2025.

At 2022-10-13, the business quote is 5.850 USD. Our projections indicate a long-term gain, and the business stock price forecast for October 6, 2027, is 30.195 USD. The projected revenue after a 5-year investment is roughly +416.15%.

AMC Share Forecast 2029-2033

According to coin price forecast the share value would increase by 25% during this time, from $37.68 to $47.22. The price in 2029 will begin at $37.68, rise to $38.46 during the first half of the fiscal year, and end at $39.27. About +555% from today, to be exact.

Is AMC share expected to go up?

As of 6 June, opinions on the future of the AMC stock varied among analysts and algorithm-based forecasting tools. This demonstrates how important it is to perform your own research and analysis of the stock before making any trading decisions.

The price of firm will reach $10 by the end of 2022 and $20 by the ending of 2024, according to the most recent long-term forecast. Stock charge will increase to $30 in 2026 and to $40 in 2030.

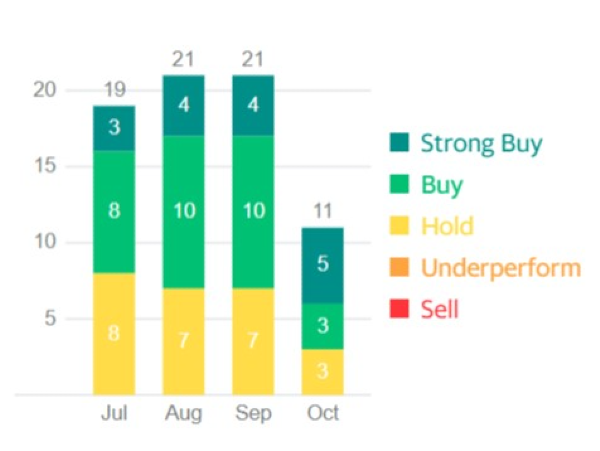

The median price objective among the 6 analysts that are providing one-year cost forecasts for AMC Entertainment Holdings Inc. is 2.57, with high and low estimates of 7.50 and 0.50, respectively. From the most recent price of $6.01, the consensus forecast reflects a reduction of 57.30%.

Should I buy amc stock now?

According to the most recent information from Yahoo Finance, short interest in AMC is increasing and now represents more than 20% of the stock's float. Therefore, there is a good chance that investors will cause a new short squeeze, sending the price of AMC's stock back to sky-high levels.

So it better option to buy AMC now.

AMC stock news headlines

For the second quarter of fiscal 2023, Lionsgate (LGF.A) reported an adjusted loss of 12 per share, 45.45% below the Zacks Consensus Estimate. In the same quarter last year, the company reported earnings of 15 cents.

Revenues fell by 0.02% annually to $875 million, 2.52% behind the consensus estimate.

The strategic decision to leave six markets in Japan and six international markets, including Continental Europe, is what has caused the revenue decline.

Also read: NIO Stock Forecast

AMC Stock Forecast, Analysis, Price & News

AMC Theatres, originally an acronym for American Multi-Cinema; frequently referred to as simply AMC; and recognized in some regions as Cinemas or Multi-Cinemas; is an American movie theatre chain that was founded in Kansas City, Missouri, and is currently based in Leawood, Kansas. It is owned by AMC Entertainment Holdings, Inc. The biggest chain of movie theatres in the world is this one. The firm, which was founded in 1920, commands a larger market share than Regal and Cinemark Movie theaters in the United States.

The largest movie theater network in the world after owning Odeon Cinemas, Carmike Cinemas and UCI Cinemas in 2016. In Europe, it has 2,807 screens spread over 353 theaters, while in the US, it has 7,755 screens throughout 593 venues.

The Wanda Group, a Chinese corporation, owned the majority of the business's shares from 2012 to 2018; the company is listed on the New York Stock Exchange. The company received a $600 million investment from private equity company Silver Lake Partners in September 2018, yet Wanda Group continued to control the majority of firm's board of directors due to the voting power of the business shares being set up in this fashion.

Due to additional financing from firm and short squeezes that led to Silver Lake changing its $600 million debt holding to stock in January 2021 during economic downturns brought on by the COVID-19 epidemic, Wanda's shareholding was becoming progressively diluted. Early in February 2021, Wanda changed its Class B shares into Class A shares, lowering its voting right to less than 50%.

AMC Stock Price Forecast 2022-2023

Firm's starting price was $27.20 in 2022. The firm share fare has dropped by -78% from the start of the year, trading at $6 today. The estimated for the end of 2022 is $9.66, representing a -64% continuous decline. Increase from now to year's end: +61% The firm share fare will increase to $13.19 in the first half of 2023; in the second half, it will increase by $1.53 to complete the 12 months at $14.72, which is a +145% increase over the current price.

Short term forecast

| October 17, 2022 | $6.10 |

| Tuesday, Oct 18 | $6.14 |

| Wednesday, Oct 19 | $6.19 |

| Thursday, Oct 20 | $6.24 |

| Friday, Oct 21 | $6.29 |

| November 15 | $7.47 |

| December 15 | $8.90 |

| January 15, 2023 | $9.95 |

| February 15, 2023 | $10.56 |

| March 15, 2023 | $11.10 |

AMC Share Forecast 2024-2028

According to coin price forecast the firm value would rise significantly over these five years, from $14.72 to $37.68, a 156% increase. Stock value in 2024 will begin at $14.72, rise to $17.15 during the first six months of the year, and end of 2024 at $20.24. This translates to +237% from today.

we expect the price to reach a lower range of $20.50, a higher range of $23.50, and a medium range of $21.75 by the year 2025.

At 2022-10-13, the business quote is 5.850 USD. Our projections indicate a long-term gain, and the business stock price forecast for October 6, 2027, is 30.195 USD. The projected revenue after a 5-year investment is roughly +416.15%.

AMC Share Forecast 2029-2033

According to coin price forecast the share value would increase by 25% during this time, from $37.68 to $47.22. The price in 2029 will begin at $37.68, rise to $38.46 during the first half of the fiscal year, and end at $39.27. About +555% from today, to be exact.

Is AMC share expected to go up?

As of 6 June, opinions on the future of the AMC stock varied among analysts and algorithm-based forecasting tools. This demonstrates how important it is to perform your own research and analysis of the stock before making any trading decisions.

What is AMC price prediction for 2022?

The price of firm will reach $10 by the end of 2022 and $20 by the ending of 2024, according to the most recent long-term forecast. Stock charge will increase to $30 in 2026 and to $40 in 2030.

What is the prediction for AMC stock?

The median price objective among the 6 analysts that are providing one-year cost forecasts for AMC Entertainment Holdings Inc. is 2.57, with high and low estimates of 7.50 and 0.50, respectively. From the most recent price of $6.01, the consensus forecast reflects a reduction of 57.30%.

Should I buy amc stock now?

According to the most recent information from Yahoo Finance, short interest in AMC is increasing and now represents more than 20% of the stock's float. Therefore, there is a good chance that investors will cause a new short squeeze, sending the price of AMC's stock back to sky-high levels. So it better option to buy AMC now.

AMC stock news headlines

For the second quarter of fiscal 2023, Lionsgate (LGF.A) reported an adjusted loss of 12 per share, 45.45% below the Zacks Consensus Estimate. In the same quarter last year, the company reported earnings of 15 cents.

Revenues fell by 0.02% annually to $875 million, 2.52% behind the consensus estimate. The strategic decision to leave six markets in Japan and six international markets, including Continental Europe, is what has caused the revenue decline.

Also read: NIO Stock Forecast