What is the world's largest consumer of raw materials?

The construction industry is the world’s largest consumer of raw materials in the sector, accounting for a significant portion of global resource use. This sector’s vast appetite for materials includes steel, concrete, wood, and various other building products. Each year, the construction industry consumes about 50% of global steel production and uses approximately 3 billion metric tons of raw materials to manufacture building products. This massive consumption is driven by the continuous growth of urban areas and infrastructure development worldwide.

In addition to its substantial material consumption, the construction industry also contributes significantly to global carbon emissions, responsible for 25-40% of total emissions. The industry’s environmental impact is further exacerbated by the fact that a large portion of construction and demolition waste is not recycled or reused. As urban populations continue to grow, the demand for construction materials is expected to rise, making it crucial for the industry to adopt more sustainable practices and embrace the principles of the circular economy to mitigate its environmental footprint.

What is the most consumed raw material?

The most consumed raw material in the world is sand and gravel. These materials are essential components for the construction industry, used in the production of concrete, roads, and buildings. In fact, the global consumption of sand and gravel is so high that it surpasses the use of any other raw material, except for water. The demand for these materials has been driven by rapid urbanization and infrastructure development, making them the backbone of modern construction.

Sand and gravel are not only crucial for construction but also play a significant role in other industries. They are used in the production of glass, electronics, and even in the extraction of oil and gas through hydraulic fracturing. The extensive use of these materials has raised concerns about their sustainability and environmental impact, as excessive extraction can lead to habitat destruction and depletion of natural resources. As the world continues to develop, finding sustainable alternatives and efficient ways to use these materials will be essential for future growth.

What raw materials are most in demand?

In 2024, the demand for raw materials is being driven by several key factors, including the transition to renewable energy and the growth of electric transportation. Metals such as lithium, cobalt, and nickel are in high demand due to their essential role in battery production for electric vehicles and energy storage systems. Additionally, the construction industry continues to see strong demand for materials like steel and aluminum, driven by ongoing infrastructure projects and urbanization efforts.

Another significant trend is the increasing demand for sustainable materials. The packaging industry, for example, is experiencing a surge in the use of paper packaging and softwood pulp as companies seek eco-friendly alternatives to plastic. Similarly, the demand for biofuels and feedstocks is rising as industries aim to reduce their carbon footprint. These trends highlight the growing importance of sustainability in driving raw material demand across various sectors.

Top Construction Materials Producers

The construction materials market is a global industry that provides essential materials for building and construction projects. This market includes a wide range of materials, such as cement, steel, wood, and glass. These materials are crucial for the development of residential, commercial, and industrial structures, making them indispensable to the construction sector.

The construction materials market is driven by the demand for new buildings, infrastructure, and renovation projects. As urbanization and population growth continue, the need for sustainable and efficient construction materials increases. This demand fuels innovation and competition within the industry, leading to the development of advanced materials that enhance the durability and sustainability of construction projects.

Market Size and Growth of Construction Materials

Image by bridgesward from Pixabay

The global construction materials market, valued at over $1 trillion in 2023, is a significant sector within the global economy. This market encompasses a wide range of materials, including cement, steel, glass, and wood, which are essential for various construction projects. The demand for these materials is driven by urbanization, infrastructure development, and the growing need for residential and commercial buildings. As countries continue to invest in infrastructure and housing, the construction materials market is poised for substantial growth.

From 2023 to 2028, the construction materials market is expected to grow at a compound annual growth rate (CAGR) of 5%. This growth is attributed to several factors, including technological advancements, sustainable construction practices, and increased government spending on infrastructure projects.

Top Manufacturers of Construction Materials

The top manufacturers of construction materials are pivotal players in the global construction industry, producing and supplying a diverse range of materials essential for building projects. Companies like Saint-Gobain, LafargeHolcim, and CRH plc are leaders in their respective product categories, offering materials such as cement, glass, and aggregates. These companies have established significant market shares through innovation, sustainability, and a commitment to quality, making them indispensable to the construction sector.

Saint-Gobain, for instance, is renowned for its extensive range of building materials, including glass and ceramics, while LafargeHolcim specializes in cement and concrete solutions. CRH plc, another major player, provides a wide array of construction materials, including precast concrete products. These companies’ leadership and market dominance are driven by their ability to adapt to evolving industry demands and their focus on sustainable development, ensuring they remain at the forefront of the construction materials market.

