The Safest Utility Stocks to Invest in Q4 2022

1). American Electric Power Company Inc (AEP)

2). American Water Works Company, Inc (AWK)

3). Duke Energy Corporation (DUK)

4). Artesian Resources Corporation (ARTNA)

5). NextEra Energy (NEE)

Dishonorable Mention - Dominion Energy, Inc (D)

1). American Electric Power Company Inc (AEP)

- Standard Deviation: 1.47%

- Max Drawdown: -32.91%

- Dividend Policy: 60% to 70% Dividend Payout Ratio

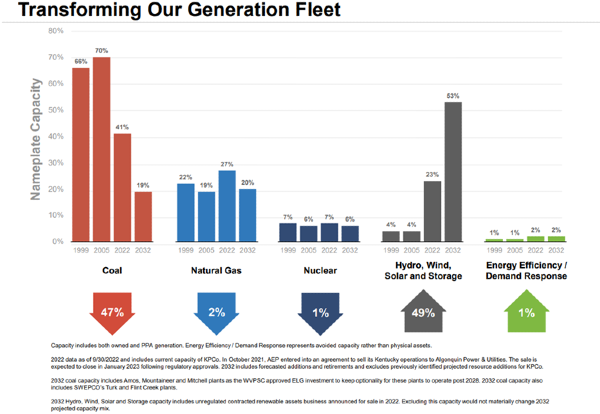

AEP is rated the best electric company stock for Q4 2022 so its no surprised it landed at the top spot of the safest utility stocks to invest in. Its low volatility and low drawdown make it a great stock to pick up if you’re an income investor. AEP has shown discipline by keeping its dividend payout ratio near 60%. This consistency has translated into 10 years of consistent dividend increases.

AEP has reduced their reliance on fossil fuels and increased their fleet of renewable energy. AEP focuses on the environmental impact of when discussing renewable energy. But this business transition, possibly, may also have the positive side effect of eliminating their exposure to the volatile energy sector.

Utilities generally pass the costs of energy to businesses and consumers. This gives them a steady rate of return regardless of the price of oil. But changing energy prices can have detrimental effects on a businesses cashflow. The utility passes the cost of energy to the customer, but this doesn’t happen immediately. The utility company has purchased the energy months ago prior to you enjoying the output of that energy.

By moving to renewables, AEP’s costs are more predictable, which gives them steady cashflow as well.

2). American Water Works Company, Inc (AWK)

- Standard Deviation: 1.65%

- Max Drawdown: -31.16%

- Dividend Policy: 55% to 60%

Oh really? Our top rated water utility stock happens to be the second safest stock as well? Really?

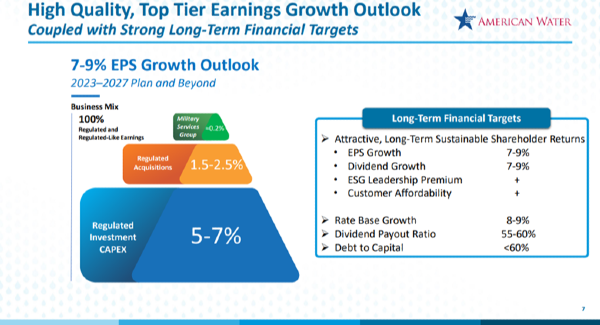

Its true, our rating system for water and electric stocks used volatility as a criteria. Volatility took up 2 of the six spots in our best of ratings system. But a well-managed utility company really translates into a safe investment. Well managed utility companies diversify their operations and set realistic dividend policies. This has allowed AWK to raise its dividend for the last 10 years without interruption.

American Water Works has also acquired Butler Area Sewer Authority (Pennsylvania), which was signed October 11, 2022

Leadership expects acquisitions will grow earnings by 1.5% to 2.5% thru 2023. Besides higher interest rates impacting their debt, they are also concerned about the growing costs of chemicals.

3). Duke Energy Corporation (DUK)

- Standard Deviation: 1.50%

- Max Drawdown: -37.37

- Dividend Policy: 65% to 75%

Duke Energy has a dividend policy that skews higher than the typical top tier utility. But Duke Energy still deserves to be on the top list of safest utility stocks. The company has reliably grown its dividend over the past decade without a single dividend cut.

Duke Energy is trying to build its renewable energy sources, but as of 2021[2], renewable energy make up 8% of their portfolio. They also have exposure to natural gas distribution thru their subsidiaries Piedmont Natural Gas and Duke Energy Ohio. Even with this high exposure to the energy markets, Duke Energy has continued to be low volatility stock with continued growth in its stock over the last 5 years.

