Understanding Materials ETFs

Material Exchange Traded Funds (ETFs) are investment funds that provide exposure to companies in the materials sector. This sector includes companies involved in the extraction, processing, and development of raw materials. These companies can range from miners and agricultural product makers to timber companies and homebuilders.

Here are some key points to understand about material ETFs:

Exposure to Global Market: Some material ETFs allow you to invest globally in companies from the materials sector. This can provide exposure to different markets and economies.

Variety of Subsectors: The materials sector is broad and includes various subsectors such as metals, agriculture, timber, and more. Different ETFs may focus on different subsectors, allowing investors to choose based on their specific interests and market predictions.

Top Issuers: Some of the top issuers of material ETFs by Assets Under Management (AUM) include VanEck, State Street, Mirae Asset Global Investments Co., Ltd., BlackRock, Inc., and Vanguard.

Definition and purpose of materials ETFs

Materials ETFs are investment funds that track the performance of companies in the materials sector, including extraction, processing, and production of raw materials.

They provide investors with exposure to the materials sector, allowing them to benefit from the growth of companies involved in the production of raw materials.

Materials ETFs can be used as a core holding in a portfolio or as a way to add diversification to an existing portfolio.

Benefits of investing in materials ETFs

Materials ETFs offer a convenient and cost-effective way to invest in the materials sector. They provide diversification benefits, as they track a broad range of companies in the materials sector. Materials ETFs can be used to hedge against inflation, as the sector is often seen as a safe-haven during periods of high inflation.

Top Materials ETFs to Invest In

List of top-performing materials ETFs

The following ETFs are some of the top performing funds in the material sector. The returns posted are 5-year annual returns from 2019 to 2024.

XLB - Materials Select Sector SPDR Fund, 10.87% return

VAW - Vanguard Materials ETF, 10.80% return

MXI - iShares Global Materials ETF, 6.94% return

Comparison of top materials ETFs

XLB has a fee of 0.10% and tracks the S&P Materials Select Sector Index.

VAW has a fee of 0.10% and provides broader exposure across all cap sizes of U.S. materials stocks.

MXI has a fee of 0.43% and provides materials exposure outside the U.S.

Specialized Material ETFs

While many ETFs give broad exposure to the materials sector, the sector is very diverse with many material companies within these ETFs having vastly different customers, processes, and products. Here are some popular specialized ETFs within the sector.

Metals and mining

Metals and mining is a sub-category of the meterials sector. Here is a comparison of two of the largest mining ETFs:

**PICK (iShares MSCI Global Metals & Mining Producers ETF) **

Issuer: BlackRock, Inc.

Expense Ratio: 0.39%

Inception Date: January 31st, 2012

Critical Data: AUM: $1.24B, Shares Outstanding: 29.1M

**XME (SPDR S&P Metals & Mining ETF) **

Copper ETFs

The interest in copper stocks in 2024 has been driven by several factors:

Surging Demand: The demand for copper is on track to double from 2022 to 2035. This surge is powered by the transition to clean energy, as copper is crucial for electrifying the transportation sector and producing renewable energy.

Growth in Various Sectors: The copper market is expected to grow from $166.25 billion in 2023 to $179.84 billion in 2024, exhibiting a compound annual growth rate of 8.2%. This growth is due to the explosive growth in the electrical and electronics, construction, industrial machinery manufacturing, automotive manufacturing, and infrastructure sectors.

Potential for High Returns: The rise in demand, fueled by the green energy transition, coupled with an expected decline in the US dollar in the latter half of 2024, is expected to contribute to the upward trend in copper prices. This could potentially drive copper prices to $15,000 per ton in 2025, surpassing the previous record peak of $10,730 per ton reached in March 2023.

Investment in Copper Stocks: Several mining companies are investing heavily to expand their copper output. Their growing copper production should boost their profits and share prices. Top copper stocks include BHP Group, Freeport-McMoRan, Teck Resources, Southern Copper, and Rio Tinto.

Investment Methods: Exchange-traded funds (ETFs), futures, and mining stocks are common methods of investing in copper, which has made it easier for capital to flow into Copper related assets.

Copper ETFs

Below is a list of the top copper ETFs:

United States Copper Index Fund (NYSEARCA: CPER): This fund provides exposure to copper futures.

Global X Copper Miners ETF (NYSEARCA: COPX): This ETF provides investors with access to a range of copper mining companies.