Largest Manufacturing Companies

ArcelorMittal (MT) is a global leader in steel production and mining, headquartered in Luxembourg. Formed in 2006 through the merger of Arcelor and Mittal Steel, it is the world’s second-largest steel producer, with an annual crude steel production of 78 million metric tons as of 2022. The company operates in over 60 countries and employs around 154,000 people.

Saint-Gobain (SGO.PA), founded in 1665, is a French multinational corporation specializing in the design, manufacture, and distribution of materials and solutions for the construction and industrial markets. With a presence in 76 countries and over 160,000 employees, Saint-Gobain is dedicated to sustainable construction and innovation. The company’s products are integral to buildings, transportation, infrastructure, and industrial applications, providing comfort, performance, and sustainability. Saint-Gobain aims to achieve net-zero carbon emissions by 2050, reflecting its commitment to environmental responsibility.

China National Building Material Group (CNBM), established in 1985, is the largest manufacturer of building materials in China and a leading integrated service provider globally. Headquartered in Beijing, CNBM operates through various segments, including cement, concrete, lightweight building materials, and glass fiber. The company has been listed in the Fortune Global 500 for eleven consecutive years, highlighting its significant impact on the global construction industry. CNBM’s comprehensive approach integrates scientific research, manufacturing, and logistics to deliver high-quality building materials and services.

Holcim (HOLN.SW), formerly known as LafargeHolcim, is a Swiss multinational company specializing in building materials and solutions. With a presence in around 60 countries and approximately 60,000 employees, Holcim is a global leader in cement, aggregates, ready-mix concrete, and other building materials. The company is committed to sustainability and innovation, focusing on developing solutions to decarbonize the building sector and promote circular cities. Holcim’s vision is to lead the transition to sustainable building, driven by its Strategy 2025 – Accelerating Green Growth.

Heidelberg Materials (HEI.DE), formerly HeidelbergCement, is one of the world’s largest integrated manufacturers of building materials, with leading market positions in cement, aggregates, and ready-mixed concrete. Headquartered in Germany, the company operates in over 50 countries with more than 51,000 employees. Heidelberg Materials is dedicated to sustainability and innovation, aiming to achieve carbon neutrality and promote a circular economy in the building materials industry. [The company’s products and services are essential for constructing houses, infrastructure, and commercial facilities.

Key Statistics about Construction Materials

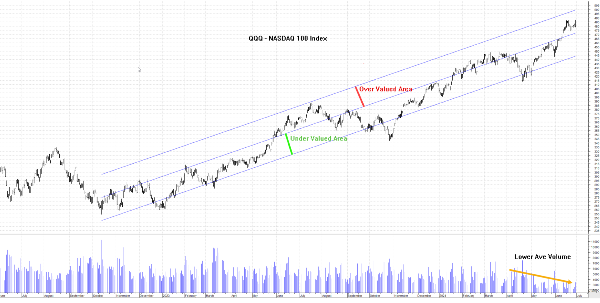

The global construction materials market is projected to reach a staggering $1.5 trillion by 2028, driven by a steady compound annual growth rate (CAGR) of 5% from 2023 to 2028. This growth is fueled by increasing urbanization, infrastructure development, and the rising demand for sustainable and innovative building materials. The market’s expansion is also supported by advancements in technology and the adoption of eco-friendly construction practices, which are becoming increasingly important to the industry.

Asia-Pacific stands out as the largest market for construction materials, contributing over 40% of the global sales value. This region’s dominance is attributed to rapid industrialization, urban growth, and significant investments in infrastructure projects. Countries like China and India are leading the charge, with substantial government initiatives aimed at modernizing infrastructure and promoting sustainable construction. As a result, the Asia-Pacific market is expected to continue its strong performance, driving the overall growth of the global construction materials market.

Global Iron Ore Mining

Iron ore, the second largest produced raw material after sand and gravel, is a cornerstone of the global economy due to its critical role in steel production. The global iron ore market is dominated by a select group of industry leaders who ensure a steady supply to meet the ever-growing demand. As the demand for steel continues to rise, driven by infrastructure development and industrial growth, the importance of reliable iron ore suppliers becomes increasingly evident.

These companies play a crucial role in maintaining the balance between supply and demand, ensuring the stability of the global economy. Their ability to provide consistent, high-quality iron ore is essential to produce steel, which in turn supports various industries worldwide. As a result, the global iron ore market remains a vital component of the material sector, with significant implications for economic growth and development.

Top Iron Ore Producing Companies

In 2024, the top five iron ore producing companies are Vale, Rio Tinto, BHP, Fortescue Metals Group, and Anglo American. These companies continue to dominate the global iron ore market, supplying the essential raw material for steel production. Their operations span across multiple continents, ensuring a steady and reliable supply of iron ore to meet the ever-growing global demand. Despite facing challenges such as fluctuating market prices and environmental concerns, these companies have maintained robust production levels, showcasing their resilience and operational efficiency.

