Is Amazon Stock a Buy?

Amazon’s Business Strengths

Amazon is one of the largest companies in the world. In fact, in terms of market cap, they are the 5th largest company in the world. This, along with how often we see their products and how popular their services have become, has made Amazon an extremely popular option for investors. But how did Amazon become such a large company?

After launching Amazon Prime in 2005, Amazon became one of the most popular shopping services on earth. By offering expedited shipping on nearly anything and their subscription model, the total revenue from Prime has steadily increased. In 2021 alone Amazon saw $31.77 billion in net sales from prime alone, and are projecting to have over 168 million subscribers by 2025.

Amazon continues to search for new ways to improve the customer experience, and that doesn't just mean streamlining the shopping experience. Launching products such as the Amazon Kindle, Echo, and Prime were all risky, but they paid off. Not every venture has paid off for Amazon, notably their cloud computing endeavors, but they have had a record of taking risks to continue improving the experiences of their customers, and that is why so many people keep coming back and shopping with Amazon.

Stock Performance and Outlook

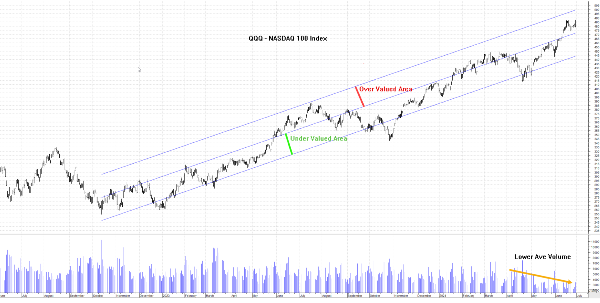

Amazon is currently trading at $183.13 per share. This is higher than it has been at almost any time in the company’s history, barring the one time it hit $201.20 in early July 2024. This continues a trend of upward growth for Amazon that has been incredible over the past five years. Since 2019, Amazon stock has increased by over 100%, with much of that growth starting in early 2020. The Covid-19 pandemic sparked incredible growth for Amazon for much of 2020, then remaining steady until taking a sharp decline in 2022. But since that dip, it has been continuous growth, hitting their all-time high just a few weeks ago.

This consistent growth is attractive, despite Amazon not offering a dividend. GuruFocus uses a formula to determine the intrinsic value of a stock based on their free-cash-flow. The GuruFocus FCF formula places Amazon’s intrinsic value at $35.89, which falls quite a lot below the current trading price of $183.13. This puts the stock value slightly overvalued compared to other retail companies, but Amazon is a unique situation.

Despite continuing to raise their own bar for performance, Amazon was able to match and even exceed their own projections for Q1 2024. Earnings per share for the quarter ending in March showed year-over-year growth of 216%. This continuous improvement is why so many continue to look to Amazon, even when the rest of the market may be struggling.

Amazon’s stock performance has been buoyed by the strong revenue performance of Amazon Web Services. AWS increased its revenue by 13.3% in 2023, to $90.76 billion. This represents 17% of Amazon’s revenue, and 62% of their operating income. If AWS continues its growth trajectory, this can help Amazon’s stock, even in times where the retail side of the company struggles. This is why USA Today has set a one-year price target of $221.78. This still represents a decent buying opportunity, especially if there is any decrease from the current trading price.

Supporting Data and Statistics

Amazon’s stock performance and future performance does depend on the continued success of Amazon Web Services, but strong earnings have helped maintain the growth trajectory in recent months. Q1 sales increased by 13% to $143.3 billion. This is just the beginning in terms of impressive Q1 numbers, which also included $9.4 billion in operating income from AWS, an increase from $5.1 billion in 2023, as well as net income increasing to $10.4 billion versus $3.2 billion the year prior.

In terms of customer impact, Amazon has increased the number of deliveries in one to two days to all-time highs, increasing customer satisfaction and continuing to drive further sales. This equaled to 2 billion deliveries either same-day or next day. In the largest markets, this was as high as 60% of prime member orders.