Sprott Junior Copper Miners ETF (NASDAQ: COPJ): This ETF provides exposure to small-cap copper mining companies.

iShares Copper & Metals Mining ETF (NASDAQ: ICOP): This ETF provides exposure to companies in the copper and metals mining sector.

copper futures ETF

While copper ETFs will give exposure to companies that manufacture and mine copper materials, copper futures ETFs provide exposure to derivatives around copper. Here are some well-known copper futures ETFs:

United States Copper Index Fund (NYSEARCA: CPER): This fund aims to give investors exposure to a portfolio of copper futures without using a commodity futures account. It tracks the performance of the SummerHaven Copper Index Total Return.

iPath Series B Bloomberg Copper Subindex Total Return ETN (NYSEARCA: JJC): This ETN provides exposure to copper futures2.

- Global X Copper Miners ETF (NYSEARCA: COPX): While this ETF primarily provides exposure to copper mining companies, it also has some exposure to copper futures.

Is there a short copper ETF?

WisdomTree Copper 3x Daily Short: This ETF provides three times the daily short exposure to copper prices. It’s a collateralized debt instrument with an ongoing charge of 0.99%. The fund size is 3.52m GBP as of Jun 30, 2024.

Silver ETFs

Global X Silver Miners ETF (SIL): This ETF invests in stocks of companies that are actively involved in mining and other aspects of silver production. It has total assets of $1,207.40 million and a year-to-date (YTD) return of 21.20%1.

Amplify Junior Silver Miners ETF (SILJ): This ETF focuses on smaller cap silver mining stocks. It has total assets of $1 Billion and a YTD return of 24%.

iShares MSCI Global Silver Miners ETF (SLVP): This ETF provides exposure to companies involved in the silver mining industry. It has total assets of $243 million and a YTD return of 27.91%.

MicroSectors Gold 3X Leveraged ETNs (SHNY): Although this ETF is more focused on gold, it also provides exposure to the silver mining industry. It has total assets of $18.24 million and a YTD return of 33.29%.

MicroSectors Gold -3X Inverse Leveraged ETNs (DULL): Similar to SHNY, this ETF is more focused on gold but also provides exposure to the silver mining industry. It has total assets of $1.83 million and a YTD return of -36.83%.

Timber ETFs

iShares Global Timber & Forestry ETF (WOOD): This ETF provides investors with broad exposure to companies that produce forest products, agricultural products, and paper and packaging products. The top holdings include several of the largest timber REITs, as well as global timber companies.

Invesco MSCI Global Timber ETF (CUT): This ETF focuses on timber REITs and companies selling forest products, paper products, and paper packaging.

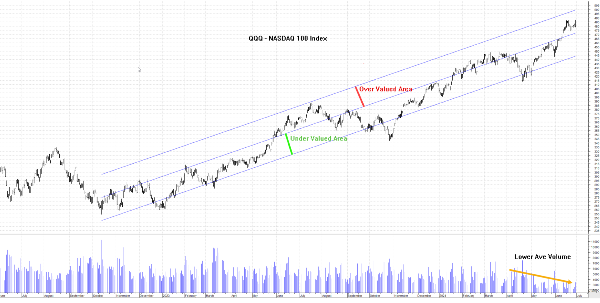

When to invest in material ETFs?

Investing in Material ETFs can be a strategic move for investors looking to diversify their portfolios and gain exposure to the materials sector. Just like the timing of the material sector in general

- Market Cycle and Inflation: The materials sector offers unique and differentiated return patterns, particularly at a point in the market cycle when inflation is still a concern for many investors.

Broad Exposure: ETFs provide broad exposure to the materials sector, including metals, mining stocks, and other raw materials. This can help absorb some single-stock shock by bundling large numbers of stocks dealing in one industry or several.

Demand Drivers: Industrial base metals like copper, iron ore, and aluminum are essential building blocks for infrastructure, buildings, appliances, vehicles, and other equipment. Many metals are also becoming vital for lower-carbon energy. These demand drivers should help boost metals prices in the future.

ETF Options: There are several ETFs focused on the metals and mining sector. Some focus on precious metals like gold and silver, while others concentrate on leading industrial base metals and emerging metals for the green energy sector.

Final Thoughts

Investing in materials ETFs can be a strategic move for those looking to diversify their portfolio and gain exposure to the global materials sector. These ETFs offer a broad range of investment opportunities, from general materials sector funds to more specialized ETFs focusing on specific subsectors like metals, mining, and even specific commodities like copper and silver.

The materials sector is vast and diverse, encompassing various industries from mining and agriculture to timber and homebuilding. This diversity can provide investors with numerous opportunities to capitalize on different market trends and economic cycles. Moreover, the global nature of many materials ETFs allows investors to gain exposure to international markets, potentially benefiting from growth in emerging economies.