4). Artesian Resources Corporation (ARTNA)

- Standard Deviation: 1.78%

- Max Drawdown: -26.77%

- Dividend Policy: 55%

Artesian Resources provides a stable water utility service along with a growing wastewater treatment business. The company provided 8.4 billion gallons of water in 2022 and has 73 treatment facilities. There water treatment business continues to expand as they acquired Tidewater Environmental Services in early 2022[3].

5). NextEra Energy (NEE)

- Standard Deviation: 1.67%

- Max Drawdown: -35.63%

- Dividend Policy: 60%

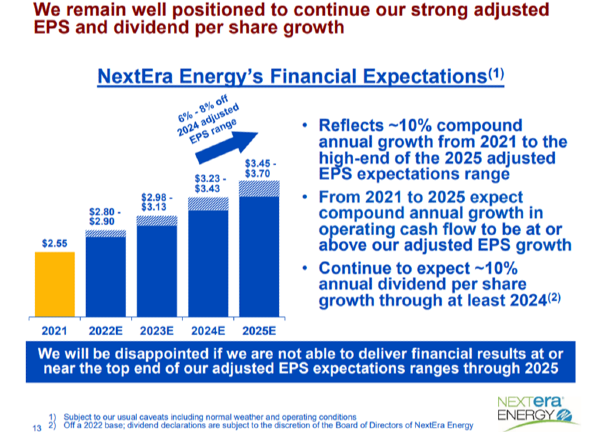

NextEra Energy provides electricity to Florida. Thanks to Florida’s continued population and economic growth, NextEra has seen a consistent growth in customers and revenue. Most of their projected EPS increase looks to be from capital reinvestment instead of acquisitions. In fact, they look quite confident in their EPS forecast growth thru 2025.

Dishonorable Mention - Dominion Energy, Inc (D)

Dominion Energy has been a “low volatility” stock over the last 5-years; however, recent turbulence forced Dominion Energy to cut its dividend in Q4 2020. Add to investor concerns over its recent price correction and Dominion Energy is just a safe investment in 2022.

One telling sign that Dominion Energy was risky is that its dividend policy is not existent. Instead, leadership had hoped to grow its dividend 6% per year[4]. Typically, leadership will tie dividend policy to a dividend ratio instead of a growth rate. Since, 2020, Dominions dividend is back to growing again, but still hasn’t reach its pre-2020 levels. To learn more about why Dominion Energy is falling see:

Are Utility Stocks Safe?

The data does not lie. The utility sector is the safest sector of all the stock sectors, but it is not a safe sector to invest in. In past 5 years, the top electric and water utility companies saw a draw down of 35% to 55%!

Let’s use an objective measure of safety and uncertainty to see if utilities really are a “safe” investment. Taking the following definitions from brokerage firm Charles Schwab[1]

A market correction is when a stock index falls more than 10% from a recent high

A bear market is when the market falls by more than 20%

By these measures, utility stocks cannot protect you from a market correction, or even a bear market. Utilities are too aligned with the broader market.

But this analysis is stuck assessing a tree when we are missing the larger forest.

The top five utility stocks have consistently increased dividends for at least the last decade. Some of these companies have been increasing their dividends for 25 years, while others have increased their dividends for 100 years!

These utilities have a conservative dividend policy. This policy mean that earnings have continued increasing, which means the utility’s stock price must have increased.

The takeaway is that a utility stock is a safe investment in the long term but it will not protect you from short-term market risks.

Why are Utilities a Safe Investment?

Most utilities are a safe investment in the long-term. The key reasons come down to:

- Off-loading energy price risk to the consumer

- Diversifying into renewable energy

- Having a monopoly or oligopoly

- High capital expenditures create large moats

- Need for credit forces consistent business practices

How we Define “Safest” Investment?

Drawdown

Drawdown is the worse-case loss a stock fell during a given time interval. It’s the difference from a local high price all the way down to a local low price. This metric matters to long term investors because this worse-case scenario will be felt by the investor as they hold through this drawdown. Large drawdowns occur due to leadership mismanagement (missing earnings or unprepared for future risks) or over speculation. For utilities, speculation should not be a factor as leadership should be giving clear guidance on its business. Results should be very close to leadership forecasts due to the stability of the utility sector.

Still, utilities are not immune to market corrections. When the overall market falls, this can drag the utility sector down regardless of company’s prospects.

Volatility

We measure the volatility of a stock by taking the standard deviation of the stock’s daily price movements. This calculation is best known for being the denominator of the Sharpe ratio. In this case, we are more interested in the safety of a stock. Because performance isn’t a major factor in the safety of an investment, we didn’t use the Sharpe ratio and instead used the standard deviation.