Vale, a Brazilian mining giant, is expected to produce between 310 and 320 million tons of iron ore in 2024. Rio Tinto, an Anglo-Australian multinational, aims to ship between 323 and 338 million tons of iron ore from its Pilbara operations. BHP, another major player, reported a record iron ore production of 260 million tons for the fiscal year 2024. Fortescue Metals Group, an Australian company, shipped 191.6 million tons of iron ore in fiscal 2024. Anglo American, a British multinational, is projected to produce between 58 and 62 million tons of iron ore in 2024.

Outlook for the iron ore market in 2024

The global iron ore market is poised for growth in 2024, primarily fueled by the rising demand from the steel industry. As infrastructure projects and industrial activities expand, the need for steel—and consequently iron ore—will surge. This growth is further supported by the increasing adoption of iron ore in the green economy, where it plays a vital role in the production of eco-friendly steel. Companies that supply iron ore are strategically positioned to benefit from this upward trend, making them key players in meeting the escalating demand.

In addition to traditional uses, iron ore’s role in sustainable development is gaining prominence. The shift towards greener technologies and renewable energy sources is driving the demand for high-quality iron ore, essential for producing low-emission steel. This transition not only supports environmental goals but also opens new avenues for investment in the iron ore sector. As a result, companies involved in iron ore extraction and supply are expected to see significant opportunities for growth and profitability in the coming years.

Final Thoughts

The construction industry stands as the world’s largest consumer of raw materials, driven by the continuous growth of urban areas and infrastructure development. This sector’s vast appetite for materials includes steel, concrete, wood, and various other building products, consuming about 50% of global steel production annually.

Gravel, sand, and steel make up the bulk of the raw materials used for construction. Various conglomerates across the world dominate the raw materials construction market.

The top iron ore producing companies—Vale, Rio Tinto, BHP, Fortescue Metals Group, and Anglo American—continue to lead the global market with their extensive operations and robust production levels. Despite facing market fluctuations and environmental challenges, these companies have demonstrated resilience and efficiency. The outlook for the iron ore market in 2024 is promising, driven by the rising demand from the steel industry and the growing emphasis on sustainable development. As the world shifts towards greener technologies, the demand for high-quality iron ore will increase, presenting significant growth and investment opportunities for these key players in the industry.

Cover Image by Pexels from Pixabay

What is the world's largest consumer of raw materials?

The construction industry is the world’s largest consumer of raw materials in the sector, accounting for a significant portion of global resource use. This sector’s vast appetite for materials includes steel, concrete, wood, and various other building products. Each year, the construction industry consumes about 50% of global steel production and uses approximately 3 billion metric tons of raw materials to manufacture building products. This massive consumption is driven by the continuous growth of urban areas and infrastructure development worldwide.

In addition to its substantial material consumption, the construction industry also contributes significantly to global carbon emissions, responsible for 25-40% of total emissions. The industry’s environmental impact is further exacerbated by the fact that a large portion of construction and demolition waste is not recycled or reused. As urban populations continue to grow, the demand for construction materials is expected to rise, making it crucial for the industry to adopt more sustainable practices and embrace the principles of the circular economy to mitigate its environmental footprint.

What is the most consumed raw material?

The most consumed raw material in the world is sand and gravel. These materials are essential components for the construction industry, used in the production of concrete, roads, and buildings. In fact, the global consumption of sand and gravel is so high that it surpasses the use of any other raw material, except for water. The demand for these materials has been driven by rapid urbanization and infrastructure development, making them the backbone of modern construction.

Sand and gravel are not only crucial for construction but also play a significant role in other industries. They are used in the production of glass, electronics, and even in the extraction of oil and gas through hydraulic fracturing. The extensive use of these materials has raised concerns about their sustainability and environmental impact, as excessive extraction can lead to habitat destruction and depletion of natural resources. As the world continues to develop, finding sustainable alternatives and efficient ways to use these materials will be essential for future growth.

What raw materials are most in demand?

In 2024, the demand for raw materials is being driven by several key factors, including the transition to renewable energy and the growth of electric transportation. Metals such as lithium, cobalt, and nickel are in high demand due to their essential role in battery production for electric vehicles and energy storage systems. Additionally, the construction industry continues to see strong demand for materials like steel and aluminum, driven by ongoing infrastructure projects and urbanization efforts.