However, like any investment, materials ETFs come with their own set of risks and considerations. The performance of these ETFs can be significantly influenced by factors such as commodity prices, geopolitical events, and economic cycles. Therefore, it’s crucial for investors to thoroughly research and understand the specific ETFs they are considering.

Whether you’re interested in a broad exposure to the materials sector or looking to invest in a specific subsector or commodity, there’s likely a materials ETF that fits your investment strategy.

Image Source: Stefan Schweihofer

Understanding Materials ETFs

Material Exchange Traded Funds (ETFs) are investment funds that provide exposure to companies in the materials sector. This sector includes companies involved in the extraction, processing, and development of raw materials. These companies can range from miners and agricultural product makers to timber companies and homebuilders. Here are some key points to understand about material ETFs:

Exposure to Global Market: Some material ETFs allow you to invest globally in companies from the materials sector. This can provide exposure to different markets and economies.

Variety of Subsectors: The materials sector is broad and includes various subsectors such as metals, agriculture, timber, and more. Different ETFs may focus on different subsectors, allowing investors to choose based on their specific interests and market predictions.

Top Issuers: Some of the top issuers of material ETFs by Assets Under Management (AUM) include VanEck, State Street, Mirae Asset Global Investments Co., Ltd., BlackRock, Inc., and Vanguard.

Definition and purpose of materials ETFs

Materials ETFs are investment funds that track the performance of companies in the materials sector, including extraction, processing, and production of raw materials.

They provide investors with exposure to the materials sector, allowing them to benefit from the growth of companies involved in the production of raw materials.

Materials ETFs can be used as a core holding in a portfolio or as a way to add diversification to an existing portfolio.

Benefits of investing in materials ETFs

Materials ETFs offer a convenient and cost-effective way to invest in the materials sector. They provide diversification benefits, as they track a broad range of companies in the materials sector. Materials ETFs can be used to hedge against inflation, as the sector is often seen as a safe-haven during periods of high inflation.

Top Materials ETFs to Invest In

List of top-performing materials ETFs

The following ETFs are some of the top performing funds in the material sector. The returns posted are 5-year annual returns from 2019 to 2024.

XLB - Materials Select Sector SPDR Fund, 10.87% return

VAW - Vanguard Materials ETF, 10.80% return

MXI - iShares Global Materials ETF, 6.94% return

Comparison of top materials ETFs

XLB has a fee of 0.10% and tracks the S&P Materials Select Sector Index.

VAW has a fee of 0.10% and provides broader exposure across all cap sizes of U.S. materials stocks.

MXI has a fee of 0.43% and provides materials exposure outside the U.S.

Specialized Material ETFs

While many ETFs give broad exposure to the materials sector, the sector is very diverse with many material companies within these ETFs having vastly different customers, processes, and products. Here are some popular specialized ETFs within the sector.

Metals and mining

Metals and mining is a sub-category of the meterials sector. Here is a comparison of two of the largest mining ETFs:

**PICK (iShares MSCI Global Metals & Mining Producers ETF) **

Issuer: BlackRock, Inc.

Expense Ratio: 0.39%

Inception Date: January 31st, 2012

Critical Data: AUM: $1.24B, Shares Outstanding: 29.1M

**XME (SPDR S&P Metals & Mining ETF) **

Issuer: State Street

Expense Ratio: 0.35%

2006-06-19 June 19th 2006

Critical Data: AUM: $2.18B, Shares Outstanding: 34.3M

Copper ETFs

The interest in copper stocks in 2024 has been driven by several factors:

Surging Demand: The demand for copper is on track to double from 2022 to 2035. This surge is powered by the transition to clean energy, as copper is crucial for electrifying the transportation sector and producing renewable energy.

Growth in Various Sectors: The copper market is expected to grow from $166.25 billion in 2023 to $179.84 billion in 2024, exhibiting a compound annual growth rate of 8.2%. This growth is due to the explosive growth in the electrical and electronics, construction, industrial machinery manufacturing, automotive manufacturing, and infrastructure sectors.

Potential for High Returns: The rise in demand, fueled by the green energy transition, coupled with an expected decline in the US dollar in the latter half of 2024, is expected to contribute to the upward trend in copper prices. This could potentially drive copper prices to $15,000 per ton in 2025, surpassing the previous record peak of $10,730 per ton reached in March 2023.

Investment in Copper Stocks: Several mining companies are investing heavily to expand their copper output. Their growing copper production should boost their profits and share prices. Top copper stocks include BHP Group, Freeport-McMoRan, Teck Resources, Southern Copper, and Rio Tinto.

Investment Methods: Exchange-traded funds (ETFs), futures, and mining stocks are common methods of investing in copper, which has made it easier for capital to flow into Copper related assets.