Dividend Cuts

If a utility cuts its dividend, its management was either unprepared for business turbulence, or they are simply mismanaging the company. A board of directors will typically avoid cutting dividends, even if leadership has found a growth opportunity to fund. Utilities are slow moving businesses, so the company shouldn’t need to slash dividends so suddenly for business opportunities. Typically, dividend cuts are a sign of business problems and a sign that the utility stock is unsafe.

Dividend Policy

We’ve seen in our article, What are the Dividend Policies of the Top Utility Stocks that the top utility companies have a declared dividend policy somewhere in their investor relations media. This policy is based on a payout ratio of dividends as a percentage of earnings. And this payout ratio is 60% to 65% for the best utility stocks.

It's no surprise that the top stocks have a disciplined approach to deciding their dividend. Setting a balanced target that benefits both investors and the business helps set expectations for both stakeholders. Always be sure to research the dividend policy for your utility stock. It is an important check market when deciding on investing in a utility stock.

The Bottom Line

- Utility stocks have had significant drawdowns of 35% to 55% in the last five years. Utility stocks are not guaranteed safe investments in the short term.

- Utility stocks, especially the safe ones on this list, have stable long-term growth and are safe long-term investments, if you do the proper research and choose the right utility stocks

- Utilities are large moat monopolies or oligopolies that pass the risk of energy prices to their customers. This is why they are safe long-term investments.

References

1). https://www.schwab.com/learn/story/market-correction-what-does-it-mean

2). Duke Energy 2021 Annual Report

3). ARTESIAN WASTEWATER MANAGEMENT, INC. ANNOUNCES CLOSING ON ITS ACQUISITION OF TIDEWATER ENVIRONMENTAL SERVICES, INC.

4). Dominion Energy Annual Meeting May 2022

The Safest Utility Stocks to Invest in Q4 2022

1). American Electric Power Company Inc (AEP)

2). American Water Works Company, Inc (AWK)

3). Duke Energy Corporation (DUK)

4). Artesian Resources Corporation (ARTNA)

5). NextEra Energy (NEE)

Dishonorable Mention - Dominion Energy, Inc (D)

1). American Electric Power Company Inc (AEP)

AEP is rated the best electric company stock for Q4 2022 so its no surprised it landed at the top spot of the safest utility stocks to invest in. Its low volatility and low drawdown make it a great stock to pick up if you’re an income investor. AEP has shown discipline by keeping its dividend payout ratio near 60%. This consistency has translated into 10 years of consistent dividend increases.

Source: AEP 2022 Factbook

AEP has reduced their reliance on fossil fuels and increased their fleet of renewable energy. AEP focuses on the environmental impact of when discussing renewable energy. But this business transition, possibly, may also have the positive side effect of eliminating their exposure to the volatile energy sector.

Utilities generally pass the costs of energy to businesses and consumers. This gives them a steady rate of return regardless of the price of oil. But changing energy prices can have detrimental effects on a businesses cashflow. The utility passes the cost of energy to the customer, but this doesn’t happen immediately. The utility company has purchased the energy months ago prior to you enjoying the output of that energy.

By moving to renewables, AEP’s costs are more predictable, which gives them steady cashflow as well.

Source: American Water Works Q3 2022 Presentation

2). American Water Works Company, Inc (AWK)

Oh really? Our top rated water utility stock happens to be the second safest stock as well? Really? Its true, our rating system for water and electric stocks used volatility as a criteria. Volatility took up 2 of the six spots in our best of ratings system. But a well-managed utility company really translates into a safe investment. Well managed utility companies diversify their operations and set realistic dividend policies. This has allowed AWK to raise its dividend for the last 10 years without interruption. American Water Works has also acquired Butler Area Sewer Authority (Pennsylvania), which was signed October 11, 2022

Leadership expects acquisitions will grow earnings by 1.5% to 2.5% thru 2023. Besides higher interest rates impacting their debt, they are also concerned about the growing costs of chemicals.

Source: news.duke-energy.com

3). Duke Energy Corporation (DUK)

Duke Energy has a dividend policy that skews higher than the typical top tier utility. But Duke Energy still deserves to be on the top list of safest utility stocks. The company has reliably grown its dividend over the past decade without a single dividend cut.

Duke Energy is trying to build its renewable energy sources, but as of 2021[2], renewable energy make up 8% of their portfolio. They also have exposure to natural gas distribution thru their subsidiaries Piedmont Natural Gas and Duke Energy Ohio. Even with this high exposure to the energy markets, Duke Energy has continued to be low volatility stock with continued growth in its stock over the last 5 years.

