Introduction

You have probably heard of Bitcoin (BTC) before, a volatile, speculative and high-risk high reward digital asset. In the last month Bitcoin has been all over the news due to reaching new all-time highs as well as gaining more traction towards mass adoption within the financial market. The hype and price development in the last months helps us to find new insights regarding the volatility, market dynamics and future of BTC and other cryptocurrencies.

Bitcoin has always been the most dominant cryptocurrency in the crypto market thanks to its decentralized nature, store of value and global accessibility characteristics. Currently, BTC has a price of $99.000 and a total market capitalization of $1.8 trillion which is 57% of the total crypto market capitalization. While some large gains could have been made in the last years if you had bought the dip in 2023, there was also a huge drop in price from November 2021 until the end of 2022. The previous all-time high in November 2021 was $69.000 where it quicky collapsed to a price of $16.000 in December 2022. Hence, a decrease of almost 77%.

In this article we will take a closer look into the definition and function of Bitcoin, the price development of Bitcoin in 2024 and the factors that drove price growth as well as a future outlook for Bitcoin and what we could expect for 2025.

What is Bitcoin?

BTC is the first decentralized digital currency that was created by Mr. Satoshi Nakamoto in 2009 who remains anonymous until this day. More simply put, BTC is a medium of exchange. But what makes Bitcoin truly unique? There are multiple benefits to take into consideration.

First, the network is decentralized meaning that BTC operates on a peer-to-peer network. Hence, there is no need for a centralized party such as a bank or any other financial institution that verifies transactions. As a result, transaction fees are lower, you can send BTC anywhere in the world, your account cannot be frozen and there will be no arbitrary limits. But who verifies the transactions and makes sure the transaction is secure if there is no central party? This is done by individuals or so called “miners” who verify transactions and are rewarded with newly generated Bitcoins.

Next, once the transaction has been validated, they are recorded on a general ledger called the blockchain which is open to the public. The major benefit of this technology is that it ensures transparency and security, as every transaction is verified by network participants.

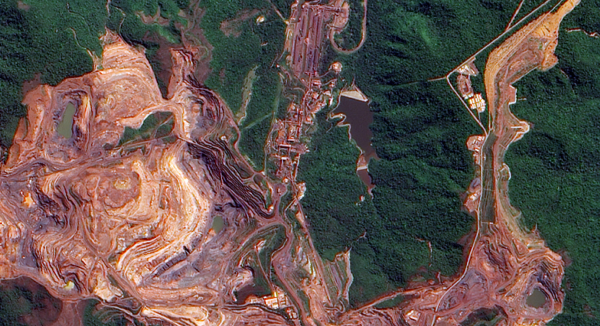

Noteworthy is that there is only a limited supply of BTC that can be created, making it a deflationary asset. Specifically, there is a fixed supply of 21 million BTC and there are 19.785 million BTC in circulation right now. After a new block has been created and added to the blockchain through the verification of transaction done by miners, miners are rewarded with 3.125 BTC per mined block. An important term to mention is the Bitcoin halving which happens every 4 years, the most recent halving was in 2024. This implies that during this event, the reward that miners receive for adding blocks to the blockchain is halved. So, in 2028 after the halving, each newly created block will be rewarded with only 1.563 BTC. But what effect does the halving have on the price of BTC. We will talk more about this later on, but the general idea is that Bitcoin becomes scarcer and the price has to increase in order for miners to remain profitable. Mining Bitcoin can be very costly due to investments in hardware regarding computing power as well as high energy costs.

To summarize, Bitcoin is a very complex and volatile digital asset due to its lack of regulation and its decentralized characteristics. The main use cases for BTC are a medium of exchange where you can buy goods and services across the globe. Next, a store of value since it is often referred to as digital gold due to its scarcity and deflationary characteristics. Finally, it can be seen as a risky and speculative investment.

The price development of Bitcoin in 2024 and its growth factors

Bitcoin has seen a major upward trend in 2024 caused by various factors. Starting off with Figure 1 as shown below and with respect to the first quarter of 2024. BTC experienced a large increase in price from around $40.000 in January all the way to a new all-time high of around $73.000 in the beginning of March.