Another significant trend is the increasing demand for sustainable materials. The packaging industry, for example, is experiencing a surge in the use of paper packaging and softwood pulp as companies seek eco-friendly alternatives to plastic. Similarly, the demand for biofuels and feedstocks is rising as industries aim to reduce their carbon footprint. These trends highlight the growing importance of sustainability in driving raw material demand across various sectors.

Top Construction Materials Producers

The construction materials market is a global industry that provides essential materials for building and construction projects. This market includes a wide range of materials, such as cement, steel, wood, and glass. These materials are crucial for the development of residential, commercial, and industrial structures, making them indispensable to the construction sector. The construction materials market is driven by the demand for new buildings, infrastructure, and renovation projects. As urbanization and population growth continue, the need for sustainable and efficient construction materials increases. This demand fuels innovation and competition within the industry, leading to the development of advanced materials that enhance the durability and sustainability of construction projects.

Market Size and Growth of Construction Materials

Image by bridgesward from Pixabay The global construction materials market, valued at over $1 trillion in 2023, is a significant sector within the global economy. This market encompasses a wide range of materials, including cement, steel, glass, and wood, which are essential for various construction projects. The demand for these materials is driven by urbanization, infrastructure development, and the growing need for residential and commercial buildings. As countries continue to invest in infrastructure and housing, the construction materials market is poised for substantial growth. From 2023 to 2028, the construction materials market is expected to grow at a compound annual growth rate (CAGR) of 5%. This growth is attributed to several factors, including technological advancements, sustainable construction practices, and increased government spending on infrastructure projects.

Top Manufacturers of Construction Materials

3-D printing of houses, Saint-Gobain

The top manufacturers of construction materials are pivotal players in the global construction industry, producing and supplying a diverse range of materials essential for building projects. Companies like Saint-Gobain, LafargeHolcim, and CRH plc are leaders in their respective product categories, offering materials such as cement, glass, and aggregates. These companies have established significant market shares through innovation, sustainability, and a commitment to quality, making them indispensable to the construction sector. Saint-Gobain, for instance, is renowned for its extensive range of building materials, including glass and ceramics, while LafargeHolcim specializes in cement and concrete solutions. CRH plc, another major player, provides a wide array of construction materials, including precast concrete products. These companies’ leadership and market dominance are driven by their ability to adapt to evolving industry demands and their focus on sustainable development, ensuring they remain at the forefront of the construction materials market.

Largest Manufacturing Companies

ArcelorMittal (MT) is a global leader in steel production and mining, headquartered in Luxembourg. Formed in 2006 through the merger of Arcelor and Mittal Steel, it is the world’s second-largest steel producer, with an annual crude steel production of 78 million metric tons as of 2022. The company operates in over 60 countries and employs around 154,000 people.

Saint-Gobain (SGO.PA), founded in 1665, is a French multinational corporation specializing in the design, manufacture, and distribution of materials and solutions for the construction and industrial markets. With a presence in 76 countries and over 160,000 employees, Saint-Gobain is dedicated to sustainable construction and innovation. The company’s products are integral to buildings, transportation, infrastructure, and industrial applications, providing comfort, performance, and sustainability. Saint-Gobain aims to achieve net-zero carbon emissions by 2050, reflecting its commitment to environmental responsibility.

China National Building Material Group (CNBM), established in 1985, is the largest manufacturer of building materials in China and a leading integrated service provider globally. Headquartered in Beijing, CNBM operates through various segments, including cement, concrete, lightweight building materials, and glass fiber. The company has been listed in the Fortune Global 500 for eleven consecutive years, highlighting its significant impact on the global construction industry. CNBM’s comprehensive approach integrates scientific research, manufacturing, and logistics to deliver high-quality building materials and services.

Holcim (HOLN.SW), formerly known as LafargeHolcim, is a Swiss multinational company specializing in building materials and solutions. With a presence in around 60 countries and approximately 60,000 employees, Holcim is a global leader in cement, aggregates, ready-mix concrete, and other building materials. The company is committed to sustainability and innovation, focusing on developing solutions to decarbonize the building sector and promote circular cities. Holcim’s vision is to lead the transition to sustainable building, driven by its Strategy 2025 – Accelerating Green Growth.

Heidelberg Materials (HEI.DE), formerly HeidelbergCement, is one of the world’s largest integrated manufacturers of building materials, with leading market positions in cement, aggregates, and ready-mixed concrete. Headquartered in Germany, the company operates in over 50 countries with more than 51,000 employees. Heidelberg Materials is dedicated to sustainability and innovation, aiming to achieve carbon neutrality and promote a circular economy in the building materials industry. [The company’s products and services are essential for constructing houses, infrastructure, and commercial facilities.