4). Artesian Resources Corporation (ARTNA)

Artesian Resources provides a stable water utility service along with a growing wastewater treatment business. The company provided 8.4 billion gallons of water in 2022 and has 73 treatment facilities. There water treatment business continues to expand as they acquired Tidewater Environmental Services in early 2022[3].

5). NextEra Energy (NEE)

NextEra Energy provides electricity to Florida. Thanks to Florida’s continued population and economic growth, NextEra has seen a consistent growth in customers and revenue. Most of their projected EPS increase looks to be from capital reinvestment instead of acquisitions. In fact, they look quite confident in their EPS forecast growth thru 2025.

Source: NextEra Investor Relations

Dishonorable Mention - Dominion Energy, Inc (D)

Dominion Energy has been a “low volatility” stock over the last 5-years; however, recent turbulence forced Dominion Energy to cut its dividend in Q4 2020. Add to investor concerns over its recent price correction and Dominion Energy is just a safe investment in 2022. One telling sign that Dominion Energy was risky is that its dividend policy is not existent. Instead, leadership had hoped to grow its dividend 6% per year[4]. Typically, leadership will tie dividend policy to a dividend ratio instead of a growth rate. Since, 2020, Dominions dividend is back to growing again, but still hasn’t reach its pre-2020 levels. To learn more about why Dominion Energy is falling see:

Are Utility Stocks Safe?

The data does not lie. The utility sector is the safest sector of all the stock sectors, but it is not a safe sector to invest in. In past 5 years, the top electric and water utility companies saw a draw down of 35% to 55%!

Let’s use an objective measure of safety and uncertainty to see if utilities really are a “safe” investment. Taking the following definitions from brokerage firm Charles Schwab[1]

By these measures, utility stocks cannot protect you from a market correction, or even a bear market. Utilities are too aligned with the broader market.

But this analysis is stuck assessing a tree when we are missing the larger forest. The top five utility stocks have consistently increased dividends for at least the last decade. Some of these companies have been increasing their dividends for 25 years, while others have increased their dividends for 100 years!

These utilities have a conservative dividend policy. This policy mean that earnings have continued increasing, which means the utility’s stock price must have increased. The takeaway is that a utility stock is a safe investment in the long term but it will not protect you from short-term market risks.

Why are Utilities a Safe Investment?

Most utilities are a safe investment in the long-term. The key reasons come down to:

How we Define “Safest” Investment?

Drawdown

Drawdown is the worse-case loss a stock fell during a given time interval. It’s the difference from a local high price all the way down to a local low price. This metric matters to long term investors because this worse-case scenario will be felt by the investor as they hold through this drawdown. Large drawdowns occur due to leadership mismanagement (missing earnings or unprepared for future risks) or over speculation. For utilities, speculation should not be a factor as leadership should be giving clear guidance on its business. Results should be very close to leadership forecasts due to the stability of the utility sector. Still, utilities are not immune to market corrections. When the overall market falls, this can drag the utility sector down regardless of company’s prospects.

Volatility

We measure the volatility of a stock by taking the standard deviation of the stock’s daily price movements. This calculation is best known for being the denominator of the Sharpe ratio. In this case, we are more interested in the safety of a stock. Because performance isn’t a major factor in the safety of an investment, we didn’t use the Sharpe ratio and instead used the standard deviation.

Dividend Cuts

If a utility cuts its dividend, its management was either unprepared for business turbulence, or they are simply mismanaging the company. A board of directors will typically avoid cutting dividends, even if leadership has found a growth opportunity to fund. Utilities are slow moving businesses, so the company shouldn’t need to slash dividends so suddenly for business opportunities. Typically, dividend cuts are a sign of business problems and a sign that the utility stock is unsafe.

Dividend Policy

We’ve seen in our article, What are the Dividend Policies of the Top Utility Stocks that the top utility companies have a declared dividend policy somewhere in their investor relations media. This policy is based on a payout ratio of dividends as a percentage of earnings. And this payout ratio is 60% to 65% for the best utility stocks.

It's no surprise that the top stocks have a disciplined approach to deciding their dividend. Setting a balanced target that benefits both investors and the business helps set expectations for both stakeholders. Always be sure to research the dividend policy for your utility stock. It is an important check market when deciding on investing in a utility stock.

The Bottom Line

References

1). https://www.schwab.com/learn/story/market-correction-what-does-it-mean

2). Duke Energy 2021 Annual Report

3). ARTESIAN WASTEWATER MANAGEMENT, INC. ANNOUNCES CLOSING ON ITS ACQUISITION OF TIDEWATER ENVIRONMENTAL SERVICES, INC.

4). Dominion Energy Annual Meeting May 2022