Copper ETFs

Below is a list of the top copper ETFs:

United States Copper Index Fund (NYSEARCA: CPER): This fund provides exposure to copper futures.

Global X Copper Miners ETF (NYSEARCA: COPX): This ETF provides investors with access to a range of copper mining companies.

Sprott Junior Copper Miners ETF (NASDAQ: COPJ): This ETF provides exposure to small-cap copper mining companies.

iShares Copper & Metals Mining ETF (NASDAQ: ICOP): This ETF provides exposure to companies in the copper and metals mining sector.

copper futures ETF

While copper ETFs will give exposure to companies that manufacture and mine copper materials, copper futures ETFs provide exposure to derivatives around copper. Here are some well-known copper futures ETFs:

United States Copper Index Fund (NYSEARCA: CPER): This fund aims to give investors exposure to a portfolio of copper futures without using a commodity futures account. It tracks the performance of the SummerHaven Copper Index Total Return.

iPath Series B Bloomberg Copper Subindex Total Return ETN (NYSEARCA: JJC): This ETN provides exposure to copper futures2.

Is there a short copper ETF?

WisdomTree Copper 3x Daily Short: This ETF provides three times the daily short exposure to copper prices. It’s a collateralized debt instrument with an ongoing charge of 0.99%. The fund size is 3.52m GBP as of Jun 30, 2024.

Silver ETFs

Global X Silver Miners ETF (SIL): This ETF invests in stocks of companies that are actively involved in mining and other aspects of silver production. It has total assets of $1,207.40 million and a year-to-date (YTD) return of 21.20%1.

Amplify Junior Silver Miners ETF (SILJ): This ETF focuses on smaller cap silver mining stocks. It has total assets of $1 Billion and a YTD return of 24%.

iShares MSCI Global Silver Miners ETF (SLVP): This ETF provides exposure to companies involved in the silver mining industry. It has total assets of $243 million and a YTD return of 27.91%.

MicroSectors Gold 3X Leveraged ETNs (SHNY): Although this ETF is more focused on gold, it also provides exposure to the silver mining industry. It has total assets of $18.24 million and a YTD return of 33.29%.

MicroSectors Gold -3X Inverse Leveraged ETNs (DULL): Similar to SHNY, this ETF is more focused on gold but also provides exposure to the silver mining industry. It has total assets of $1.83 million and a YTD return of -36.83%.

Timber ETFs

iShares Global Timber & Forestry ETF (WOOD): This ETF provides investors with broad exposure to companies that produce forest products, agricultural products, and paper and packaging products. The top holdings include several of the largest timber REITs, as well as global timber companies.

Invesco MSCI Global Timber ETF (CUT): This ETF focuses on timber REITs and companies selling forest products, paper products, and paper packaging.

When to invest in material ETFs?

Investing in Material ETFs can be a strategic move for investors looking to diversify their portfolios and gain exposure to the materials sector. Just like the timing of the material sector in general

Broad Exposure: ETFs provide broad exposure to the materials sector, including metals, mining stocks, and other raw materials. This can help absorb some single-stock shock by bundling large numbers of stocks dealing in one industry or several.

Demand Drivers: Industrial base metals like copper, iron ore, and aluminum are essential building blocks for infrastructure, buildings, appliances, vehicles, and other equipment. Many metals are also becoming vital for lower-carbon energy. These demand drivers should help boost metals prices in the future.

ETF Options: There are several ETFs focused on the metals and mining sector. Some focus on precious metals like gold and silver, while others concentrate on leading industrial base metals and emerging metals for the green energy sector.

Final Thoughts

Investing in materials ETFs can be a strategic move for those looking to diversify their portfolio and gain exposure to the global materials sector. These ETFs offer a broad range of investment opportunities, from general materials sector funds to more specialized ETFs focusing on specific subsectors like metals, mining, and even specific commodities like copper and silver.

The materials sector is vast and diverse, encompassing various industries from mining and agriculture to timber and homebuilding. This diversity can provide investors with numerous opportunities to capitalize on different market trends and economic cycles. Moreover, the global nature of many materials ETFs allows investors to gain exposure to international markets, potentially benefiting from growth in emerging economies. However, like any investment, materials ETFs come with their own set of risks and considerations. The performance of these ETFs can be significantly influenced by factors such as commodity prices, geopolitical events, and economic cycles. Therefore, it’s crucial for investors to thoroughly research and understand the specific ETFs they are considering.

Whether you’re interested in a broad exposure to the materials sector or looking to invest in a specific subsector or commodity, there’s likely a materials ETF that fits your investment strategy.