Conclusions

The combination of increasing delivery consistency, improved revenue growth, especially from AWS, and increased order volume lead me to believe that Amazon is not in danger of slowing down. Many have been indicating that Amazon continues to be a buy, and I would agree. The impact of AWS on Amazon’s stock price is important as that sector expands, but the overall consistency of Amazon’s sales revenue also leads me to believe this stock warrants consideration as a buy.

Is Amazon Stock a Buy?

Amazon’s Business Strengths

Amazon is one of the largest companies in the world. In fact, in terms of market cap, they are the 5th largest company in the world. This, along with how often we see their products and how popular their services have become, has made Amazon an extremely popular option for investors. But how did Amazon become such a large company?

After launching Amazon Prime in 2005, Amazon became one of the most popular shopping services on earth. By offering expedited shipping on nearly anything and their subscription model, the total revenue from Prime has steadily increased. In 2021 alone Amazon saw $31.77 billion in net sales from prime alone, and are projecting to have over 168 million subscribers by 2025.

Amazon continues to search for new ways to improve the customer experience, and that doesn't just mean streamlining the shopping experience. Launching products such as the Amazon Kindle, Echo, and Prime were all risky, but they paid off. Not every venture has paid off for Amazon, notably their cloud computing endeavors, but they have had a record of taking risks to continue improving the experiences of their customers, and that is why so many people keep coming back and shopping with Amazon.

Stock Performance and Outlook

Amazon is currently trading at $183.13 per share. This is higher than it has been at almost any time in the company’s history, barring the one time it hit $201.20 in early July 2024. This continues a trend of upward growth for Amazon that has been incredible over the past five years. Since 2019, Amazon stock has increased by over 100%, with much of that growth starting in early 2020. The Covid-19 pandemic sparked incredible growth for Amazon for much of 2020, then remaining steady until taking a sharp decline in 2022. But since that dip, it has been continuous growth, hitting their all-time high just a few weeks ago.

This consistent growth is attractive, despite Amazon not offering a dividend. GuruFocus uses a formula to determine the intrinsic value of a stock based on their free-cash-flow. The GuruFocus FCF formula places Amazon’s intrinsic value at $35.89, which falls quite a lot below the current trading price of $183.13. This puts the stock value slightly overvalued compared to other retail companies, but Amazon is a unique situation.

Despite continuing to raise their own bar for performance, Amazon was able to match and even exceed their own projections for Q1 2024. Earnings per share for the quarter ending in March showed year-over-year growth of 216%. This continuous improvement is why so many continue to look to Amazon, even when the rest of the market may be struggling.

Amazon’s stock performance has been buoyed by the strong revenue performance of Amazon Web Services. AWS increased its revenue by 13.3% in 2023, to $90.76 billion. This represents 17% of Amazon’s revenue, and 62% of their operating income. If AWS continues its growth trajectory, this can help Amazon’s stock, even in times where the retail side of the company struggles. This is why USA Today has set a one-year price target of $221.78. This still represents a decent buying opportunity, especially if there is any decrease from the current trading price.

Supporting Data and Statistics

Amazon’s stock performance and future performance does depend on the continued success of Amazon Web Services, but strong earnings have helped maintain the growth trajectory in recent months. Q1 sales increased by 13% to $143.3 billion. This is just the beginning in terms of impressive Q1 numbers, which also included $9.4 billion in operating income from AWS, an increase from $5.1 billion in 2023, as well as net income increasing to $10.4 billion versus $3.2 billion the year prior.

In terms of customer impact, Amazon has increased the number of deliveries in one to two days to all-time highs, increasing customer satisfaction and continuing to drive further sales. This equaled to 2 billion deliveries either same-day or next day. In the largest markets, this was as high as 60% of prime member orders.

Conclusions

The combination of increasing delivery consistency, improved revenue growth, especially from AWS, and increased order volume lead me to believe that Amazon is not in danger of slowing down. Many have been indicating that Amazon continues to be a buy, and I would agree. The impact of AWS on Amazon’s stock price is important as that sector expands, but the overall consistency of Amazon’s sales revenue also leads me to believe this stock warrants consideration as a buy.