Key Statistics about Construction Materials

Image by Anna from Pixabay

The global construction materials market is projected to reach a staggering $1.5 trillion by 2028, driven by a steady compound annual growth rate (CAGR) of 5% from 2023 to 2028. This growth is fueled by increasing urbanization, infrastructure development, and the rising demand for sustainable and innovative building materials. The market’s expansion is also supported by advancements in technology and the adoption of eco-friendly construction practices, which are becoming increasingly important to the industry. Asia-Pacific stands out as the largest market for construction materials, contributing over 40% of the global sales value. This region’s dominance is attributed to rapid industrialization, urban growth, and significant investments in infrastructure projects. Countries like China and India are leading the charge, with substantial government initiatives aimed at modernizing infrastructure and promoting sustainable construction. As a result, the Asia-Pacific market is expected to continue its strong performance, driving the overall growth of the global construction materials market.

Global Iron Ore Mining

Image by lin2015 from Pixabay

Iron ore, the second largest produced raw material after sand and gravel, is a cornerstone of the global economy due to its critical role in steel production. The global iron ore market is dominated by a select group of industry leaders who ensure a steady supply to meet the ever-growing demand. As the demand for steel continues to rise, driven by infrastructure development and industrial growth, the importance of reliable iron ore suppliers becomes increasingly evident. These companies play a crucial role in maintaining the balance between supply and demand, ensuring the stability of the global economy. Their ability to provide consistent, high-quality iron ore is essential to produce steel, which in turn supports various industries worldwide. As a result, the global iron ore market remains a vital component of the material sector, with significant implications for economic growth and development.

Top Iron Ore Producing Companies

In 2024, the top five iron ore producing companies are Vale, Rio Tinto, BHP, Fortescue Metals Group, and Anglo American. These companies continue to dominate the global iron ore market, supplying the essential raw material for steel production. Their operations span across multiple continents, ensuring a steady and reliable supply of iron ore to meet the ever-growing global demand. Despite facing challenges such as fluctuating market prices and environmental concerns, these companies have maintained robust production levels, showcasing their resilience and operational efficiency.

Vale, a Brazilian mining giant, is expected to produce between 310 and 320 million tons of iron ore in 2024. Rio Tinto, an Anglo-Australian multinational, aims to ship between 323 and 338 million tons of iron ore from its Pilbara operations. BHP, another major player, reported a record iron ore production of 260 million tons for the fiscal year 2024. Fortescue Metals Group, an Australian company, shipped 191.6 million tons of iron ore in fiscal 2024. Anglo American, a British multinational, is projected to produce between 58 and 62 million tons of iron ore in 2024.

Outlook for the iron ore market in 2024

Image by Bakhrom Tursunov from Pixabay

The global iron ore market is poised for growth in 2024, primarily fueled by the rising demand from the steel industry. As infrastructure projects and industrial activities expand, the need for steel—and consequently iron ore—will surge. This growth is further supported by the increasing adoption of iron ore in the green economy, where it plays a vital role in the production of eco-friendly steel. Companies that supply iron ore are strategically positioned to benefit from this upward trend, making them key players in meeting the escalating demand.

In addition to traditional uses, iron ore’s role in sustainable development is gaining prominence. The shift towards greener technologies and renewable energy sources is driving the demand for high-quality iron ore, essential for producing low-emission steel. This transition not only supports environmental goals but also opens new avenues for investment in the iron ore sector. As a result, companies involved in iron ore extraction and supply are expected to see significant opportunities for growth and profitability in the coming years.

Final Thoughts

The construction industry stands as the world’s largest consumer of raw materials, driven by the continuous growth of urban areas and infrastructure development. This sector’s vast appetite for materials includes steel, concrete, wood, and various other building products, consuming about 50% of global steel production annually. Gravel, sand, and steel make up the bulk of the raw materials used for construction. Various conglomerates across the world dominate the raw materials construction market.

The top iron ore producing companies—Vale, Rio Tinto, BHP, Fortescue Metals Group, and Anglo American—continue to lead the global market with their extensive operations and robust production levels. Despite facing market fluctuations and environmental challenges, these companies have demonstrated resilience and efficiency. The outlook for the iron ore market in 2024 is promising, driven by the rising demand from the steel industry and the growing emphasis on sustainable development. As the world shifts towards greener technologies, the demand for high-quality iron ore will increase, presenting significant growth and investment opportunities for these key players in the industry.