The main reason for this increase was the highly anticipated Bitcoin halving which occurred on the 19th of April. As previously mentioned, this event caused the rewards that miners receive from validating transactions to be halved. Specifically, from 6.25 BTC to 3.125 BTC per newly created block. This is a significant factor that positively influences the price of BTC due to a lower supply of new Bitcoins entering the market. Hence, more scarcity. History further shows that many institutional investors anticipate this event which caused more demand, significant market sentiment as well large price volatility and higher trading volumes. After the all-time high had been reached, many large price shocks occurred causing the price to drop and jump between 10 and 20% weekly in the following months.

Ultimately, suggesting that long term investors are taking profits, accumulating Bitcoin in dips as well as new investors entering the market. New investors often fall trap to FOMO, the fear of missing out. Bitcoin is all over the news and everyone is making large gains. As a result, new investors believe everyone can make money by just buying Bitcoin. However, they are often the ones that do not understand the market and volatility related to crypto and therefore lose money in the process.

Hence, the Bitcoin halving attracts both retail and institutional investors to the market and is often seen as the main indicator when the next bull run is about to start. The bull run underscores Bitcoin’s cyclical nature as past halving events have similarly triggered bullish returns. More specifically, this means that the price of Bitcoin and other cryptocurrencies tends to skyrocket for around 1 to 2 years and after experiences a huge drop in the price. History confirms this hypothesis. For example, after the all-time high in 2021, Bitcoin dropped 77%. The same happened after the all-time high in December 2017, where the price plummeted more than 80%. While history does not repeat itself, it does certainly rhyme.

Figure 1: BTC price chart YT (2024)

Next, a closer look is taken into the technical analysis of Bitcoin with the help of major support and resistance lines. During the period from March 2024 until November 2024 we see there is a strong resistance at around $72.000. This resistance line depicts the all-time high that was reached back in March. When an all-time high has been reached, the price quickly drops back down as people take profits. Alternatively, there was not enough momentum for Bitcoin to break out and reach a new all-time high. Not only did this happen in March, but the chart also shows that there are multiple moments where we reach this point. More specifically, Around June and the beginning of November we reach the resistance line again, but Bitcoin was unable to break out of it previous all-time high.

On the contrary, there are 2 major support lines that must be taken into consideration. Noteworthy is that support lines act as psychological or technical price floors, where buying pressure tends to counteract selling pressure, preventing further declines. Starting off with the first support line at around $60.500. This number sounds familiar as it was also the all-time high back in April 2021, currently presenting a historical benchmark level. Hence, after the price of Bitcoin reached the resistance level of $72.000, the price experienced a correction but the support line of $60.500 held steady. Implying that investors and traders view this price level as a strong accumulation indicator after substantial profit taking of investors above $70.000.

Finally, there is a strong second support line at $54.500 that acts as a safety net for stronger corrections caused by external factors such as news, geopolitical factors, macroeconomic events etc. This line also aligns with Bitcoin’s consolidation phase back in the previous bull run in 2020. Showcasing the importance of the historical price performance of Bitcoin as it now acts as a benchmark level. When looking at figure 2, we see that this price level has been reached 3 times. Namely, in July, August and September. During periods with more volatility where the first support line of $60.500 does not hold, the price level of $54.500 is a strong buying signal for investors. Hence, many investors buy the dip and as a result, the price of BTC quickly bounces back up.

**Figure 2: Resistance and Support **

A new all-time high in November 2024.

Finally, in November 2024 we experienced a major breakthrough. The Bitcoin price skyrocketed past its previous resistance level of $72.000, all the way to a new all-time high of around $99.000. The are multiple reasons that caused the breakthrough, but the most important reason was the U.S elections where President Trump came out victorious. President Trump alongside with his administration are pro crypto. As a result, there is now more support towards the integration of digital assets into the traditional financial markets. One of pro-crypto policies of Trump was his campaign focusing on creating a strategic Bitcoin reserve for the United States.

Another major factor that positively influenced the price of Bitcoin was the announcement that SEC Chair’s Gary Gensler is planning to step down once President Trump takes office in January 2025. While Gary Gensler did oversee the launch of the first spot Bitcoin ETF in the US in January 2024, his perspective was against the integration of cryptocurrencies as many new regulations were implemented as well as lawsuits against major crypto exchanges that affected digital assets. With Trump as president, the market is expecting a more crypto-friendly SEC and administration which in return caused both retail and institutional investors to increase their Bitcoin holdings. Ultimately, driving up the price.

Finally, now that the crypto environment is likely to significantly improve in the future, many retail and institutional investors are accumulating Bitcoins through spot Bitcoin ETFs which were created in January 2024, causing billions of dollars to flow into these ETFs. To further commit to crypto trading on a global scale, on November 18, the Options Clearing Corporation (OCC) agreed to accept the start of options trading for spot Bitcoin ETFs led by BlackRock’s Ishares Bitcoin Trust ETF (IBIT). Other major ETFs that offer options trading include Grayscale Bitcoin Trust (GBTC), Bitcoin Mini Trust (BTC), ARK 21Shares Bitcoin ETF (ARKB) and Bitwise Bitcoin ETF Trust (BITB). Options trading on Spot Bitcoin ETFs definitely contributed to price increase of Bitcoin since many investors bought call options rather than put options. Additionally, huge purchases from major corporations such as MicroStrategy further validated Bitcoin’s role as a store of value and successful investment instrument.

Future outlook for Bitcoin

In the short term, Bitcoin is approaching a huge milestone of reaching $100.000 which holds an incredible sentimental value within the crypto community. This corresponds to a total market capitalization of $2 trillion. However, investors should prepare for incoming volatility spikes as this threshold will trigger both stop-loss limits on short positions as well as profit taking by long term and leveraged investors. Furthermore, when looking at the relative strength index (RSI) which measures the momentum and signals whether a security is either overbought or oversold currently is at 82. Signaling that Bitcoin is currently overbought, suggesting a potential correction.

Figure 3: RSI – 14 days

Despite this, the long term looks very positive for the growth and adaptation of Bitcoin. With a continuing increase in the M3 money supply and hence more liquidity coming into the market, Bitcoin is likely to continue to grow thanks to its deflationary supply, its scarcity and a fixed supply of 21 million coins.

Bitcoin has become mainstream, and its adoption will continue to accelerate In the following years. Crypto advocates are entering the government as well as a new SEC chairperson may suggest a shift towards a more crypto-friendly regulatory environment.

2025 is close and the future for Bitcoin and the cryptocurrency industry looks promising. While it is going to be a wild ride with large corrections as well as large jumps, predictions made by analysts differ widely. Forecasts range from $120.000 to $200.000 for 2025 due to a lot of speculation on the short term. Hence, more regulation is required for BTC to truly experience mass adoption. Governments are focusing on implementing new regulations that improve the security, accessibility and transparency of Bitcoin. Ultimately, building a secure and transparent cryptocurrency market while ensuring broader accessibility for both individual investors and institutions.

I/we have a position in an asset mentioned

Introduction

You have probably heard of Bitcoin (BTC) before, a volatile, speculative and high-risk high reward digital asset. In the last month Bitcoin has been all over the news due to reaching new all-time highs as well as gaining more traction towards mass adoption within the financial market. The hype and price development in the last months helps us to find new insights regarding the volatility, market dynamics and future of BTC and other cryptocurrencies.

Bitcoin has always been the most dominant cryptocurrency in the crypto market thanks to its decentralized nature, store of value and global accessibility characteristics. Currently, BTC has a price of $99.000 and a total market capitalization of $1.8 trillion which is 57% of the total crypto market capitalization. While some large gains could have been made in the last years if you had bought the dip in 2023, there was also a huge drop in price from November 2021 until the end of 2022. The previous all-time high in November 2021 was $69.000 where it quicky collapsed to a price of $16.000 in December 2022. Hence, a decrease of almost 77%.

In this article we will take a closer look into the definition and function of Bitcoin, the price development of Bitcoin in 2024 and the factors that drove price growth as well as a future outlook for Bitcoin and what we could expect for 2025.

What is Bitcoin?

BTC is the first decentralized digital currency that was created by Mr. Satoshi Nakamoto in 2009 who remains anonymous until this day. More simply put, BTC is a medium of exchange. But what makes Bitcoin truly unique? There are multiple benefits to take into consideration.

First, the network is decentralized meaning that BTC operates on a peer-to-peer network. Hence, there is no need for a centralized party such as a bank or any other financial institution that verifies transactions. As a result, transaction fees are lower, you can send BTC anywhere in the world, your account cannot be frozen and there will be no arbitrary limits. But who verifies the transactions and makes sure the transaction is secure if there is no central party? This is done by individuals or so called “miners” who verify transactions and are rewarded with newly generated Bitcoins.

Next, once the transaction has been validated, they are recorded on a general ledger called the blockchain which is open to the public. The major benefit of this technology is that it ensures transparency and security, as every transaction is verified by network participants.

Noteworthy is that there is only a limited supply of BTC that can be created, making it a deflationary asset. Specifically, there is a fixed supply of 21 million BTC and there are 19.785 million BTC in circulation right now. After a new block has been created and added to the blockchain through the verification of transaction done by miners, miners are rewarded with 3.125 BTC per mined block. An important term to mention is the Bitcoin halving which happens every 4 years, the most recent halving was in 2024. This implies that during this event, the reward that miners receive for adding blocks to the blockchain is halved. So, in 2028 after the halving, each newly created block will be rewarded with only 1.563 BTC. But what effect does the halving have on the price of BTC. We will talk more about this later on, but the general idea is that Bitcoin becomes scarcer and the price has to increase in order for miners to remain profitable. Mining Bitcoin can be very costly due to investments in hardware regarding computing power as well as high energy costs.

To summarize, Bitcoin is a very complex and volatile digital asset due to its lack of regulation and its decentralized characteristics. The main use cases for BTC are a medium of exchange where you can buy goods and services across the globe. Next, a store of value since it is often referred to as digital gold due to its scarcity and deflationary characteristics. Finally, it can be seen as a risky and speculative investment.

The price development of Bitcoin in 2024 and its growth factors

Bitcoin has seen a major upward trend in 2024 caused by various factors. Starting off with Figure 1 as shown below and with respect to the first quarter of 2024. BTC experienced a large increase in price from around $40.000 in January all the way to a new all-time high of around $73.000 in the beginning of March.

The main reason for this increase was the highly anticipated Bitcoin halving which occurred on the 19th of April. As previously mentioned, this event caused the rewards that miners receive from validating transactions to be halved. Specifically, from 6.25 BTC to 3.125 BTC per newly created block. This is a significant factor that positively influences the price of BTC due to a lower supply of new Bitcoins entering the market. Hence, more scarcity. History further shows that many institutional investors anticipate this event which caused more demand, significant market sentiment as well large price volatility and higher trading volumes. After the all-time high had been reached, many large price shocks occurred causing the price to drop and jump between 10 and 20% weekly in the following months.

Ultimately, suggesting that long term investors are taking profits, accumulating Bitcoin in dips as well as new investors entering the market. New investors often fall trap to FOMO, the fear of missing out. Bitcoin is all over the news and everyone is making large gains. As a result, new investors believe everyone can make money by just buying Bitcoin. However, they are often the ones that do not understand the market and volatility related to crypto and therefore lose money in the process.

Hence, the Bitcoin halving attracts both retail and institutional investors to the market and is often seen as the main indicator when the next bull run is about to start. The bull run underscores Bitcoin’s cyclical nature as past halving events have similarly triggered bullish returns. More specifically, this means that the price of Bitcoin and other cryptocurrencies tends to skyrocket for around 1 to 2 years and after experiences a huge drop in the price. History confirms this hypothesis. For example, after the all-time high in 2021, Bitcoin dropped 77%. The same happened after the all-time high in December 2017, where the price plummeted more than 80%. While history does not repeat itself, it does certainly rhyme.

Figure 1: BTC price chart YT (2024)

Next, a closer look is taken into the technical analysis of Bitcoin with the help of major support and resistance lines. During the period from March 2024 until November 2024 we see there is a strong resistance at around $72.000. This resistance line depicts the all-time high that was reached back in March. When an all-time high has been reached, the price quickly drops back down as people take profits. Alternatively, there was not enough momentum for Bitcoin to break out and reach a new all-time high. Not only did this happen in March, but the chart also shows that there are multiple moments where we reach this point. More specifically, Around June and the beginning of November we reach the resistance line again, but Bitcoin was unable to break out of it previous all-time high.

On the contrary, there are 2 major support lines that must be taken into consideration. Noteworthy is that support lines act as psychological or technical price floors, where buying pressure tends to counteract selling pressure, preventing further declines. Starting off with the first support line at around $60.500. This number sounds familiar as it was also the all-time high back in April 2021, currently presenting a historical benchmark level. Hence, after the price of Bitcoin reached the resistance level of $72.000, the price experienced a correction but the support line of $60.500 held steady. Implying that investors and traders view this price level as a strong accumulation indicator after substantial profit taking of investors above $70.000.

Finally, there is a strong second support line at $54.500 that acts as a safety net for stronger corrections caused by external factors such as news, geopolitical factors, macroeconomic events etc. This line also aligns with Bitcoin’s consolidation phase back in the previous bull run in 2020. Showcasing the importance of the historical price performance of Bitcoin as it now acts as a benchmark level. When looking at figure 2, we see that this price level has been reached 3 times. Namely, in July, August and September. During periods with more volatility where the first support line of $60.500 does not hold, the price level of $54.500 is a strong buying signal for investors. Hence, many investors buy the dip and as a result, the price of BTC quickly bounces back up.

**Figure 2: Resistance and Support **

A new all-time high in November 2024.

Finally, in November 2024 we experienced a major breakthrough. The Bitcoin price skyrocketed past its previous resistance level of $72.000, all the way to a new all-time high of around $99.000. The are multiple reasons that caused the breakthrough, but the most important reason was the U.S elections where President Trump came out victorious. President Trump alongside with his administration are pro crypto. As a result, there is now more support towards the integration of digital assets into the traditional financial markets. One of pro-crypto policies of Trump was his campaign focusing on creating a strategic Bitcoin reserve for the United States.

Another major factor that positively influenced the price of Bitcoin was the announcement that SEC Chair’s Gary Gensler is planning to step down once President Trump takes office in January 2025. While Gary Gensler did oversee the launch of the first spot Bitcoin ETF in the US in January 2024, his perspective was against the integration of cryptocurrencies as many new regulations were implemented as well as lawsuits against major crypto exchanges that affected digital assets. With Trump as president, the market is expecting a more crypto-friendly SEC and administration which in return caused both retail and institutional investors to increase their Bitcoin holdings. Ultimately, driving up the price.

Finally, now that the crypto environment is likely to significantly improve in the future, many retail and institutional investors are accumulating Bitcoins through spot Bitcoin ETFs which were created in January 2024, causing billions of dollars to flow into these ETFs. To further commit to crypto trading on a global scale, on November 18, the Options Clearing Corporation (OCC) agreed to accept the start of options trading for spot Bitcoin ETFs led by BlackRock’s Ishares Bitcoin Trust ETF (IBIT). Other major ETFs that offer options trading include Grayscale Bitcoin Trust (GBTC), Bitcoin Mini Trust (BTC), ARK 21Shares Bitcoin ETF (ARKB) and Bitwise Bitcoin ETF Trust (BITB). Options trading on Spot Bitcoin ETFs definitely contributed to price increase of Bitcoin since many investors bought call options rather than put options. Additionally, huge purchases from major corporations such as MicroStrategy further validated Bitcoin’s role as a store of value and successful investment instrument.

Future outlook for Bitcoin

In the short term, Bitcoin is approaching a huge milestone of reaching $100.000 which holds an incredible sentimental value within the crypto community. This corresponds to a total market capitalization of $2 trillion. However, investors should prepare for incoming volatility spikes as this threshold will trigger both stop-loss limits on short positions as well as profit taking by long term and leveraged investors. Furthermore, when looking at the relative strength index (RSI) which measures the momentum and signals whether a security is either overbought or oversold currently is at 82. Signaling that Bitcoin is currently overbought, suggesting a potential correction.

Figure 3: RSI – 14 days

Despite this, the long term looks very positive for the growth and adaptation of Bitcoin. With a continuing increase in the M3 money supply and hence more liquidity coming into the market, Bitcoin is likely to continue to grow thanks to its deflationary supply, its scarcity and a fixed supply of 21 million coins.

Bitcoin has become mainstream, and its adoption will continue to accelerate In the following years. Crypto advocates are entering the government as well as a new SEC chairperson may suggest a shift towards a more crypto-friendly regulatory environment.

2025 is close and the future for Bitcoin and the cryptocurrency industry looks promising. While it is going to be a wild ride with large corrections as well as large jumps, predictions made by analysts differ widely. Forecasts range from $120.000 to $200.000 for 2025 due to a lot of speculation on the short term. Hence, more regulation is required for BTC to truly experience mass adoption. Governments are focusing on implementing new regulations that improve the security, accessibility and transparency of Bitcoin. Ultimately, building a secure and transparent cryptocurrency market while ensuring broader accessibility for both individual investors and institutions.

I/we have a position in an asset mentioned